Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 11 August 2015 01:03 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securuties

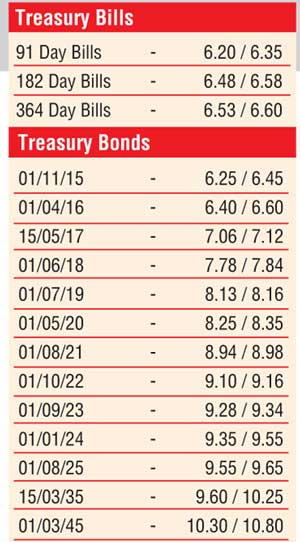

Activity in the secondary bond market dropped considerably yesterday as yields were seen closing the day broadly steady ahead of two Treasury bond auctions due today.

A limited amount of activity was witnessed on the 1 July 2019 maturity within the thin range of 8.14% to 8.16% while the rest of the  yield curve remained stagnant. The auction will see a total amount of Rs. 8 billion on offer consisting of Rs. 3 billion on a 4.8 year maturity of 1 May 2020 and Rs. 5 billion on a 10 year maturity of 1 August 2025. These two maturities fetched weighted averages of 8.39% and 9.63% respectively at its previous auctions.

yield curve remained stagnant. The auction will see a total amount of Rs. 8 billion on offer consisting of Rs. 3 billion on a 4.8 year maturity of 1 May 2020 and Rs. 5 billion on a 10 year maturity of 1 August 2025. These two maturities fetched weighted averages of 8.39% and 9.63% respectively at its previous auctions.

Overnight call money and repo rates remained steady to average 6.13% and 5.88% respectively despite surplus liquidity dipping to Rs. 70.665 billion yesterday.

Rupee steady on thin trades

The USD/LKR rate remained steady at Rs. 133.75 yesterday on thin trades. The total USD/LKR traded volume for the previous day (7 August) was $ 42.27 million.

Some of the forward dollar rates that prevailed in the market were one month – 134.40/50; three months – 135.55/65 and six months – 137.00/20.