Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 2 July 2015 00:13 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

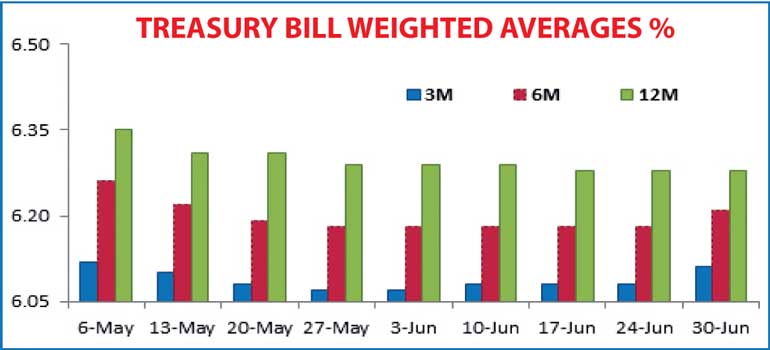

The weekly Treasury bill auction conducted Tuesday witnessed a mixed outcome as weighted averages (W.Avgs) on the 91-day and 182-day bills increased for the first time in four weeks while the W.Avg on the 364 day bill remained unchanged at 6.28% for a third consecutive week.

The increase on the 91 day and 182 day bills were three basis points each to 6.11% and 6.21% respectively as the total accepted amount was seen falling short of the total offered amount for a second consecutive week with the 91 day bill representing 63.83% of the total accepted amount of Rs 19.07 billion.

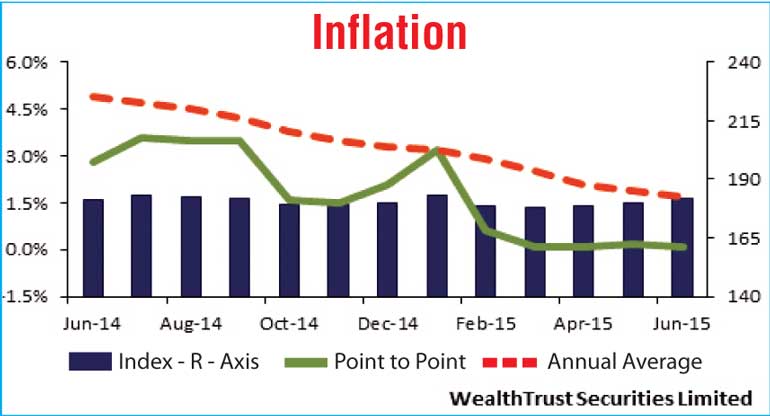

Meanwhile, the expectation and final outcome of Inflation for the month of June at where its point to point and annualised average dipped further to 0.10% and 1.70% respectively reflected in further buying interest in secondary bond markets Tuesday.

Activity centred the 1 August 2021, 1 September 2023 and 15 March 2025 maturities within the range of 8.84% to 8.86%, 9.01% to 9.05% and 9.05% to 9.10% respectively. In addition, a further Rs. 10 billion in Treasury bond auctions were announced for Thursday consisting of Rs. 5 billion each on a 4.10 year maturity of 1 May 2020 and a 7.03 year maturity of 1 October 2022.

In money markets, overnight call money and repo rates increased marginally to average 6.12% and 5.92% respectively as surplus liquidity decreased to Rs. 67.10 b on Tuesday.

Rupee remains steady

In forex markets, the USD/LKR rate on spot contracts remained steady to close the day at Rs. 133.70. The total USD/LKR traded volume for 29 June was $ 77.90 million.

Some of the forward dollar rates that prevailed in the market were three months – 135.30/45 and six months – 136.95/10.