Sunday Feb 22, 2026

Sunday Feb 22, 2026

Thursday, 21 May 2015 00:00 - - {{hitsCtrl.values.hits}}

Minister of Industry and Commerce of Sri Lanka Rishad Bathiudeen addresses the fourth Sri Lanka Islamic Banking and Finance (IBF) Awards event at Galadari Hotel on 12 May

Though Sri Lanka’s Islamic Banking and Finance (IBF) industry has a small assets base, it shows strong growth. “In 2014, the Lankan IBF sector has grown by a strong 42% from 2013’s total assets. That is, 2013’s Rs. 35 billion IBF assets have increased to Rs. 50 billion in 2014,” said Minister of Industry and Commerce Rishad Bathiudeen.

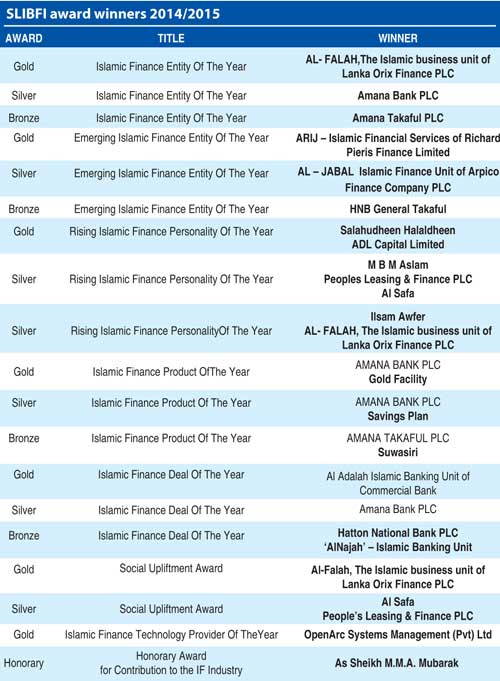

Minister Bathiudeen was addressing the fourth Sri Lanka’s Islamic Banking and Finance (IBF) industry awards event held at Galadari Hotel on 12 May. Organised by UTO EduConsult, the only kind of such awards in Sri Lanka, saw 18 awards being given to local banking and financial firms and an additional Honorary Award.

“This is the fourth time that this awards event is taking place,” said Minister Bathiudeen and added: “The continuous progress of this event over the past few years speaks volumes about the gradual recognition of the Islamic Banking and Finance industry or ‘IBF’ in Sri Lanka. As you may already be aware the Global IBF sector has been growing steadily. As for Sri Lanka, the penetration of IBF is very low here. Of Sri Lanka’s total banking and finance sector assets, less than 1% only belongs to Islamic banking and finance. However, I am pleased to say that there is good news.

“Despite its small base, Sri Lanka’s IBF sector is showing steady growth. In that, in 2014, the Lankan IBF sector has grown by a strong 42% from 2013’s total IBF assets. That is, 2013’s Rs. 35 billion IBF assets have increased to Rs. 50 billion ($ 373 million) in 2014. In my conversations with the banking and finance experts of Sri Lanka this week, I understood that the key reason for Sri Lanka’s small IBF base is lack of awareness. More than 85% of Lankan Muslims alone are unaware about IBF and how to join it.

“Also much more attention and keenness by our national banking and finance sector is needed for us to see bigger IBF growth here. Lankan banking and finance experts inform me that there are two ways to effectively expand the Islamic finance sector in Sri Lanka. Firstly, creating a demand from the market – that is from the consumers’ side; secondly, facilitation and offerings of Islamic finance products by the financial regulators of the government such as the Central Bank.

“Sri Lanka primarily being a non-Islamic country has taken great steps to legislate and regulate Islamic banking. We have amended the Banking Act in 2005 to accommodate Islamic financial transactions. Our key tax laws also were amended in 2011 to include provisions for Islamic Financial transactions.”

At the 13 May event, Lanka Orix Finance Ltd’s ‘Al Salaah Islamic Banking Unit’ was awarded the 2015 Islamic Financial Entity of the Year, which was accepted by LOFC GM-CEO Krishan Thilekaratne.

-Pix by Lasantha Kumara