Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 28 May 2015 01:12 - - {{hitsCtrl.values.hits}}

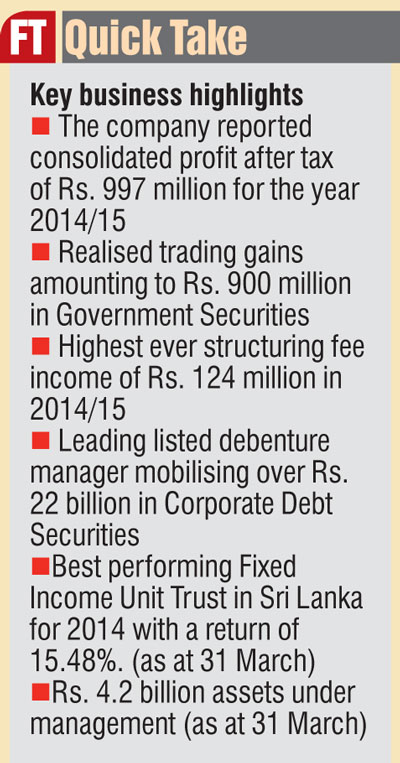

First Capital Holdings PLC has reported notable growth in performance during the 2014/15 financial year. The company has recorded a consolidated profit after tax of Rs. 997 million for the year 2014/15. The results reflect an increase of 200% from the previous financial year.

First Capital Holdings PLC has reported notable growth in performance during the 2014/15 financial year. The company has recorded a consolidated profit after tax of Rs. 997 million for the year 2014/15. The results reflect an increase of 200% from the previous financial year.

Reflecting on the results, First Capital Holdings PLC Chief Executive Officer Dilshan Wirasekara said: “We are delighted with our financial performance and remarkable business momentum during the past year and will endeavour to keep raising the bar for investment banking services in Sri Lanka. Our commitment towards becoming the country’s leading investment bank has been validated over the year through our performance, management discipline and perpetual emphasis on ethics.”

First Capital Holdings PLC comprises of First Capital Treasuries Ltd, First Capital Asset Management Ltd, First Capital Equities Ltd, First Capital Markets Ltd and First Capital Ltd. The Group’s largest subsidiary, First Capital Treasuries Ltd, was the prime contributor towards the Group’s Net Earnings (Net Profit after Tax) for this year. First Capital Treasuries Ltd capitalised on opportunities arising from the continuous decline in secondary market interest rates and realised net trading gains of Rs. 900 million during the period under review.

This is a significant increase in comparison to Rs. 227 million reported during the previous year. First Capital Treasuries Ltd also fortified its long term capital base (Tier II) through a Listed Debenture Issue of 500 million in the fourth quarter of the financial year.

Recording its highest ever fee income, First Capital Limited mobilised Rs. 22 billion through corporate debt for its clients during the financial year under review. The company reported a fee income of Rs. 124 million during 2014/15, reflecting almost a 3.2 times growth from the previous year.

First Capital Ltd also achieved significant milestones during 2014/15. The company recorded its largest ever listed debenture issue of Rs. 5 billion; managed its largest asset backed securitisation of Rs. 1 billion and reported its first private equity placement of Rs. 100 million. During the year 2014/15, the company became the leader in managing listed corporate debentures through its management of listed debenture Issues worth Rs. 10 billion.

The Group’s other subsidiaries also reflected positive growth over the period under review. The Group’s investment management arm, First Capital Asset Management Ltd, reported assets under management amounting to Rs. 4.2 billion as at 31 March compared to Rs. 1.3 billion the previous year. As per industry reports, First Capital Wealth Fund was recognised as the best performing Fixed Income Fund in Sri Lanka for the second consecutive year, with a return of 15.48% (31 March).

First Capital Equities Ltd displayed a remarkable turnaround in its business, weathering a loss after tax in 2013/2014, and reported a profit after tax in 2014/15. First Capital Markets Ltd demonstrated resilience, recording the third highest listed debt (DEX) trades in the Colombo Stock Exchange during 2014. With the acquisition of a stake of 5%, Orient Finance PLC became an investment in associate of the company and contributed Rs. 11 million to the Group’s profit after tax during the year 2014/15. First Capital Holdings PLC paid an interim dividend of Rs. 2 per share totalling Rs. 202.5 million for 2014/15 in March 2015.

“We are grateful for the trust placed in us by our investor base and the support of all regulatory authorities and governing bodies involved in making 2014/15 a significant year for the company. As we enter the next fiscal year we hope to sharpen our strategic focus and align resources towards achieving more growth in fee-based business operations,” elaborated Dilshan Wirasekara, outlining the company’s business roadmap for 2015/16.

First Capital Holdings PLC offers a range of investment banking products and services and operates in Colombo, Matara and Kandy. The company’s Board of Directors comprises of Executive Chairperson Manjula Mathews, Managing Director Dinesh Schaffter, Nihara E. Rodrigo, Eardley Perera, Minette Perera, Nishan Fernando and Chandana de Silva as Independent Directors.