Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 4 May 2016 00:00 - - {{hitsCtrl.values.hits}}

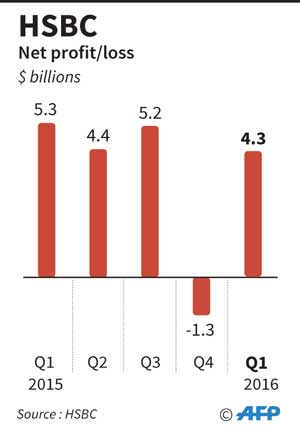

AFP: HSBC’s net profit fell by a fifth in the first quarter as it was hit by “extreme levels” of volatility in world markets over January and February, with bad loan costs almost doubling.

Equity and currency markets from Asia to the Americas were sent into meltdown at the start of the year as a growth slowdown in China and plunging oil prices fanned concerns about the world economy.

But group chief executive Stuart Gulliver said: “Our first quarter performance was resilient in tough market conditions that affected the entire banking sector.”

The first two months of the year saw “reduced client activity” in foreign exchange and stocks, with a partial recovery in March, the bank said in its report.

In a statement to the Hong Kong stock exchange the banking giant said net profit fell 18% to $4.3 billion while revenues were down 4% at $13.91 billion.

Charges for bad loans surged $692 million to $1.16 billion year on year, related to the oil and gas, and metals and mining sectors, Gulliver added, although he described the rise as “anticipated”.

However, pre-tax profits beat its own estimates, and bank chiefs said it was on track to reach cost targets after a radical overhaul announced last year. The news sent shares in the firm rallying 1.54% to HK$52.60 in the afternoon, having been 1.7% down going into the break.

Although reported pre-tax profits were down 14% at $6.1 billion, they were better than expected, beating an estimated average of $4.3 billion by the bank’s analysts, according to Bloomberg News. Gulliver said in the statement on Tuesday that cost-saving programmes had reduced operating expenses, adding: “We are confident of hitting our cost target by the end of 2017.”

HSBC – Europe’s largest bank – last year announced a radical overhaul to cut costs that included shedding 50,000 jobs worldwide, exiting unprofitable businesses and focusing more on Asia.

Gulliver said there was growing momentum in the bank’s Asia businesses, with “strong business wins” after HSBC’s investment in the region.

But, like many global banks, it has continued to face turmoil in global financial markets, while stricter regulations have driven up costs.

It reported disappointing results for the end of 2015, with a shock pre-tax loss in the final quarter.

HSBC also revealed in February that it is one of the banks being investigated by the US Securities and Exchange Commission in relation to its hiring practices in Asia-Pacific. The probe is looking at hiring practices of candidates “referred by or related to government officials or employees of state-owned enterprises in Asia-Pacific” the February report said. HSBC said at the time it was co-operating with the investigation. It came as the bank tried to move beyond recent scandals, including the rigging of foreign exchange markets.

Last month HSBC distanced itself from the Panama Papers leaks, which listed the bank as one of the institutions that helped set up the most offshore accounts.

The trove of documents from Panama-based law firm Mossack Fonseca revealed the vast extent of global tax evasion, putting the spotlight on how politicians and tycoons manage their money.

HSBC announced in February it would keep its headquarters in London, despite concerns about growing regulation in Britain and an upcoming vote on whether it could leave the European Union.