Friday Feb 20, 2026

Friday Feb 20, 2026

Tuesday, 1 November 2016 00:04 - - {{hitsCtrl.values.hits}}

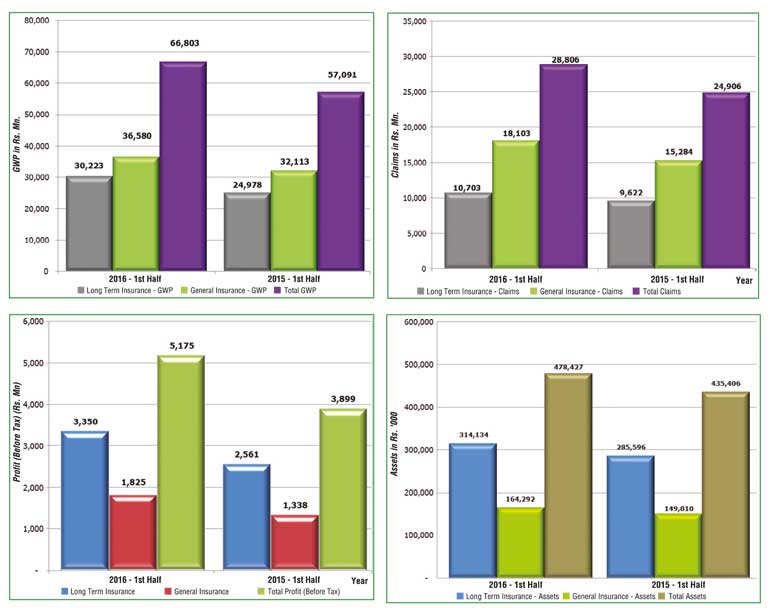

The Sri Lankan insurance industry performed well during the first half of 2016 with commendable growth of 17.01% in terms of Gross Written Premium (GWP), when compared to the same period of 2015. This growth is relatively higher than the growth experienced in the first half of 2015 i.e. 11.73% and attributable to increased premium incomes in both the long-term and general insurance business sectors.

The GWP for the long-term insurance and general insurance businesses for the six months up to 30 June 2016 was Rs. 66,803 million compared to the first six months of 2015 amounting to Rs. 57,091 million. The GWP of the long-term insurance business amounted to Rs. 30,223 million (1st half of 2015: Rs. 24,978 million) while the GWP of the general insurance business amounted to Rs. 36,580 million (1st half of 2015: Rs. 32,113 million) during the first half of 2016. Thus, the long-term insurance business and general insurance businesses witnessed a GWP growth of 21.0% and 13.91% respectively when compared to the corresponding period of 2015.

The total assets of insurance companies have increased to Rs. 478,427 million as at 30 June 2016 when compared to Rs. 435,406 million recorded as at 30 June 2015, reflecting a growth of 9.88%. This growth rate is significantly higher when compared to the growth experienced in the first half of 2015 i.e. 0.84%. The assets of the long-term insurance business amounted to Rs. 314,134 million (first half of 2015: Rs. 285,596 million) indicating a growth rate of 9.99% year-on-year. The assets of the general insurance business amounted to Rs. 164,292 million (first half of 2015: Rs. 149,810 million) depicting a growth rate of 9.67%, at the end of the first six months of 2016.

At the end of the first six months of 2016, investment in Government Debt Securities amounted to Rs. 158,239 million, representing 50.37% (first half of 2015: Rs. 120,503; 42.19%) of the total assets of the long-term insurance business, while such investment compared to the total assets of the general insurance business amounted to Rs. 31,986 million, representing 19.47% (first half of 2015: Rs. 29,312; 19.57%).

Accordingly, the total investment of assets of both technical reserve of the general insurance business and the long-term insurance fund of the life insurance business amounted to Rs. 190,224 million, representing 39.76% (first half of 2015: Rs. 149,816; 34.41%) as at 30 June 2016.

The profit (before tax) of insurance companies in both the long-term insurance business and general insurance business has increased to Rs. 5,175 million (first half of 2015: Rs. 3,899 million) showing a remarkable growth in profits by 32.73%.

The profit (before tax) of the long-term insurance business amounted to Rs. 3,350 million (first half of 2015: Rs. 2,561 million) while the profit (before tax) of the general insurance business amounted to Rs. 1,825 million (first half of 2015: Rs. 1,338 million) during the first half of 2016. Thus, profit (before tax) of the long-term insurance business and general insurance business witnessed a growth of 30.81% and 36.41% respectively, when compared to the corresponding period of 2015.

The claims incurred by insurance companies in both the long-term insurance business and general insurance business amounted to Rs. 28,806 million (first half of 2015: Rs. 24,906 million) showing an increase in total claims of 15.66% year-on-year. Long-term insurance claims, including maturity and death benefits, amounted to Rs. 10,703 million (first half of 2015: Rs. 9,622 million).

The claims incurred in the general insurance business, including Motor, Fire, Marine and other categories, amounted to Rs. 18,103 million (first half of 2015: Rs. 15,284 million). Hence, during the first half of 2016, there was an increase in claims incurred by 11.24% and 18.44% for the long-term Insurance and general insurance businesses respectively, when compared to the corresponding period of 2015.

IBSL, under its overall objective of safeguarding the interests of policyholders, inquires into policyholders’ grievances in connection with insurance claims pertaining to life and general insurance policies. IBSL also investigates any other complaint referred to it against any insurer, broker or agent.

During the first six months of 2016, 167 new matters were referred to the Board. A total of 158 matters were settled or closed during this period. The aggregate value of the claims settled during the period, due to the intervention of the Board, was around Rs. 14.0 million.

Out of 28 insurance companies (insurers) registered with the Board as at 30 June 2016, 12 are engaged in the long-term (life) insurance business, 13 companies are engaged in the general insurance business and three are composite companies (dealing in both the long-term and general insurance businesses).

Fifty-seven insurance brokering companies registered with the Board as at 30 June 2016, mainly involved in the general insurance business. The total assets of insurance brokering companies increased to Rs. 3,813 million as at 30 June 2016 when compared to Rs. 3,568 million recorded as at 30 June 2015, reflecting a growth of 6.87% year-on-year.

(Notes: 1) 2016 - Unaudited figures; 2) Above analysis does not include National Insurance Trust Fund (NITF) information; 3) Inter-segment transactions (i.e. transactions between the long-term and general insurance segments) have not been considered; 4) The assets belonging to shareholders of MBSL, SLIC and Sanasa have been reported under general insurance.)