Monday Feb 23, 2026

Monday Feb 23, 2026

Friday, 8 July 2016 00:00 - - {{hitsCtrl.values.hits}}

Fitch Ratings expects claims arising from Sri Lanka’s May 2016 floods to be manageable for most local insurers due to low retention levels. Underwriting profitability is likely to weaken in 2H16, but Fitch does not expect this to threaten most insurers’ credit profiles.

Fitch sees ongoing regulatory changes as positive for the industry, as they will promote efficient capital allocation and improve corporate governance. Sri Lanka moved to a risk-based (RBC) regime in 2016, after running it parallel with the previous solvency regime for two years.

The RBC regime will increase precision in measuring capital on a risk-adjusted basis and help promote better risk management.

Minimum regulatory capital was raised to Rs. 500 m from Rs. 100 m in 2015, strengthening the capitalisation of insurers. Several companies are expected to list in 2016-2017, in line with regulatory requirements. However, the listing of some players may be delayed, and three composite insurers are yet to split.

What to watch

Higher non-life combined ratios: Fitch expects record-high claims from the recent floods to worsen the combined ratio of non-life insurers. Higher reinsurance premiums will also raise expense ratios, once reinsurance contracts are renegotiated upon renewal for 2017.

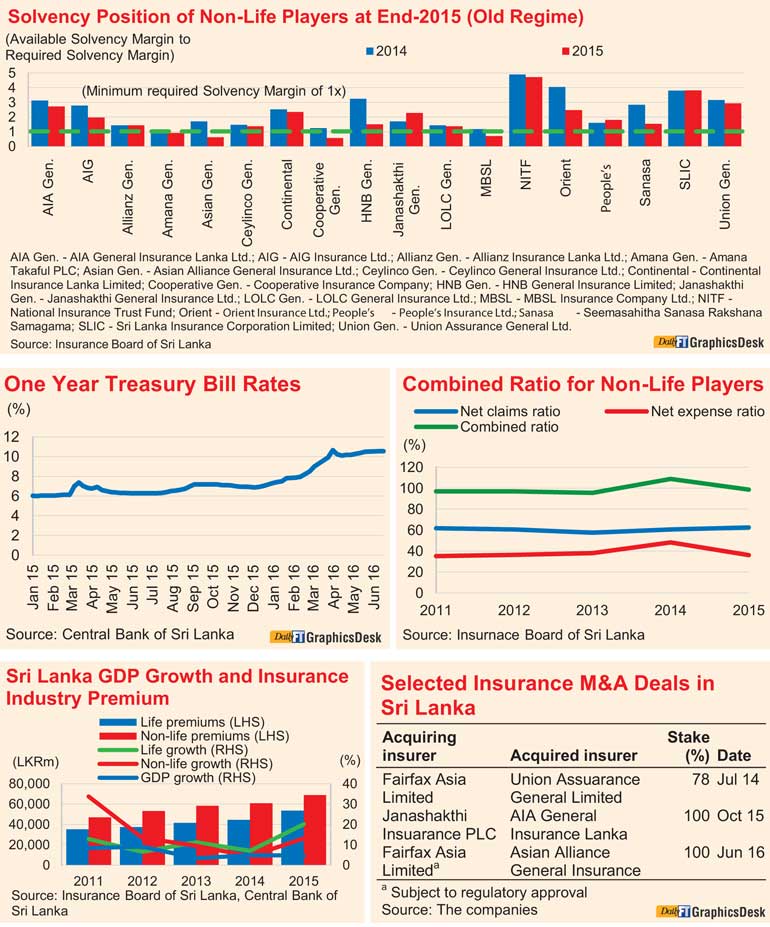

Non-life capitalisation threatened: Fitch expects weaker profitability, driven by intense competition, especially in motor, to threaten the capitalisation of some lower-capitalised insurers. According to the Insurance Board of Sri Lanka, out of all 18 non-life insurers, four small players collectively accounting for 9% of industry gross written premiums in 2015 had failed to meet the regulatory minimum under the previous solvency regime by end-2015. The capitalisation of some lower-capitalised insurers could also be affected by lower profitability stemming from flood-related claims.

Merger and acquisition activity expected: Fitch sees expected market consolidation in the medium-and long-term as positive, due to the high number of insurers in Sri Lanka. Many are keen to concentrate on the more profitable life segment, while divesting the fiercely competitive non-life business. In June 2016, Asian Alliance Insurance PLC announced that it will sell its non-life operation to Fairfax Asia Limited, subject to regulatory approval.

Investment income to increase: Fitch expects higher interest rates to support increased investment income in 2H16. Sri Lanka’s one-year treasury bill rates climbed by more than 300bp in 1H16, as the central bank tightened credit growth to curb the build-up of inflationary pressures.

Ratings impact: Neutral

Fitch expects the credit metrics of rated insurers to remain intact in 2H16, following satisfactory capitalisation and sustained market share.