Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 10 August 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

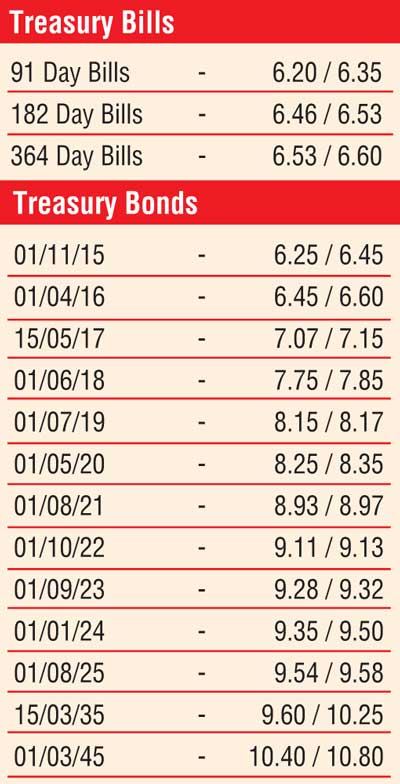

The momentum in the secondary bond market turned bearish during the week ending 7 August, as auction weighted averages were seen increasing at the Treasury bond auctions and the weekly Treasury bill auction.

The weighted average on the six-year maturity of 1 August 2021 was seen increasing by 20 basis points (bp) to 9.07% during the week against its previously recorded average while the 182- and 364-day bills reflected increases of 07 bp and 06 bp respectively to 6.50% and 6.54%.

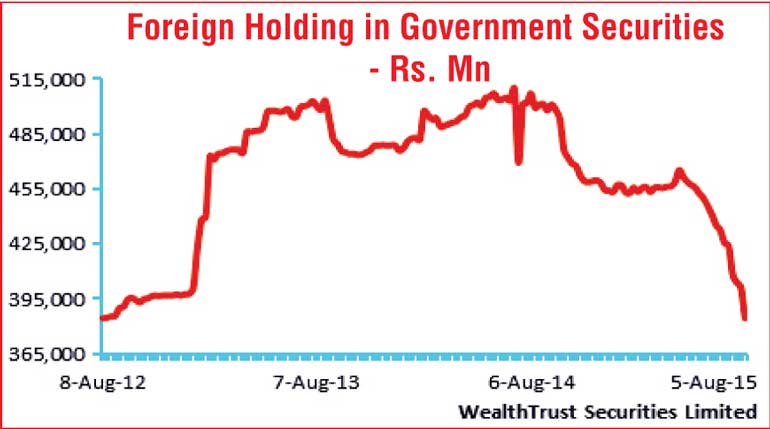

The drop in foreign holdings in rupee bonds to a three-year low of Rs. 384.41 billion, contributed to this change in momentum as well. Activity mainly centered on the 1 August 2021 maturity during the week, as its yield was seen increasing to a weekly high of 9.08% post its auction but subsequently dipped to a weekly low of 8.94% once again towards the latter part of the week.

Similarly, yields on the liquid maturities of 01.07.2019, 01.10.2022 and 01.09.2023 were seen increasing to weekly highs of 8.26%, 9.18% and 9.33% respectively before bouncing back to lows of 8.15%, 9.11% and 9.28%.

In addition, a limited amount of activity was witnessed on the ten-year maturity of 1 August 2025 within the range of 9.53% to 9.60% during the week.

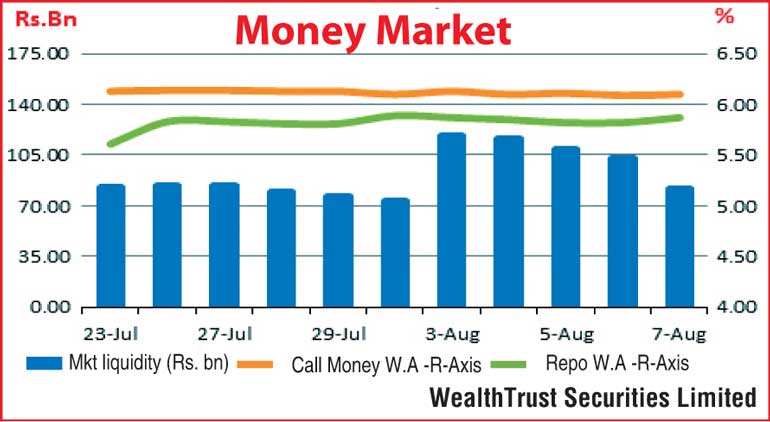

In money markets, the overnight call money and repo rates remained mostly unchanged during the week ending 7 August, to average 6.11% and 5.85% respectively despite surplus liquidity increasing considerably to average Rs.105.77 billion against its previous week’s average of Rs. 78.37 billion.

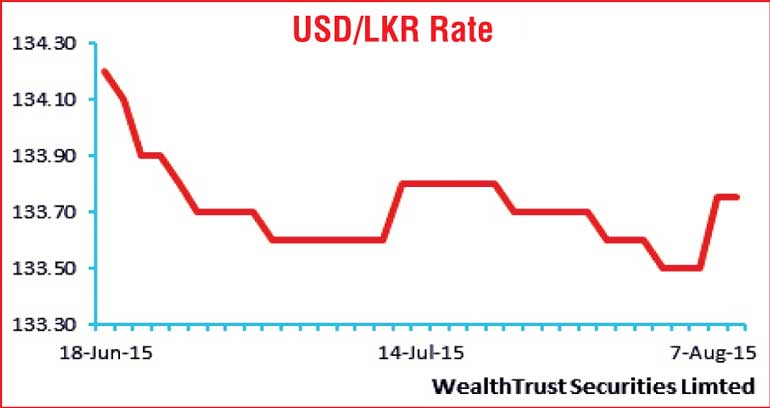

Rupee depreciates for the first time in three weeks

The rupee lost ground by 25 cents to Rs. 133.75 during the week for the first time in three weeks on the back of importer demand, foreign selling in rupee bonds and foreign outflows at the Colombo bourse. The daily average USD/LKR traded volume for the first four days of the week was at $ 32.12 million. Some of the forward dollar rates that prevailed in the market were one month - 134.30/40; three months - 135.40/50 and six months - 136.70/90.