Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 14 September 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

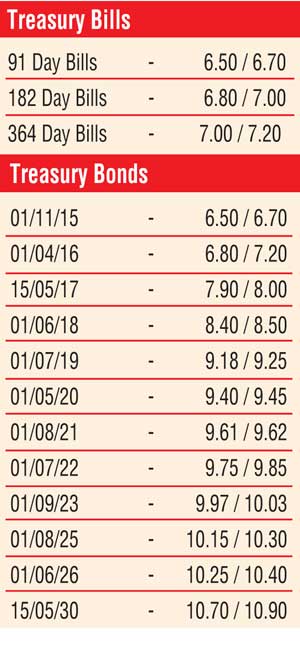

The momentum in secondary bond markets switched from bearish to positive during the week ending 11 September following the rejection of all bids at the weekly Treasury bills auction for the first time in 11 months, signaling that the bids submitted were too high according to market sources.

Following the outcome of the bill auction, buying interest on the liquid maturities of 01.07.2019, 01.05.2020, 01.08.2021, 01.09.2023, 01.08.2025 and 01.06.2026 saw their yields dip to weekly lows of 9.09%, 9.35%, 9.55%, 9.95%, 10.20% and 10.35% respectively against its weeks opening highs of 9.25%, 9.65%, 9.90%, 10.25%, 10.32% and 10.45%, reflecting a marginal parallel shift downwards of the yield curve for the first time in four weeks.

In addition, on the shorter end of the yield curve the 15.05.2017 and 01.06.2018 maturities were seen changing hands within the range of 7.90% to 8.25% and 8.40% to 8.70% as well during the week. However, yields were seen increasing once again from their weekly lows recorded on Friday on the back of Rs. 16 billion of Treasury bond auctions due on Tuesday. In secondary bill markets, October 2015 and February 2016 maturities were seen changing hands at levels of 6.30% to 6.75% and 6.75% to 7.15% respectively during the week.

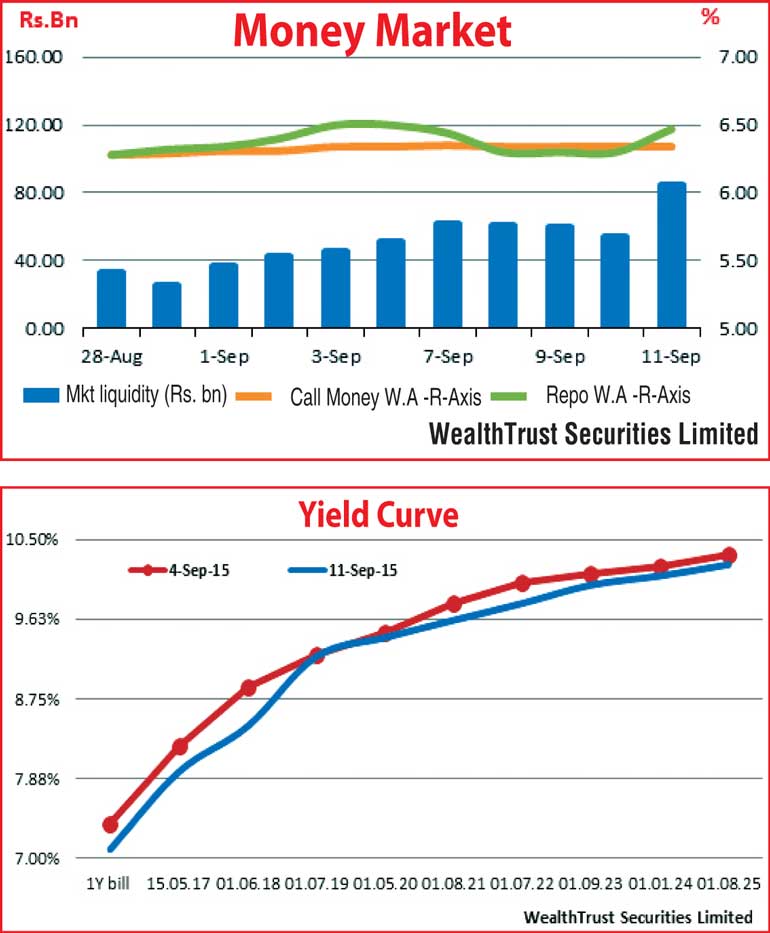

Meanwhile, in money markets, overnight call money and repo rates decreased during the week ending 11 September, to average 6.34% and 6.36% respectively as surplus liquidity in markets was seen increasing to average of Rs. 64.23 billion for the week against its previous week’s average of Rs. 40.30 billion as it peaked to a one-month high of Rs. 84.32 billion on Friday.

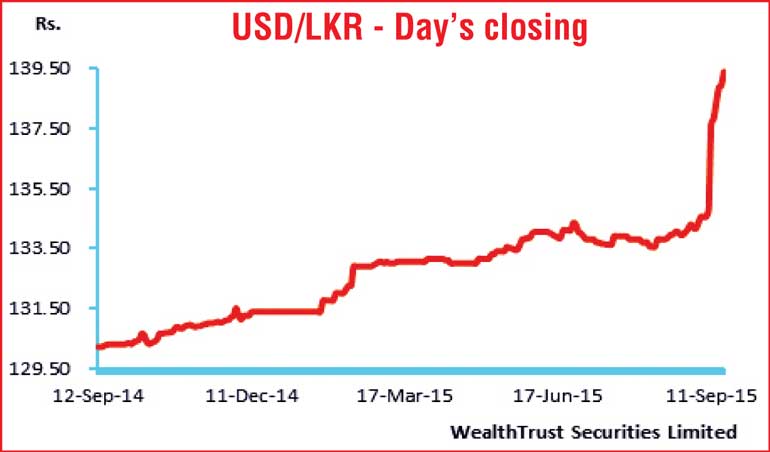

Depreciating trend continues for the rupee

The rupee depreciated further during the week against its previous week’s closing levels of Rs. 137.50/75 to an all-time low of Rs. 139.30 on the back of importer demand. The daily average USD/LKR traded volumes for the first four days of the week stood at $ 55.54 million.

Some of the forward dollar rates that prevailed in the market were one month - 139.85/10; three months - 140.90/10 and six months - 142.55/65.