Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 12 February 2016 00:00 - - {{hitsCtrl.values.hits}}

Reuters: The Federal Reserve is unlikely to reverse its plan to raise interest rates further this year, but tighter credit markets, volatile financial markets, and uncertainty over Chinese economic growth have raised risks to the U.S. economy, Fed Chair Janet Yellen told U.S. lawmakers on Wednesday.

“I don’t expect the (Federal Open Market Committee) is going to be soon in the situation where it is necessary to cut rates,” Yellen said. “There is always a risk of a recession...and global financial developments could produce a slowing in the economy,” she added.

Yellen said she expected continued U.S. economic growth would allow the Fed to pursue its plan of “gradual” rate hikes, but her comments kept the central bank’s options open.

“I think we want to be careful not to jump to a premature conclusion about what is in store for the U.S. economy. I don’t think it is going to be necessary to cut rates.”

Investors have all but ruled out further interest rate rises this year, after the Fed raised its fed funds rate for the first time in a decade in December.

“The general message she intended to deliver is that additional rate hikes remain the base case, but markets have to stabilise before we see more,” said Cornerstone Macro analyst Roberto Perli.

Stock indexes worldwide recovered some ground before ending little changed on Wednesday after Yellen’s comments eased concerns about the likely path of U.S. interest rates.

Worries about Chinese economic growth, poor U.S. fourth quarter corporate earnings, and the impact on capital spending and employment in the energy sector of the slump in oil prices, have roiled global markets in the past month.

The MSCI all-country world equity index ended little changed around 358.08, while the S&P 500 stock index closed steady at 1,851.86.

The U.S. dollar fell to a 15-month low against the yen as investors backed away from earlier expectations that the Federal Reserve would continue to raise interest rates.

Yellen’s comments were her first since the Fed’s December rate hike, allowing her to take stock of several weeks in which concerns have grown about slowing U.S. growth, a continued collapse in oil markets, a downturn in U.S. equities, and more than one suggestion that the Fed’s December move was a mistake.

Some of the most pointed questions from lawmakers on the House Committee on Financial Services, however, focussed less on the broad economics of the Fed’s rate hike and more on the tools the central bank has used to achieve it, particularly the payment to banks of interest on the roughly $2.5 trillion in reserves held at the Fed.

While Yellen said the interest payments on bank reserves are currently an indispensable part of the Fed’s arsenal to raise short term interest rates, the programme drew bipartisan criticism.

In her prepared remarks, however, Yellen acknowledged that a series of global problems have grown worse since the Fed lifted rates from near zero in December.

“These developments, if they prove persistent, could weigh on the outlook for economic activity and the labour market,” Yellen said in her semi-annual appearance before lawmakers.

But Yellenemphasised a steady-as-she-goes account of Fed policy, with good reason to believe the United States economy will continue to grow and allow the Fed to pursue its plan of gradual rate hikes.

The Fed “expects that with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace in coming years and that labour market indicators will continue to strengthen,” she said.

Reuters: Turbulence tore through global markets on Thursday as investors sought the safety of Japanese yen, gold and top-rated bonds while dumping US dollars on bets the Federal Reserve could be done with raising interest rates.

Even the absence of Tokyo for a holiday could not stop the dollar from hitting a 15-month low on the yen, and gold finally broke major chart resistance to reach its highest since May as a wave of risk aversion swept through trading floors.

Europe got off to a torrid start, with Britain’s FTSE 100 down 2.3%, Germany’s DAX 2.4% lower, France’s CAC 40 down 2.8% and US futures also pointing to 1% drop for Wall Street later.

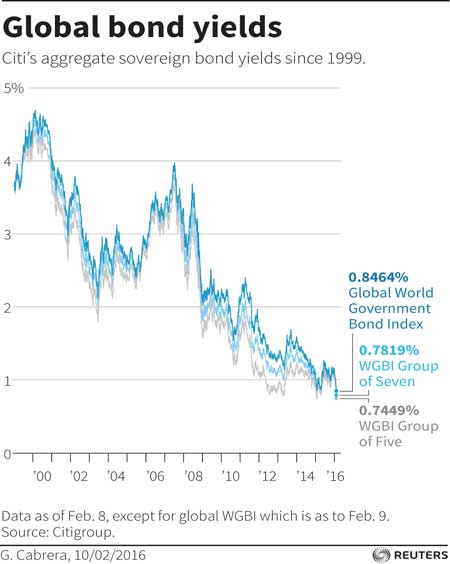

Sweden’s crown and government bond yields were sent tumbling as its central bank delivered a surprise cut to its already deeply negative interest rates.

Insatiable demand for US Treasuries drove longer-term yields to almost three-year lows and flattened the yield curve in a way that has presaged economic recession in the past.

Benchmark European German Bund yields dropped like a stone and UK yields hit an all-time low too, as riskier Spanish, Italian and Portuguese bonds moved in the opposite direction.

The euro zone’s finance ministers are set to meet later with worries creeping back in about Portugal and Greece’s ability to stick to the terms of their bailouts again.

“What this shows is that the risk-off mode has come back very quickly and that the worst may still be to come in these markets,” said Rabobank European strategist Emile Cardon.

“What is different to previous times is that the bad news in now coming from everywhere, China, Portugal the US the commodity sector the banking sector. It’s like several smaller crises could combine into one big crisis.”

The flight from risk told on most Asian shares, with Hong Kong – a favorite channel for global investors to play China – diving 4.2% as investors there returned from the long Lunar New year holidays. Mainland China markets are closed all week.

MSCI’s broadest index of Asia-Pacific shares outside Japan shed 1.4%, and South Korea resumed with a 2.9% drop.

Wall Street had ended Wednesday mixed after Fed Chair Janet Yellen sounded optimistic on the U.S. economy, but acknowledged risks from market turmoil and a slowdown in China.

The yen was again lifted by safe-haven flows, as befits Japan’s position as the world’s largest creditor nation. The dollar sliced down through 111.36 yen to reach depths not delved since October 2014 at 110.99.

The euro also weakened against its Japanese peer, sliding to a 2-1/2 year low of 126.06 yen. Against the greenback though, the euro drove to three-month high of $1.1355.

The aversion to risk helped lift gold as far as $1,217.00 an ounce, clearing stiff resistance around $1,200.