Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Thursday, 18 February 2016 00:00 - - {{hitsCtrl.values.hits}}

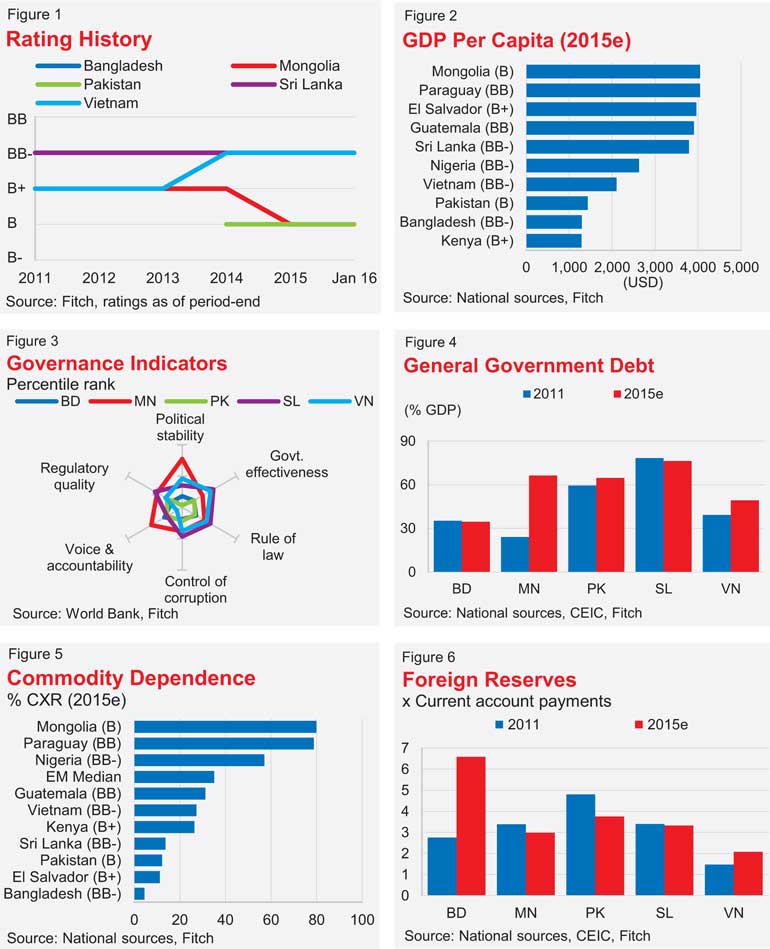

Structural factors – including low per-capita income, weak governance indicators, and high political risks – weigh on the ratings of the five Asia frontier sovereigns assessed by Fitch Ratings (Figure 1) despite exhibiting some of the strongest GDP growth rates globally (5-year average of about 6.8%).

Fitch has taken four rating actions across the Asia frontier sovereign portfolio since end-2011: initiating coverage of Bangladesh in August 2014, and of Pakistan 13 months later; upgrading Vietnam to BB/Stable in November 2014, and downgrading Mongolia to B/Stable in November 2015.

Per-capita incomes of Asia’s frontier markets remain low relative to that in other regions.

Bangladesh and Pakistan both report per-capita incomes of under $ 1,500 per year, and Mongolia is the only Asia frontier sovereign with per-capita income in excess of $ 4,000. High levels of violence, corruption, and political instability weigh on broader governance scores in Pakistan and Bangladesh (Figure 3). Vietnam scores poorly in voice and accountability, whereas Mongolia outperforms across nearly all governance metrics.

Public debt across a number of frontiers has increased since 2011. Mongolia’s government debt rose to about 66% of GDP in 2015, from 24% in 2011, due to high deficits and external bond issuance. Vietnam’sgovernment debt increased to 49% in 2015, from 39% of GDP in 2011, as fiscal revenues declined from aseries of corporate-tax cuts and lower oil receipts. Sri Lanka’s headline debt levels are the highest among Asia frontier sovereigns at about 76% of GDP, and Fitch’s 2016 budget deficit forecast of 6.3% of GDP (official budget: 5.9%) suggests that government debt will rise further absent a change in fiscal policy.

Commodity dependence is low among Asia frontier sovereigns relative to their peers in Latin America and Africa, with the exception of Mongolia. Bangladesh has the lowest commodity dependence across all emerging markets globally, at about 4.5% of current account receipts. Pakistan, Sri Lanka, and Vietnam also exhibit relatively low dependence, which in part reflects economic models focused on the export of garments and other labour-intensive manufactured goods. Mongolia’s high dependence reflects its rich endowment of natural resources and a ramp-up in copper exports from the OyuTolgoi project.

Foreign-reserve buffers are by far the highest in Bangladesh, at an estimated 6.6x current externalpayments. Vietnam’s reserve coverage ratio had risen to 2.1x in 2015, from 1.5x in 2011, but still stands out as a weakness relative to the ‘B’ and ‘BB’ median peer, particularly in light of its quasi-fixed exchange rate regime. Pakistan has seen the most significant deterioration in reserve coverage since 2011, but Fitch expects buffers to increase in 2016 amid ongoing support from an IMF Extended Fund Facility.

Ratings impact

Structural and governance reforms that improve medium-term growth prospects would be ratings positive since structural factors – at 54% – represent the largest weight in Fitch’s sovereign rating model. Public and external finances bear model weights of 17% and 18%, respectively, suggesting prudent fiscal and monetary policies are also important ratings determinants.