Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 9 February 2016 00:13 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

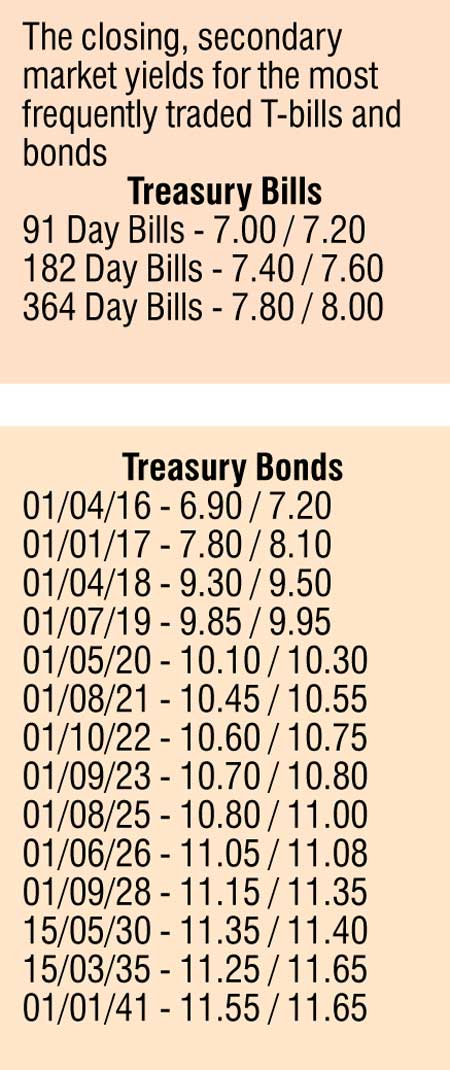

The secondary bond market witnessed continued buying interest on the long end of the yield curve yesterday as yields on the liquid maturities of 1 June 2026, 15 May 2030 and 1 January 2041 were seen dipping to intraday lows of 11.06%, 11.40% and 11.60% respectively against its days opening highs of 11.10%, 11.45% and 11.75%.

In addition, a limited amount of activity was witnessed on the 1 August 2021 and 1 September 2023 maturities within the range of 10.49% to 10.51% and 10.75% to 10.80% respectively.

On the short end of the yields curve, 2018 maturities were seen changing hands within the range of 9.50% to 9.55% as well.

In money markets, overnight call money and repo rates eased marginally to average 6.80% and 6.40% respectively as surplus liquidity stood at Rs 62.05 billion yesterday. The Open Market Operations (OMO) department of Central Bank was seen mopping up an amount of Rs. 13.30 billion by way of outright sales of Treasury bills valued for today at weighted averages 6.47% and 6.64% for durations of 17 days and 24 days respectively.

Rupee on spot and one week contracts remain steady

The USD/LKR rate on spot and one week forward contracts remained steady to close the day at Rs.143.95/20 and Rs.144.25/35 respectively as markets were at equilibrium yesterday. The total USD/LKR traded volume for 5 February was $ 59.50 million.

Some of the forward USD/LKR rates that prevailed in the market were one month – 144.70/00; three months – 145.90/10 and six months – 147.65/75.