Friday Feb 20, 2026

Friday Feb 20, 2026

Thursday, 3 December 2015 00:00 - - {{hitsCtrl.values.hits}}

Janashakthi Insurance MD Prakash Schaffter - Pic by Lasantha Kumara

By Shehana Dain

By Shehana Dain

Q: What’s ahead for Janashakthi post AIA acquisition?

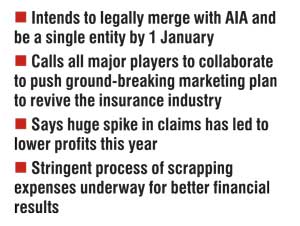

A: The AIA legal acquisition has been completed but what we have now to do is to integrate the two organisations. Our short-term intention is to legally merge and Janashakthi will be the surviving brand because we legally feel it has got greater attraction as a brand. Our core theme which has been consistent is that, we have to be sensitive to the human dynamics of this project.

So we have approached it one step at a time, integrating functions. We are hoping to legally merge by 1 January, we have written to the Insurance Board with our intentions. They will make their observations as it’s called within courts known to us. The next process thereafter is to apply to courts and get formal approval. So if the timing is right we will be a single entity by 1 January next  year.

year.

We are also planning on listing but currently but there is some degree of discussion taking place between the IASL and IBSL because there appears to be some degree of rethink in the issue of listing. We will await the outcome of that discussion. The overall philosophy of our company and the majority shareholders proposition will be to list any new entity.

It will be a larger entity than the current Janashakthi because you will have Janashakthi General merged with AIA.

Q: Is the Board planning on investing in similar levels of acquisitions in the near future?

A: We believe that the market is ready for consolidation. We did state in our Annual Report and via other methods as well that we will actively pursue in acquisitions as a means to grow our market share. This is not the first and if there are opportunities that arise, we will certainly look at them.

Q: How would you rate Janashakthi’s performance past, present and future?

A: Well, when it comes to performance, it depends on what you use as the indicator of performance, whether it’s top line or whether its bottom line, which are the two most common indicators. With those two one can see that we have grown and managed to retain our market share. On the life side we have lost marginally and we have come down as far as market ranking is concerned but we have restructured our life structure and I’m confident that we will grow the life side. Also currently with the AIA acquisition we hope to grow our market share organically rather than just hold on to market share.

As far as the future is concerned in the general side now we have a stronger entity and we will be poised to acquire market share. In the past four five years what we managed to do is hold our market share while the larger players found that their market share been chipped away while we retained it.

Life side we have restructured our entire sales and distribution structure which includes network and the basis of commission payment which has already yielded dividend growth of 18% which I’m sure will continue the next year as well.

Q: Why do you think life insurance penetration has never taken off in Sri Lanka?

A: My view is that we have an educated society, a society which is more literate than any other South Asian country. Adding to that our living standards is also higher than many other in the region. These two generally leads to awareness such as risk but over here it’s not the case. The only reason I can think of is culture. We are an island and we don’t take risk very seriously, there’s an attitude where we presume that risk will never happen to us.

Q: Don’t you think some sort of consolidation or collaboration will help create greater awareness on life insurance?

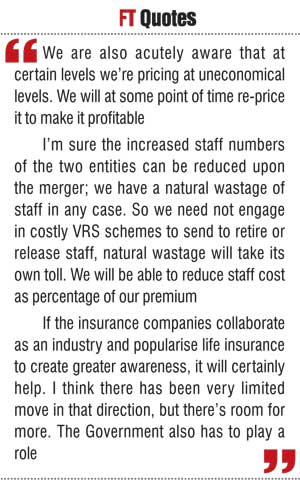

A: I’m not sure if consolidation itself will help certain aspects of stronger companies. It will have more financially stable companies and it will have smaller companies defray their expenses over a larger base so they would provide insurance maybe at a lower cost. So it doesn’t mean consolidation alone will help insurance penetration. Indirectly it may help because theoretically and I stress ‘theoretically’ because a company which consolidates may then find that it’s costs are lower so it can spend more money on popularising insurance. One can extend it in that direction, but I don’t think consolidation would necessarily mean greater penetration.

There is a certain degree of responsibility which we insurers need to take, we’re responsible for the development of the industry and if penetration is low we can’t raise our hands and say ‘it’s not our fault.’ I did give some reasons earlier, but we are to be blamed as well. We have to think what we can do to further popularise insurance.

Q: So don’t you think a collaborative move would help the cause?

A: If the insurance companies collaborate as an industry and popularise life insurance to create greater awareness it will certainly help. I think there has been very limited move in that direction, but there’s room for more. The Government also has to play a role. I think either we should engage with them or they should engage with us to popularise insurance.

Q: Where do you think the insurance industry as a whole is positioned today?

A: The returns on investment were greater earlier they are not as attractive now. Especially in the general insurance side it’s because of intense price competition. I haven’t done an in-depth analysis as such in the life side, but I guess it’s because the market is dispersed. So yes certainly it’s not as attractive as a proposition as it was five or 10 years ago.

Q: What do you think can be done to get back the old glory of the industry?

A: Consolidation. I mean greater consolidation will lead to greater returns, better efficiency and that certainly will help. Plus I must say there is a greater need for insurers to go out there and get insurance, we haven’t really looked at innovative ways of marketing on how do we reach out and get people to insure because when you look at house holders and small shop owners the cost of distribution is high.

