Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Thursday, 21 May 2015 00:00 - - {{hitsCtrl.values.hits}}

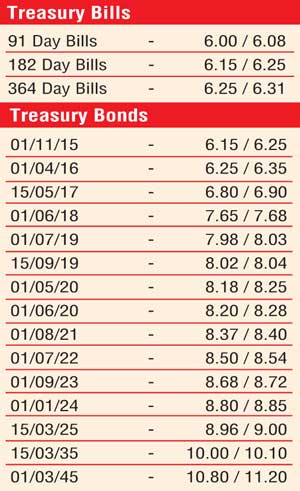

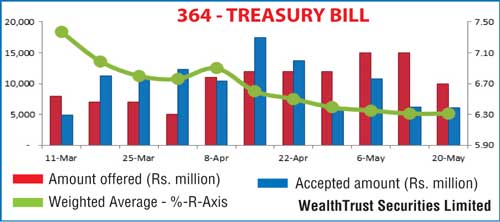

The outcome of the weekly Treasury bill auction led to downward momentum in secondary market bond yields halting yesterday as the weighted average (W. Avg) on the 364-day bill remained unchanged against its previous weeks W.Avg for the first time in six weeks.

However, the W. Avg’s of the 91-day and 182-day bills dipped by two basis points (bp) and three bp respectively as the total accepted amount was seen exceeding the total offered amount of Rs. 20 billion by Rs. 8.30 billion with the 91-day and 182-day bills representing 78.69% of this volume.

In secondary bond markets yields were seen dipping in the morning hours of trading on the back of considerable buying interest mainly on the liquid maturities of 01.06.2018, 01.07.2019, 15.09.2019, 01.05.2020, 01.08.2021, 01.07.2022, 01.09.2023 and 15.03.2025 to intraday lows of 7.62%, 8.00%, 8.01%, 8.22%, 8.36%, 8.50%, 8.67% and 8.95% respectively as volumes changing hands remained high. However, following the outcome of the bill auction, yields were seen increasing marginally once again to close the day broadly steady against its previous day’s closings levels. Meanwhile, overnight call money and repo rates averaged 6.12% and 5.78% respectively as surplus liquidity remained high at Rs. 126.10 b yesterday.

Rupee on spot contracts dip further

The rupee lost ground by around 20 cents yesterday to close the day at Rs. 133.70 while active three month forward contracts were seen closing at levels of Rs. 136.45/50 against its previous day’s closing levels of Rs. 136.30.40. The total USD/LKR traded volume for the previous day (19-05-15) stood at $ 21 million.

The six-month forward dollar rate that prevailed in the market was 137.90/20.