Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 21 September 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The mixed outcomes at the Treasury bond and bill auctions, coupled with the Federal Open Market Committee’s (FOMC) decision to continue to hold interest rates in the US near zero levels, saw secondary market bonds witness some volatility during the week ending 18 September.

During the early part of the week, yields were seen increasing mainly on the back of the outcomes of the Treasury bond auctions,  where weighted averages on the belly-end to the long-end of the yield curve were seen increasing while the short-end reflected a dip.

where weighted averages on the belly-end to the long-end of the yield curve were seen increasing while the short-end reflected a dip.

Activity surrounded the liquid maturities of 01.07.2019, 01.05.2020, 01.08.2021, 01.10.2022 and 01.09.2023 as their yields were seen increasing to weekly highs of 9.20%, 9.58%, 9.75%, 10.05% and 10.02% respectively.

However, the outcome of the weekly Treasury bill auction, where weighted averages on the 91-day and 364-day bills remained unchanged at 6.79% and 7.17% respectively after a lapse of one week, plus the FOMC outcome led to yields dipping towards the latter part of the week once again to weekly lows of 9.15%, 9.50%, 9.65%, 9.95% and 9.96%.

In addition, the maturities of 01.08.2025 and 01.09.2028 were seen changing hands within a thin range of 10.36%-10.40% and 10.87%-10.90% respectively. In secondary bill markets, November 2015 and February 2016 maturities were seen changing hands at levels of 6.65%-6.75% and 6.95%-7.05% respectively post auction.

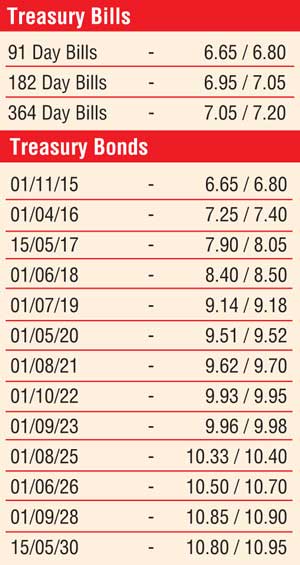

Meanwhile, in money markets, despite the increase in average surplus liquidly by Rs. 6.77 billion to Rs. 71.00 billion, overnight call money and repo rates increased during the week ending 18 September to average 6.35% and 6.41% respectively.

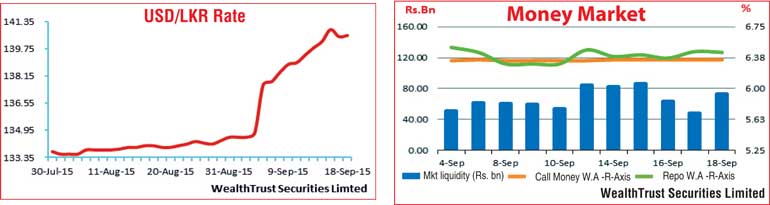

Rupee depreciates during the week

The USD/LKR rate on spot contracts dipped to an all-time low of Rs. 140.99 during the week on the back of continued importer demand. However, it was seen gaining back a tad of its lost ground towards the latter part of the week on export conversions and foreign buying in government securities and equities to close the week at Rs. 140.50/60 in comparison to its previous week’s closing of Rs. 139.30/50.

The daily average USD/LKR traded volumes for the first four days of the week stood at $ 54.04 million.

Some of the forward dollar rates that prevailed in the market were one month - 140.10/30; three months - 142.35/45 and six months - 143.90/20.