Sunday Feb 15, 2026

Sunday Feb 15, 2026

Friday, 11 September 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

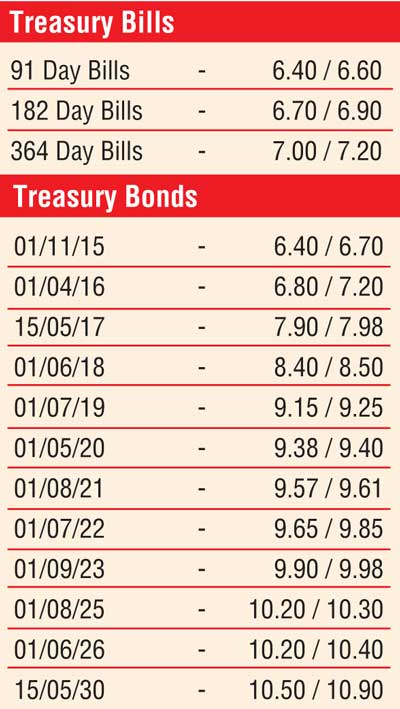

The downward trend in secondary market bond yields driven by the outcome of Wednesday’s Treasury bill auction continued for a second consecutive day yesterday.

Yields on the liquid maturities of 01.05.20, 01.08.21 and 01.09.2023 were seen hitting intraday lows of 9.40%, 9.60% and 9.95% respectively against its day’s opening highs of 9.47%, 9.70% and 10.06% on the back of continued buying interest from local and foreign participants.

In addition, activity was witnessed on the maturities of 01.07.19 and 15.09.19 within the range of 9.20% to 9.25% and 9.25% to 9.30% respectively as well. More interestingly the buying pressure on secondary market bills saw the December 2015 and February 2016 maturities being demanded at levels of 6.50% and 6.80% respectively.

In money markets, surplus liquidity of Rs. 54.09 billion saw overnight call money and repo rates remaining mostly unchanged to average 6.34% and 6.30% respectively yesterday.

Rupee continues

to lose ground

Meanwhile, in Forex markets, the USD/LKR rate on spot contracts depreciated further to break the psychological level of Rs. 139.00 yesterday to close the day at Rs. 138.95/05 against its previous day’s closing of Rs. 138.80/90 on the back of continued importer demand. The total USD/LKR traded volume for 9 September 2015 was $ 43.40 million.

Some of the forward USD/LKR rates that prevailed in the market were one month - 139.40/60, three months - 140.65/80 and six months - 142.20/40.