Thursday Feb 26, 2026

Thursday Feb 26, 2026

Monday, 17 August 2015 00:00 - - {{hitsCtrl.values.hits}}

Activity in the secondary bond market remained sluggish during the week ending 14 August as primary auction yields continued to increase on the backdrop of a wait and see policy adopted by most market participants.

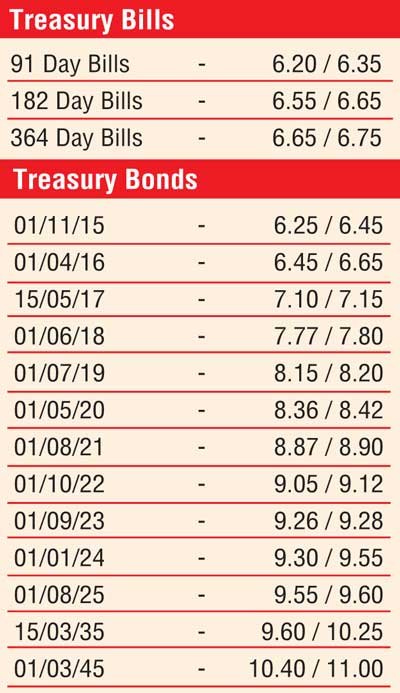

The weighted averages on the 182 day bill, 364 day bill and the 10 year bond maturity of 1 August 2025 were seen increasing by 07, 09 and 04 basis points respectively during the week to 6.57%, 6.63% and 9.67%.

However, secondary market bond yields were seen dipping marginally week on week mainly on the belly end of the yield curve with the 1 August 2021, 1 October 2022, 1 September 2023 and 1 August 2025 maturities dipping to weekly lows of 8.86%, 9.08%, 9.25% and 9.55% respectively while yields on the shorter end of the yield curve continued to increase.

On the longer end of the curve, yields remained stagnant translating to a flattening yield curve. In secondary bill markets, selling interest saw durations centering the 182 day and 364 day bills been offered at levels of 6.55% and 6.65% respectively.

Meanwhile, the foreign holding in rupee bonds continued to decline for a seventeenth consecutive week by Rs. 5.12 billion to a total of Rs. 379.12 billion.

In money markets, the surplus liquidity in the system lost its dominance over CBSL’s holding of Government securities during the week ending 14 August as surplus liquidity dipped below its holding levels. The overnight call money and repo rates averaged at 6.12% and 5.90% respectively for the week against its previous weeks averages of 6.11% and 5.85% with average liquidity dipping to Rs. 67.10 billion during the week against its previous week’s average of Rs. 102.52 billion.

Rupee depreciates further

The rupee lost ground by a further 15 cents during the week to close the week at Rs.133.90. In a surprise development towards the latter part of the week, the one year forward contract was seen changing hands at a low level of Rs. 141.22 as well. The daily average USD/LKR traded volume for the first four days of the week was at $ 50.63 million.

Some of the forward dollar rates that prevailed in the market were one month – 134.52/62; three months – 135.74/84 and six months – 137.58/65.