Sunday Mar 09, 2025

Sunday Mar 09, 2025

Monday, 24 July 2017 00:27 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

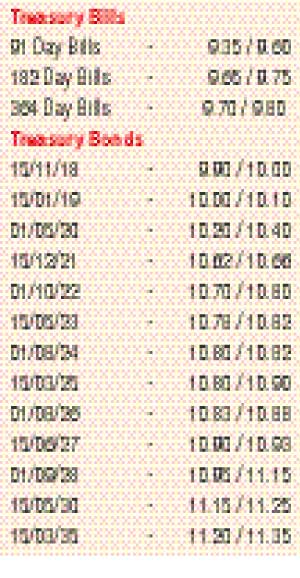

The downward trend in secondary market bond and bill yields, witnessed during the previous week, continued throughout the week ending 21 July as well.

The week began with the announcement of the completion of the second review of the Extended Fund Facility (EFF) arrangement and approval for the disbursement of $ 167.2 million by the IMF, followed by the sharp drop in the weighted average yields at the weekly Treasury bill auction, where the 91,182 and 364-day maturity yields dipped to 9.56%, 10.01% and 10.18% respectively. Furthermore, market liquidity too turned to a net positive for the first time since 7 June 2017.

The two liquid 2021 maturities (i.e. 01.08.21 and 15.12.21) were seen decreasing to lows 10.60% each against its previous weeks closing levels of 11.00/05 and 11.01/04, while the 15.05.23, 01.08.24 and 01.08.26 maturities were seen decreasing to lows of 10.74%, 10.75% and 10.82% respectively, against its previous weeks closing levels of 11.12/17, 11.16/20 and 11.23/25.

In addition, on the shorter end, the 15.01.19 maturity was seen changing hands at a low of 10.02%, with considerable buying interest in secondary market bills where the January and July 2018 maturities changed hands within the range of 9.70%-9.80%.

The foreign holding in rupee bonds continued to increase, recording a 52-week high inflow of Rs. 15.43 billion and total outstanding increasing to Rs. 252.85 billion.

The daily secondary market Treasury bond transacted volume for the first four days of the week averaged Rs. 10.81 billion.

In money markets, the overnight call money and repo rates decreased during the week to average 8.72% and 8.78% respectively against its previous week’s average of 8.75% and 8.81% with the net surplus liquidity in the system increasing to Rs. 23.90 billion, against its previous week’s average shortfall of Rs. 13.45 billion.

The OMO (Open Market Operations) Department of the Central Bank of Sri Lanka was seen mopping up excess liquidity by way of four auctions of outright sales of Treasury bills. It drained out an amount of Rs. 14.5 billion in total at weighted averages of 8.48% for a period 21 days, 8.74% for a period 28 days, 9.00% for a period 39 days and 9.23% for a period 46 days. Furthermore, it continuously drained out liquidity by way of overnight repo auctions at weighted averages ranging from 7.31% and 7.34%.

Rupee remains mostly unchanged for a second consecutive week

In Forex markets, the USD/LKR rate on spot contracts remained mostly unchanged to close the week at Rs. 153.70/75.

The daily USD/LKR average traded volume for the four days of the week stood at $ 80.74 million.

Some of the forward dollar rates that prevailed in the market were one month - 154.75/90; three months - 156.65/85 and six months - 159.65/85.

Discover Kapruka, the leading online shopping platform in Sri Lanka, where you can conveniently send Gifts and Flowers to your loved ones for any event including Valentine ’s Day. Explore a wide range of popular Shopping Categories on Kapruka, including Toys, Groceries, Electronics, Birthday Cakes, Fruits, Chocolates, Flower Bouquets, Clothing, Watches, Lingerie, Gift Sets and Jewellery. Also if you’re interested in selling with Kapruka, Partner Central by Kapruka is the best solution to start with. Moreover, through Kapruka Global Shop, you can also enjoy the convenience of purchasing products from renowned platforms like Amazon and eBay and have them delivered to Sri Lanka.

Discover Kapruka, the leading online shopping platform in Sri Lanka, where you can conveniently send Gifts and Flowers to your loved ones for any event including Valentine ’s Day. Explore a wide range of popular Shopping Categories on Kapruka, including Toys, Groceries, Electronics, Birthday Cakes, Fruits, Chocolates, Flower Bouquets, Clothing, Watches, Lingerie, Gift Sets and Jewellery. Also if you’re interested in selling with Kapruka, Partner Central by Kapruka is the best solution to start with. Moreover, through Kapruka Global Shop, you can also enjoy the convenience of purchasing products from renowned platforms like Amazon and eBay and have them delivered to Sri Lanka.