Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 9 November 2016 00:39 - - {{hitsCtrl.values.hits}}

Q: Can you tell us about the new loan product which is on offer by Cargills Bank and how it distinguishes itself from personal loans?

A: The Cargills Bank ‘Loan Against Property’ (LAP) is an innovative loan scheme on offer to our customers. It is open to professionals and other individuals between the ages of 18 and 55 in permanent employment as well as entrepreneurs who have a steady source of income.

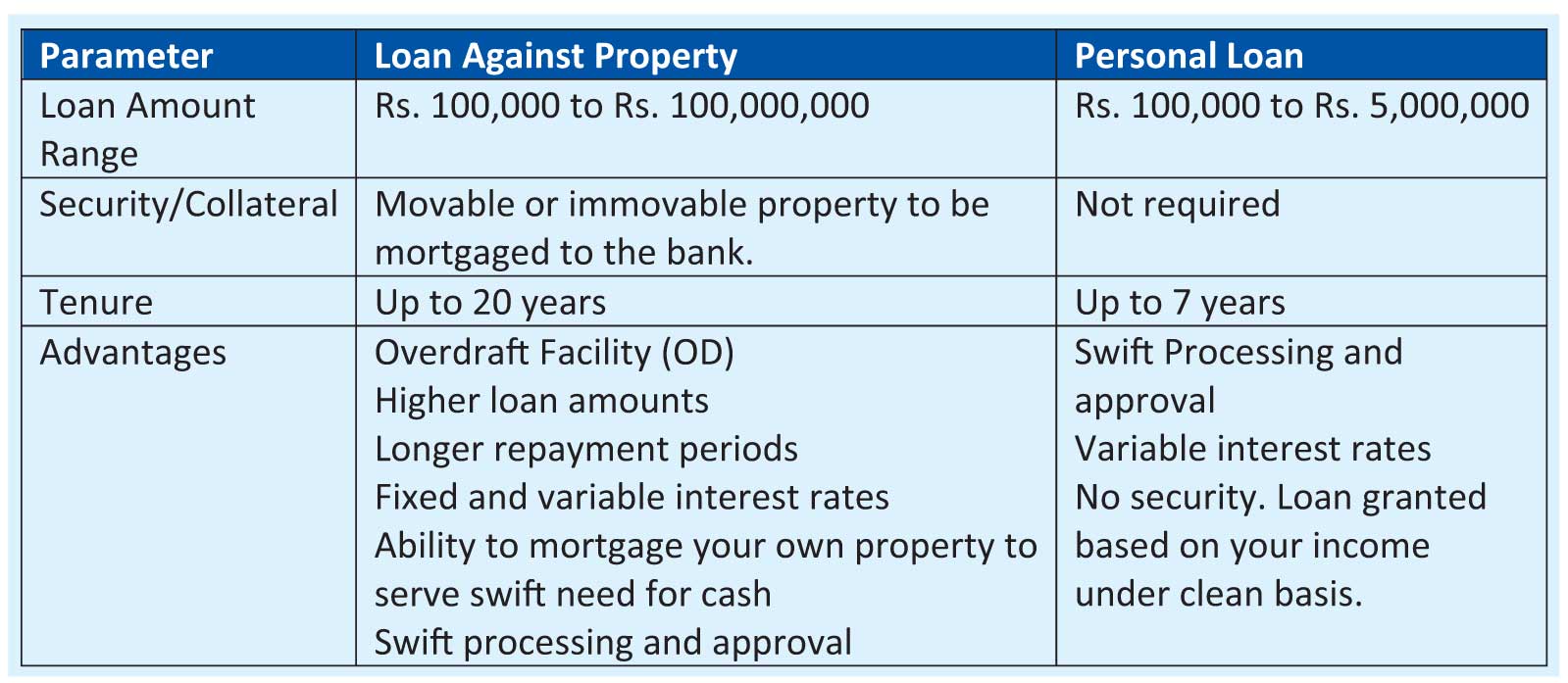

One of the key features of LAP is that the customer has the option of requesting an Overdraft instead of the Loan through LAP. The OD limit will be decided based on the value of the mortgaged property. The table provides a greater understanding of how LAP would be beneficial to your specific financial needs.

