Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Friday, 7 August 2015 00:41 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

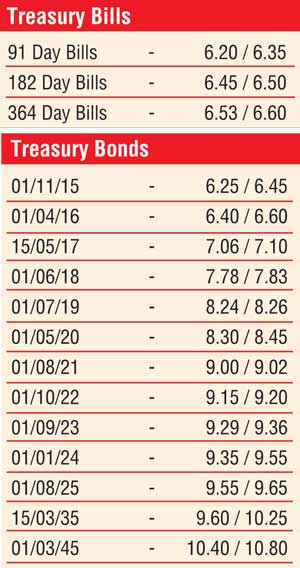

The bearish sentiment in secondary bond markets continued yesterday as selling interest coupled with profit taking saw yields edge up marginally in thin trade.

Activity centered on the 1 July 2019, 1 August 2021 and 1 September 2023 maturities as its yields edged up to intraday highs of 8.26%, 9.02% and 9.33% respectively on thin volumes changing hands. The announcement of two further bond auctions totalling Rs. 8 billion scheduled for 11 August, contributed to this direction as well.

In money markets, the surplus liquidity of Rs.102.96 billion saw overnight call money and repo rates remaining steady to average 6.09% and 5.82% respectively.

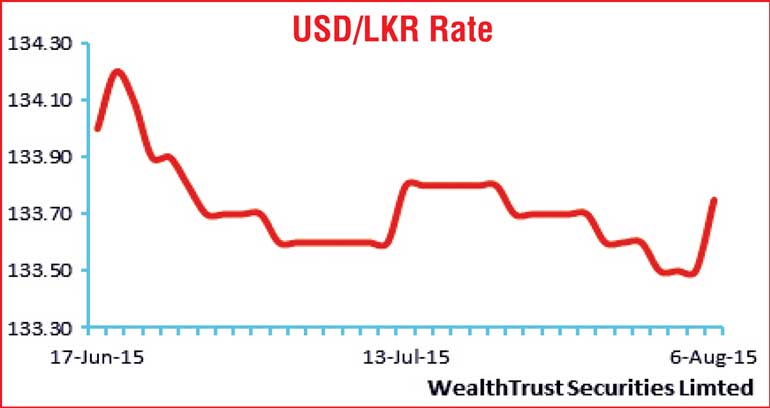

Rupee depreciates once gain

The volatile pattern in the USD/LKR rate on spot contracts was evident once again yesterday as it depreciated by 25 cents to Rs. 133.75 for the first time in four days. The total USD/LKR traded volume for the previous day (5 August) was $ 46.50 million.

Some of the forward dollar rates that prevailed in the market were: one month – 134.35/45, three months – 135.30/45 and six months – 136.70/85.