It’s not attractive to the agent to go and sell it because the commission he gets is small. We also have to look at telemarketing which has never happened here, it was common in the UK 30 years ago. There is also very limited exploration on how to sell insurance via mobile, that’s a new thing that has to happen. We really have to sit down and come up with ground breaking distribution methodology which will help us spread insurance.

Q: Consolidated profit before tax declined by 45% while Janashakthi has recorded a loss in the interim financial reports this year. What led to this financial result?

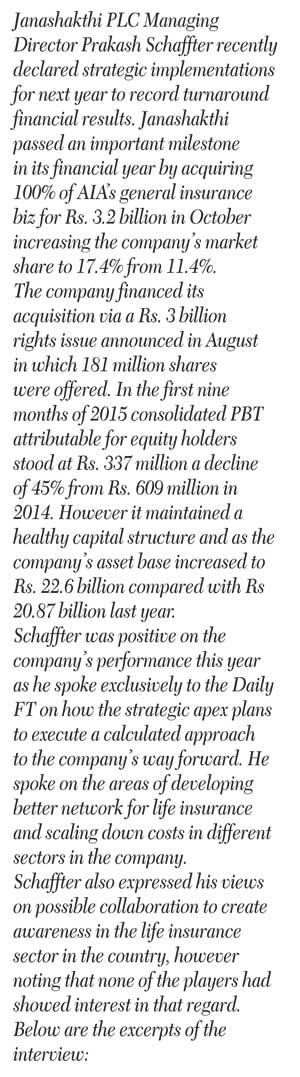

A: There are two reasons for this. One is the Gross Written Premium (GWP) increase which will yield in profits only later on. The accounting methodologies refer to deferment on our turnover, so the results will come in only after 12 to 13 months in time. This is one of the better years we have had; we are running at around 13% growth in the general side and 18% on life. I should also mention we have managed to control management expenses at probably around 4% growth YoY which is very creditable.

The fact remains that we have had huge spike on claims and that has led to lower profits. This is also partly to do with fuel prices, with prices dropping and more vehicles in the road for longer periods and that has impacted the claims.

We are looking at this year as a year of expanding our market share and we will look at consolidating our bottom line maybe in the year after. We’re comfortable with this. Needless to say we would have liked to have had higher profits and we will rectify our temporary hit on bottom line in the years ahead. Mainly because the higher market share and increase top line will enable us to make minor adjustments in the top line which will subsequently allow us to overcome this.

Q: Do you think the company’s performance this year is satisfactory?

A: Always one has to strive to do better. So I would say we could have done better in both our top line and bottom line. If we say we have as much as we can, then that’s the day we stop going forward. So I would say whatever our results are we could have done better and need to strive better.

Q: What’s Janashakthi’s action plan to transform the current bottom line to a more profitable one?

A: In a philosophical view there are three lines that we tackle with; top line, claims line and the expenses line. If we tackle those three lines, it automatically impacts the bottom line. If I start at the top, the top-line is something which we have done reasonably well this year more or less in line with market growth. The AIA acquisition coming in I’m sure there will be a boost to our top line, we have more salesman on the ground and I’m certain we will be able to outperform market next year. Customers will also have confidence on us because it will be a stronger entity in the general insurance business; it will be close up to eight billion after the merger.

If you look at the claims line, after the merger we will be able to revisit our claims practices and procedure and further tighten the leakages. Also the top line we will be able to look at the pricing of both organisations and re-price to give us an advantage. We are also acutely aware that at certain levels we’re pricing at uneconomical levels. We will at some point of time re-price it to make it profitable. We are consciously growing our market share in some segments despite it not being economical at this point in time in the future we are hoping to repair that glitch as well.

When it comes to the expense line we’re very happy at the way it’s going on, we’re looking at technology to help us so we will not need to increase staff numbers.

I’m sure the increased staff numbers of the two entities can be reduced upon the merger; we have a natural wastage of staff in any case. So we need not engage in costly VRS (Voluntary Redundancy Scheme) schemes to send to retire or release staff, natural wastage will take its own toll. We will be able to reduce staff cost as percentage of our premium. Overall synergies have to follow when you merge two organisations, there will be certain costs which will not be duplicated. We have identified them and I’m sure our expenses which are currently around 20% of the premium will certainly drop. So because of the acquisition let’s say expenses fell from 20% to 17.5% if I were saving 2.5% in expenses in a Rs. 12 billion turnover that alone is fairly substantial, that alone is Rs. 250 million.

Investment income will be another area we will be trying to improve, 2015 has been a year of low interest yields. We are hoping that interest yields will pick up even if marginally. We also have a bigger portfolio to manage that will give us a certain amount of bargaining power.

Q: What sort of a backing do you wish for from the Government to uplift the insurance industry?

A: Well on the life side and for pensions the Government can improve the tax benefits which is very low currently at Rs. 75,000. Apart from that the Government can help popularise certain insurances making them compulsory. This can also be done by part contributing or subsidising a campaign maybe from state media can help us.

Apart from that, the bulk of the work has to be done by us and we should not constantly pressurise the Government for financial assistance and the industry is large enough to make our own way.