Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 13 September 2016 00:04 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

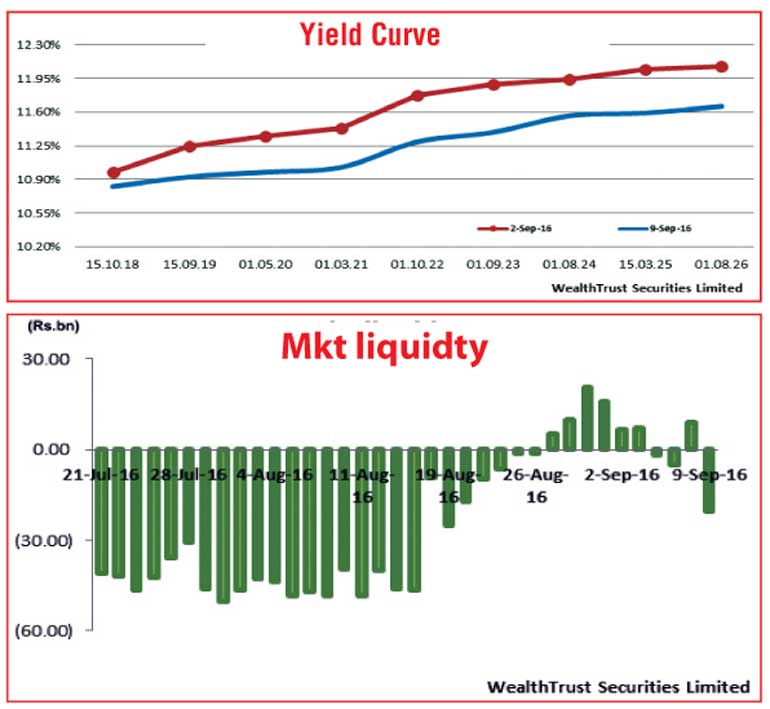

The considerable buying interest witnessed across the yield curve saw secondary market bond yields decrease during the week ending 9 September, reflecting a parallel shift downwards of the overall yield curve. Trading volumes increased as well, with  considerable activity being witnessed along the yield curve from short term to long term durations.

considerable activity being witnessed along the yield curve from short term to long term durations.

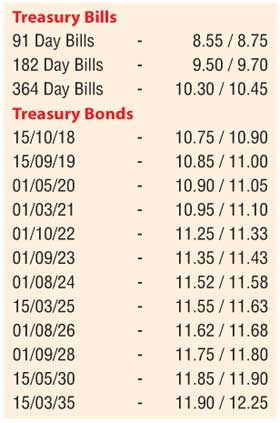

Yields of the liquid maturities of 01.03.21, 01.10.22, 01.09.23, 01.08.24, 01.08.25, 01.08.26 and 15.05.30 reflected a decline of 50, 57, 60, 50, 61 54 and 47 basis points respectively week on week to weekly lows of 10.93%, 11.20%, 11.29%, 11.44%, 11.43% , 11.53% each and 11.83%. In addition demand on the shorter end of the curve continued with the 2018, 2019 and 2020 maturities changing hands at lows of 10.75%, 10.85% and 11.90% respectively.

This trend was further supported by the weekly Treasury bill auction results where weighted averages dipped across the board by 28, 24 and 34 basis points to 8.75%, 9.71% and 10.39% respectively on the 91, 182 and 364 day maturities.

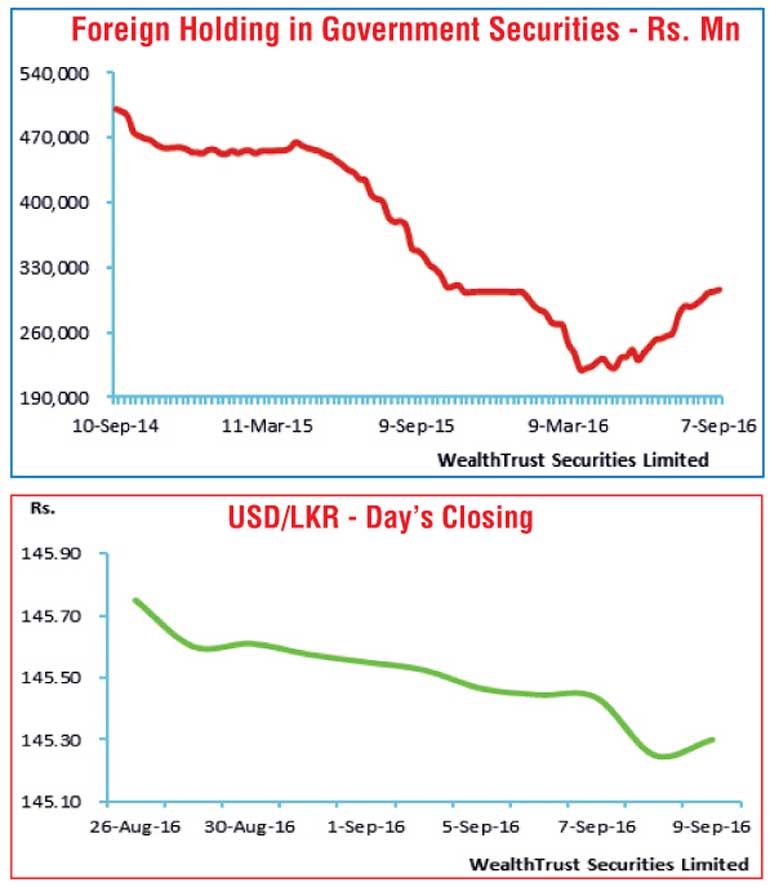

Furthermore, foreign buying in to Rupee bonds continued for a fifth consecutive week, recording an inflow of Rs.2.1 billion for the week ending 7 September.

Meanwhile, the weekly Treasury bill auction for the week commencing 13 September will be conducted on Tuesday due to a shortened trading week, where a total amount of Rs. 26 billion will be on offer consisting of Rs. 5 billion of the 91 day maturity, Rs. 8.0 billion of the 182 day and Rs. 13.0 billion of the 364 day maturity.

In the money market, Overnight repo rates increased marginally to average 8.58% during the week as liquidity decreased marginally to average a net deficit of 2.30 billion while call money stood steady at 8.40%.

The USD/LKR rate appreciated during the week to close at Rs.145.25/35 against its previous weeks closing level of Rs.145.50/55 on the back of foreign buying in Rupee bonds, export conversions and inward remittances.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 53.08 million.

Some of the forward dollar rates that prevailed in the market were one month – 146.05/25; three months – 147.65/85; and six months – 150.00/25.