It is hassle free to avail yourself of a Loan Against Property (LAP), provided you possess all the required documents with regards to your property and the LAP specialised legal, administration teams are ready to assist customers who would require more information to in assessing options. The final loan amount is subject to the credit scoring of the bank and the Cargills Bank Loan Against Property is available with fixed and variable interest rates with a repayment period of up to 20 years.

Q: Home loans are on offer by many financial institutions. How does ‘Loan Against Property’ differ from this?

A: In both cases the title deed of the property you are about to buy is kept as collateral until the repayment of your home loan. Generally, a home loan is a loan obtained to facilitate the funding of purchasing or constructing a new home and the eligibility criteria may depend mainly on the income of the applicant. The home loan process is quite tedious because the legalities of the property to be purchased needs to be verified, similarly the credit history of the applicant needs to evaluated before disbursing the loan. In case of houses under construction, the funds will be disbursed after a site visit by verification of progress at each stage of construction and the entire process may take up to three weeks. For a LAP, the funds are disbursed in a single payment and the whole process take about a week’s time.

Q: Under what circumstances can a customer apply for a ‘Loan Against Property’?

A: LAP is one of the most convenient types of loans available in the market. Although there are various avenues of availing cash, a Loan Against Property (LAP) is probably the best option there is, especially when you want a large amount of funds to say, expanding your business, to fund your child’s higher education, to make payments for your wedding, to purchase heavy machinery and equipment, buying a property (commercial/residential) and closing off other high cost loans which acts as a loan buy back facility, where a customer could consolidate all his debt to one bank and an competitive interest rate and repayment period. The property can be a house, land or even a vehicle which is registered under your name.

Further, you can apply a LAP loan up to 75% of the value of your property and if the value of the property has risen during the tenure of the loan, the owners may have the option to top-up the loan which is useful for entrepreneurs and the SME segment. This will also be useful for individuals who would need an overdraft or a revolving loan who can obtain principle approval from the bank and have the peace of mind to have the ability to borrow a large amount in case of an emergency. This is also helpful if you earn lump sums of additional income as you are able to pay towards your borrowings without any early settlement fees. Customers can visit our website www.cargillsbank.com to use the loan calculator and call our 24 hour call center to make an appointment to meet with an experienced LAP advisors.

Q: Can you tell us more about Cargills Bank?

A: Customer convenience lies at the heart of the Bank’s initiatives, and the launch of this new loan product reaffirms the Bank’s ongoing commitment to enhance its portfolio with cutting edge products that deliver greater efficiency and increased convenience. Customers can apply and obtain a Loan Against Property from any Cargills Bank branch around the country. The bank operates branches in Colpetty (Head Office), Old Moor Street, Maitland Crescent, Matara, Maharagama, Vavuniya, Hawa-Eliya, Thanamalwila, Kurunegala, Jaffna, Chunnakam, and Galle.

Cargills Bank is a fully fledged commercial bank providing banking solutions across all customer segments and provides a comprehensive portfolio of products and services to support personal and business banking needs which include current and savings accounts, fixed deposits, trade services and treasury services as well as a range of other loan facilities. Cargills Bank is also supported by innovative, technologically advanced digital banking services to assist customers with their daily banking. We are driven by the philosophy of consistency and attempt to simplify our banking transactions by offering innovative and attractive banking products.

In recent years, the real estate market in Sri Lanka has been experiencing a boom, which has resulted in a positive outlook in the property market. With the population growth and per capita income on the rise, the country is experiencing a positive shift in spending on consumer durables.

However, one often lacks the necessary financial resources that are needed to invest in your dream home or your dream car. Life is all about making the best of the opportunities you get and with Cargills Banks ‘Loan Against Property’ you can do just that.

Introduced for the first time in Sri Lanka, Cargills Bank announces the launch of an innovative new product which offers its customers the opportunity to borrow funds against their fully owned property. Whether it is to pay for a family holiday abroad, emergency medical attention or to cover personal expenses, this multi-purpose loan can raise the necessary funds you need against your residential property.

Here, Cargills Bank DGM Consumer Banking Lewie Diasz outlines the Bank’s new initiative: