Monday Feb 23, 2026

Monday Feb 23, 2026

Wednesday, 7 October 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

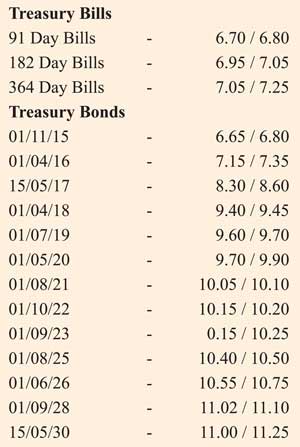

The secondary bond market saw yields increase marginally yesterday on the back of selling interest on selected maturities ahead of today’s weekly Treasury bill auction.

Selling interest on the liquid maturities of 1 July 2019 and 1 May 2021 saw its yields increase to intraday highs of 9.70% and 10.10% respectively against its days opening lows of 9.65% and 10.05%.

This intern saw yields on other maturities increasing as well due to the pass-through effect with the 1 April 2018, 1 August 2021 and 1 October 2022 maturities changing hands within the range of 9.38% to 9.42%, 10.05% to 10.08% and 10.13% to 10.17% respectively.

Meanwhile in secondary market bills, December 2015 and February 2016 bills were traded at levels of 6.75% to 6.80% and 6.95% to 7.05% respectively.

At today’s auction, an total amount of Rs. 22 billion will be on offer, consisting of Rs. 4 billion on the 91 day maturity, Rs. 8 billion on the 182 day maturity and Rs. 10 billion on the 364 day maturity respectively.

At last week’s auction, weighted averages remained steady at 6.78% and 7.07% respectively on the 91 day and 182 day maturities while all bids received for the 364 day maturity was rejected.

Meanwhile in money markets, overnight call money and repo rates remained steady to average 6.35% and 6.49% respectively as surplus liquidity stood at Rs. 56.42 billion yesterday.

Rupee gains marginally

The rupee closed the day higher at Rs. 141.00/05 yesterday in comparison to its previous day’s closing levels of Rs. 141.24/30 subsequent to hitting intraday high of Rs. 140.95 on the back of export conversions outweighing importer demand.

The total USD/LKR traded volume for 5 October was $ 94.00 million.

Some forward USD/LKR rates that prevailed in the market: one month – 141.60/70; three months – 142.70/80; six months – 144.35/45.