Sunday Mar 08, 2026

Sunday Mar 08, 2026

Wednesday, 28 October 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

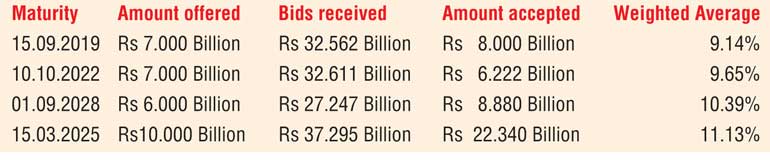

The impressive outcome of the Treasury bond primary auctions conducted on Monday, at where weighted averages (W.Avgs) were seen dipping across all four auctioned maturities in comparison to its previously recorded W.Avgs, led to secondary market bond yields closing the day lower.

The 12.10 year maturity of 1 September 2028 recorded the sharpest drop of 65 basis points (bp) to 10.39%, closely followed by the 3.10 year maturity of 15 September 2019 by 36 bp to 9.14% and the 6.11 year maturity of 1 October 2022 by 30 bp to 9.65%.

In addition, the 19.04 year maturity of 15 March 2035 dipped by seven bp to 11.13% in comparison to its previously recorded W.Avg on 10 March 2015 as its accepted amount more than doubled its offered amount.

The auctions were conducted in line with a Treasury bond and coupon maturity of Rs. 91.61 billion due on 1 November 2015.

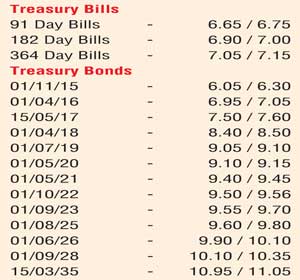

The outcome of the auction reversed an upward trend in yields witnessed during morning hours of trading on Monday as buying interest set in towards the latter part of the day. The auctioned maturities of 15 September 2019 and 1 October 2022 was seen hitting daily lows of 9.07% and 9.55% respectively subsequent to its morning highs of 9.21% and 9.65%.

In addition, the two 2021 maturities (i.e. 1 May 2021 and 1 August 2021) were seen changing hands within the range of 9.42% to 9.48% during the day while on the long end of the curve, the auctioned 15 March 2035 changed hands within the range of 10.98% to 11.05%.

Meanwhile in money markets, overnight repo rates decreased further to average 6.11% as surplus liquidity increased to Rs. 71.73 b yesterday. The Overnight call money rate remained steady to average 6.35%.

Rupee remains mostly unchanged

The USD/LKR rate on spot contracts remained mostly unchanged to close the day at levels Rs.141.05/15 as markets were at equilibrium. The total USD/LKR traded volume for 23 October was $ 67.75 million.

Given below are some forward USD/LKR rates that prevailed in the market: one month – 141.65/75; three months – 142.75/90; six months – 144.30/50.