Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 8 March 2017 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The secondary market bond yields were seen increasing marginally yesterday in thin trade ahead of the weekly Treasury bill auction  due today.

due today.

Foreign and local selling interest on the 2021 maturities (i.e. 01.05.21, 01.08.21 and 15.12.21) saw its yields increase to daily highs of 12.95% each and 12.97% respectively against its day opening lows of 12.90% each and 12.93%. In addition on the short end of the yield curve, the 01.04.18, 15.10.18 and 15.01.19 were seen changing hands at levels of 11.12%, 11.62% and 12.12% respectively while on the long end the 15.05.30 was traded within the range of 13.05%-13.10% as well.

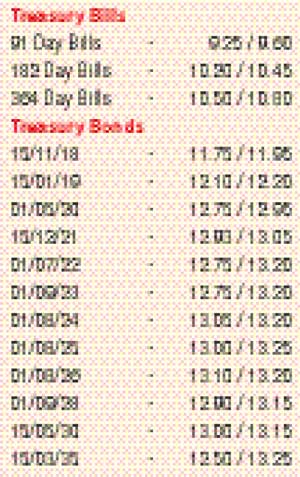

At today’s auction, a total amount of Rs. 25 billion will be on offer consisting of Rs. 8.5 billion each on the 91 day and 182 day bills and a further Rs. 8.0 billion on the 364 day bill. At last week’s auction, weighted averages on 182 day and 364 day bills increased by eight basis points each to 10.27% and 10.66% respectively while the weighted average on 91 day increased by six basis points to 9.38%.

In money markets, the OMO Department of the Central Bank of Sri Lanka was seen infusing an amount of Rs. 5 billion at a weighted average of 8.50%, by way of an overnight reverse repo auction as the net deficit in the system stood at Rs. 10.61 billion yesterday. The overnight call money and repo averaged 8.50% and 8.58% respectively.

In Forex markets yesterday, the USD/LKR rate on active two weeks and one month forward contracts remained mostly unchanged to close the day at Rs. 151.85/00 and Rs. 152.50/65 respectively as markets were at equilibrium.

The total USD/LKR traded volume for 6 March 2017 was $ 44.43 million.

Some of the forward USD/LKR rates that prevailed in the market were three months - 154.55/70 and six months - 157.45/60.