Tuesday Mar 10, 2026

Tuesday Mar 10, 2026

Monday, 17 August 2015 00:00 - - {{hitsCtrl.values.hits}}

Pursuant to a proposal by Minister of Finance Ravi Karunanayake to repay 41% of the security deposit holding balances of GKCCCL depositors, the Central Bank of Sri Lanka has formulated the modalities to effectuate the repayment plan and submitted same to the Supreme Courts (SC) on 4 August 2015.

During the Supreme Court proceedings of the SC/FR/191/2009 case Viraj Dayaratne, Deputy Solicitor General tendered to Court a motion with notice to the Petitioners and Respondents indicating the modalities that are required to be put in place to effectuate this repayment plan.

Learned Counsels of the Petitioners and the Respondents of the SC/FR/191/2009 had no objection to the modalities being implemented. Accordingly, in view of the settlement reached among the said parties, the Monetary Board of the Central Bank would take steps to give effect to the modalities of the proposal.

Accordingly the Security Deposit Holders (SDH) who have deposits to the value of Rs. 2 m would be paid off within one month. The quantum of funds required for same is Rs. 544.3 m and same has already been received by GKCCCL.

The second tranche would be for the SDH who have deposits ranging from Rs. 2 m to Rs. 10 m and is due to be paid within two months and Rs. 3.9456 billion is required for same. The final tranche amounting to Rs. 4.0551 billion would for the customers who have deposits above Rs. 10 m and is to be completed within a period of one year.

Golden Key Credit Card Company Chief Executive Officer Dinesh Perera, says that depositors are pleased with the move of the Government and the Monetary Board of the Central Bank to settle 41% of the balance of security deposit holders.

He also confirms that the cheques for deposit holdings of up to Rs. 1 m had been posted two weeks back. The payments for deposits have been processed and made by drawing account payee cheques in the name of the security deposit holders. The cheques for depositors up to Rs. 2 m have been posted to their addresses available with the GKCCCL database. The CEO informs that there were a lot of inquiries coming in asking about the new repayment and hence provides the following answers for the frequently asked questions for the easy reference of the customers.

Q: How is the calculation taking place in making the payments?

A: The payments are being made based on a maximum of 41% of the net SD value as at end of 2008.

Q: What is net SD value?

A: The net SD value is the total deposit less any credit card outstanding as at end of 2008.

Q: What is the calculation mechanism?

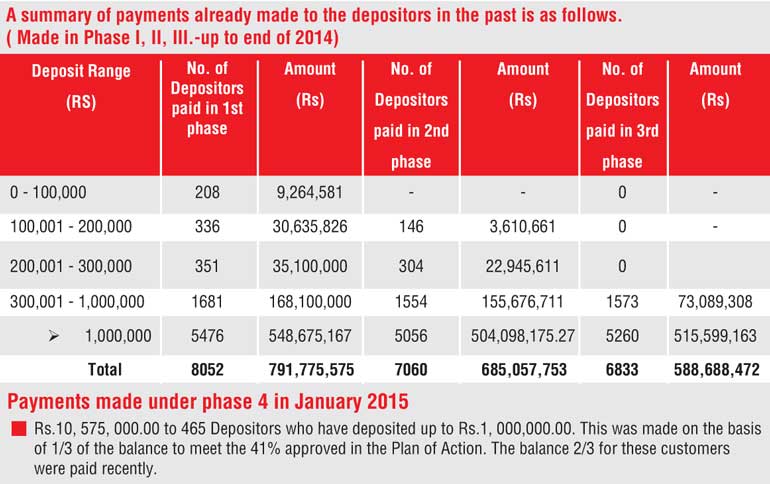

A: 41% of the deposit less the payments already made under the different phases mentioned above. Hence a depositor having a balance of Rs. 2 m would now receive a payment of Rs. 520,000 as Rs. 300,000 had been paid under the first 3 phases.

Q: Why are the payments limited to 41%?

A: The 41% is the agreed amount to be repaid as per the action plan presented to SC in 2013 and agreed by all parties including the depositors’ representatives.

Q: What will happen to customers who had been issued cheques by the company in 2008 but returned for insufficient funds?

A: 41% of such cheques would be settled at the end of the final tranche and confirms that the fund requirement for such payments is also included in the final tranche.

Q: Why are you making payments by way of cheques?

A: This is to be in accordance with the proposed Modalities and approved by SC.

SDH’s cheques are released subject to an audit procedure and the payments are audited against the Earnest and Young Audit report and several payments had been held back due to variances in the ID numbers, names, etc., and would only be released after further scrutiny. The CEO also states the audit procedures in sending out of the cheques and the checking mechanism would be further strengthened in handling the payments from the next tranche as the values were increasing.