Sunday Feb 15, 2026

Sunday Feb 15, 2026

Friday, 17 March 2017 00:00 - - {{hitsCtrl.values.hits}}

Late President Ranasinghe Premadasa as the Minister for Housing created a Building Society in 1983 to help finance housing for the poor. The Building Society evolved with time into a licensed specialised housing bank named Housing Development Finance Corporation Bank (HDFC Bank). Subsequently, the HDFC bank was floated in the stock market becoming the only State bank quoted in the Colombo Stock Exchange, showcasing Public Private Sector partnership in banking in Sri Lanka. At present, 51% of the shares are owned by the State and 49% shares are owned by the private sector.

Late President Ranasinghe Premadasa as the Minister for Housing created a Building Society in 1983 to help finance housing for the poor. The Building Society evolved with time into a licensed specialised housing bank named Housing Development Finance Corporation Bank (HDFC Bank). Subsequently, the HDFC bank was floated in the stock market becoming the only State bank quoted in the Colombo Stock Exchange, showcasing Public Private Sector partnership in banking in Sri Lanka. At present, 51% of the shares are owned by the State and 49% shares are owned by the private sector.

HDFC bank developed further in 2011, amendments to the Housing Development Finance Corporation Act was enacted enabling the bank to change its traditional business model to a wider market. As a result, a number of new short term lending products were introduced in a short time enabling the bank to diversify the business model beyond housing finance.

Between 2013 and now, the HDFC gave tremendous support to the Government in the growth of a vibrant middle class while considering commercial profits. This also helped the HDFC to build its own image as a national bank. By 2014, success in Micro and SME lending prompted the bank to establish a separate department exclusively for Microfinance and Small and Medium Enterprise activities, catering to various untapped geographical areas and rural financial markets.

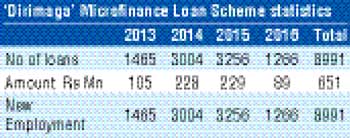

However, core business of the HDFC bank remained as housing. While the bank continued to support ‘the provision of housing for the economically disadvantaged sections of the society’ (Act No 7 of 1977 – Section 12 h), as envisaged by the State, HDFC in 2014 introduced its own ‘Dirimaga’ Microfinance credit scheme focusing on small scale clients to develop their existing projects or start new income generation activities. This newly introduced loan scheme became very popular amongst the urban and semi urban areas mainly due to the comparatively lower rate of interest and door step service. Well trained business promotion officers began engaging in promoting micro finance loans island-wide.

With the expansion of the bank’s lending portfolio towards the new area of banking and having identified the necessity of starting SME finance to support emerging business and new entrants to SME development, the HDFC with the assistance of the Central Bank, commenced entrepreneurship development by conducting various programs such as ‘financial literacy and entrepreneurship development programs’ throughout the country and entered in to Central Bank loan schemes, available to the SME sector.

In a short span of three years and by September last year, 9016 loans amounting to Rs. 653 million was disbursed as SME loans to the poor and under privileged.

In the year 2014, HDFC Bank also signed an MOU with the CBSL as a PCI for Commercial Scale Dairy Development Loan Scheme (CSDDLS) and took positive efforts, within very short period, to promote this credit scheme among the commercial scale dairy farmers of the country with the assistance of large scale stakeholders such as MILCO, Nestle, Rich life, Fonterra, Pelawatta, and Lucky Lanka Dairies greatly involved in the dairy industry.

The bank has so far conducted several staff awareness and financial literacy programs for entrepreneurs in the milk industry, dairy farmer meetings at district level and also a number of pocket meetings for the members of milk collecting societies with collaboration of the above mentioned companies.

The HDFC states that out of the CBSL total loan portfolio of Rs. 703 million, HDFC alone achieved a phenomenal disbursement of 41.25% (Rs. 290 m) within a very short period of time (2013 onwards).

NADEP (National Agri Business Development Program) which mainly focuses on rural women and youth was started in February 2016. Since then, bank has granted Rs. 75 million among 577 clients.

The HDFC-NEDA (National Enterprise Development Authority) partnership initiated in 2016, helps strengthening demand driven technology transfer, organise training and skills development programs, empower people, build human capital with technical skills as an integral component of enterprise development and facilitate access to finances required for enterprise growth. In addition, special programs are planned to develop Women and Youth entrepreneurship development and both organisations jointly conducted 34 Entrepreneurship Development Programs in Polonnaruwa, Matale and Kandy district and identified 2,688 SMEs.

With a view to exploring the possibilities to cater to the SME export sector, the HDFC bank came to partner the EDB in 2016 and working on much focused sectors such as SME Apparel sector, Clay Roof tiles, Green and Sustainable Products, Business Startups and the Horticulture sector.

In addition, the bank is registered for few other credit schemes of Central Bank, such as New Comprehensive Rural Credit Scheme (NCRCS) Self-Employment Promotion Initiative (SEPI) and Tharuna Diriya loan scheme,

With the initiation of Ministry of National Policies and Economic Affairs and with the association of CBSL, a loan scheme was formulated to cater to MSME sector by utilising Rs. 4 billion fund for Micro Small and Medium Enterprise Development and to generate employement opportunities under the government plan.