Sunday Feb 22, 2026

Sunday Feb 22, 2026

Friday, 12 February 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

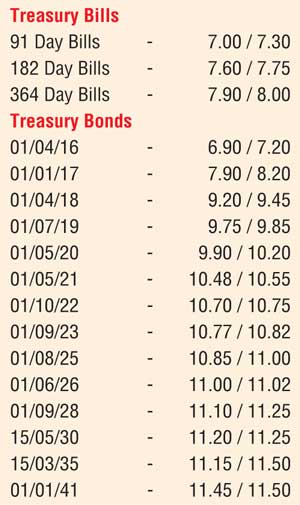

The secondary bond market saw yields dip marginally yesterday as local buying interest was seen out beating foreign selling during the day. Yields on the liquid maturities of 01.09.2023, 01.06.2026 and 15.05.2030 were seen dipping to intraday lows of 10.76%, 11.02% and 11.20% respectively against its days opening highs of 10.82%, 11.05% and 11.38% on the back of considerable volumes changing hands. However, continued foreign selling on the two 2021 maturities (i.e. 01.05.2021 & 01.08.2021) and the 01.07.2022 maturity saw it change hands within the range of 10.50% to 10.55% and 10.70% to 10.75%.

The surplus liquidity in money markets was seen dipping yesterday to Rs.44.58 billion as overnight call money and repo rates remained broadly steady at 6.81% and 6.36% respectively.

One week forward contracts appreciate marginally.

The USD/LKR rate on the active one week forward contract was seen closing the day marginally stronger at Rs.144.30/35 against its previous day’s closing of Rs.144.35/40 on the back of foreign remittances outweighing importer demand. The total USD/LKR traded volume for 10 February was $ 60.50 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 144.75/85; 3 Months - 144.85/20 and 6 Months - 147.65/10.

Reuters: Sri Lankan shares fell for the fourth straight session on Thursday to end at a more than three-week low, as weaker global markets weighed and as investors stayed off risky assets on concerns over rising domestic interest rates.

Turbulence tore through global markets on Thursday as investors sought the safety of Japanese yen, gold and top-rated bonds while dumping U.S. dollars on bets the Federal Reserve could be done with raising interest rates.

Sri Lanka’s main stock index ended 0.78 % or 49.58 points weaker at 6,314.82, its lowest close since 20 January.

“Weak economic conditions are the main cause for the lack of confidence among the investors, and also the investors are expecting interest rates to go up further,” said First Capital Equities Ltd Research Manager Dimantha Mathew

The key index has fallen 8.4 % this year through Thursday.

Yields on t-bills rose between 8 and 17 basis points at a weekly auction on Wednesday, with the 182-day and the 364-day t-bill yields rising to over two-year highs, signalling a further rise in market interest rates.

Some investors are shifting to fixed interest rate-bearing assets due to a gradual rise in interest rates, analysts said.

Foreign investors were net buyers of Rs. 22.2 million (about $154,273) worth shares on Thursday, but they have been net sellers of Rs. 188.7 million worth of equities so far this year.

Turnover was Rs. 207.2 million, less than a third of this year’s daily average of Rs. 749.99 million.

Shares of conglomerate John Keells Holdings Plc fell 2.4 %, while Hemas Holdings Plc lost 4.9 % and the biggest listed lender Commercial Bank of Ceylon Plc dropped by 1.40 %.