Sunday Feb 22, 2026

Sunday Feb 22, 2026

Wednesday, 18 November 2015 00:00 - - {{hitsCtrl.values.hits}}

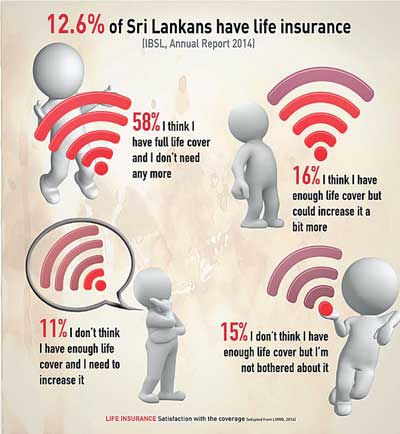

It is a fact that Sri Lanka’s life insurance market is under-penetrated and most Sri Lankans are under-protected. With only 12.6% of Sri Lankans possessing life insurance (IBSL annual report, 2014), there exists a considerable protection gap in the country.

What is the gap? Ignoring liabilities such as loans, outstanding credit card bills, the rule of thumb is that a family needs x3 annual income as a minimum sum insured. That’s probably the regular cost of a re-load to enable a family to re-cover from the loss of the main income earner?

LMRB research (2014) suggests that even out of this very small segment of life insurance policyholders, only 58% think that they are sufficiently covered. This means that the remaining 42% realise there is a gap in their required levels of protection. On an interesting note, 16% of those who feel sufficiently covered, still think there is room to increase their coverage. This means that while they have taken the initiative to protect themselves and their families, they understand that there is room to close the gap further.

So what of those that are aware they are not sufficiently covered? The LMRB statistics reveal that 11% of life policyholders actually think they need to increase their coverage. These people are acutely aware of a protection gap in their lives and want to bridge it, but haven’t been able to do so as yet. Notably, awareness is half the battle won and they hope to close the gap as soon as finances and opportunity allows.

But then, there is still a 15% who know they are not sufficiently covered but don’t seem to care enough to pursue the matter. Insurance Ombudsman, Dr Wickrema Weerasooria was quoted in a recent interview for Life Insurance Month in September 2015 saying “you can take a horse to water but you cannot make it drink”! He further cited a recent survey of how household incomes are spent, which showcased that the number one priority was the money reserved for mobile phone re-loads!

The irony here of course begs the question, ‘isn’t yours and your family’s future more important than a mobile re-load?’

AIA is the second largest life insurer in the world and all its businesses are in Asia, where it has observed family expenditure choices change across 18 markets over 90 years. Spending prioritisation evolves from first fulfilling basic needs to a basket that includes life insurance. It is interesting that a mobile re-load has become a basic necessity.