Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Wednesday, 16 August 2017 00:00 - - {{hitsCtrl.values.hits}}

In the third part of Daily FT series on creating a customer centric-culture, Stephen Rosling, Director of TCF Consulting and Chandri Gunawardhana, CEO/Principal Consultant of Global Business Counselling look at some of the fundamental aspects of putting customers first.

In the third part of Daily FT series on creating a customer centric-culture, Stephen Rosling, Director of TCF Consulting and Chandri Gunawardhana, CEO/Principal Consultant of Global Business Counselling look at some of the fundamental aspects of putting customers first.

What will help the winners pull ahead will be genuinely reengineering their business around the customer. However, many insurers have yet to realise the scale of the transformation required. And fewer still are successfully achieving it.

Firms which are able to sustain success even in a volatile low-yield environment exhibit specific attributes that distinguish them from their competition. Above all, those firms that put their customers at the heart of their business are able to navigate through the storms and chart a new course for growth, while satisfying changing regulatory demands. Hence, putting the customer first must be the fundamental theme underpinning insurers’ strategic response to the current and emerging challenges.

However, genuinely focusing on the customer (rather than simply paying lip service to the concept) in most cases requires fundamental change. It means stripping back the value chain to its essentials and focusing consistently on satisfying customer needs. Achieving this involves putting the business under the microscope, defining specific strategic objectives and single-mindedly focusing on delivering them. This involves giving importance to soft obligations such as ethical behaviour, acting in good faith and prohibition of abusive practices.

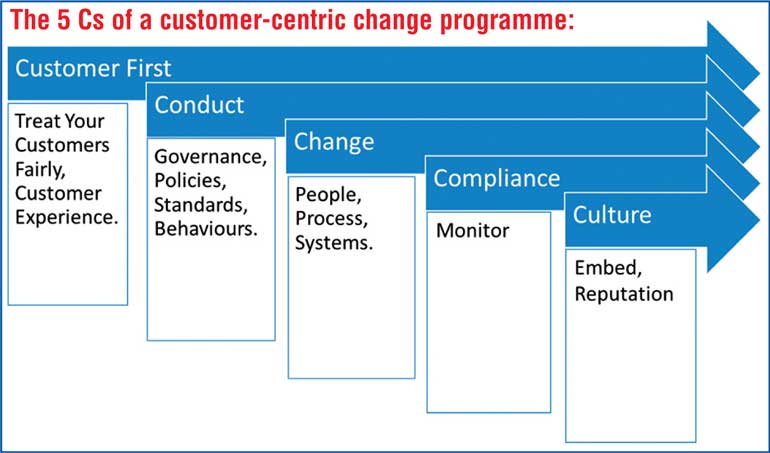

A genuine and determined focus on the customer often involves a radical reconfiguration of the business model:

1.Customer First: The primary element is transformational leadership which sets the “tone from the top”. Leadership, strategy, decision making, business planning, communication are all critical for a sustainable customer-centric culture. The insurance industry needs to put customers’ needs at the absolute centre of their corporate planning and thinking.

2.Conduct: Governance, including corporate policies and standards needs a fundamental overhaul to become genuinely customer and conduct-focused. Every firm should have a specific Conduct Risk Framework.

3.Change: Both business and customer processes need a transformational review to become genuinely customer and conduct-focused. In insurance, customer processes have traditionally been secondary to underwriting processes, and their significance under-played. But activities such as claims processing are at the heart of the customer’s experience of dealing with an insurer. Customer needs cut across product silos. They need to be prioritised. They need to be designed from the “outside in” and complaint handling should be a top priority.

4.Compliance: Change doesn’t happen without checks and controls. Evidence of compliance with the new “norms” is the only way firms can be sure of avoiding any regulatory punishment. “No news” is no longer “good news” and “good news” can help build your corporate reputation.

5.Culture: The employee journey, from recruitment through to performance management, (and everything in-between), needs to reflect the importance that the firm attaches to the fair treatment of customers. The right behaviours and attitudes are key to embedding cultural change and sustaining your corporate reputation.

In the fourth and final part tomorrow in this a series on creating a customer centric culture, we’ll look at some of the practical steps that can be taken.

(The complete article was previously published in the Asia Insurance Review Commemorative Edition for the 2016 EAIC Conference).