Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 20 February 2017 00:27 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

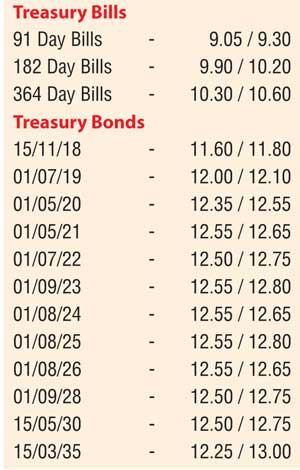

The declining trend in secondary market bond yields witnessed over the week ending 9 February was seen continuing into the early part of the week ending 17 February as well with buying interest outweighing selling interest. The liquid two 2021 maturities (i.e. 01.05.21 and 01.08.21) were seen dipping to weekly lows of 12.40% and 12.45% respectively on the back of continued buying interest. However, market momentum was seen taking a U-turn once again towards the latter part of the week on continued foreign selling interest to see the 2021 yields hit a high of 12.60% once again.

In addition, the 01.07.2019 was seen touching a high of 12.10% followed by the 01.04.18, 01.06.18, 15.07.18, 15.08.18, 15.11.18 and 01.05.20 changing hands at levels of 11.06% to 11.20%, 11.20% to 11.40%, 11.35% to 11.60%, 11.45% to 11.65%, 11.65% to 11.80% and 12.35% respectively as well. The upward trend was further supported by the outcome of the weekly bill auction at where weighted averages continued to increase.

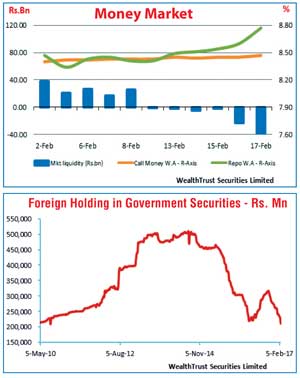

Furthermore, all bids for the four Treasury bond auctions were rejected during the week as activity dried up considerably. The foreign holding in Rupee bonds recorded an outflow to the value of 17.7 billion for the week ending 15 February whilst its total value dipped to a low of Rs. 211.49 billion for the first time since 18 August 2010.

In money markets, the overnight call money and repo rate increased further during the week to average 8.45% and 8.58% respectively against its previous weeks averages of 8.43% each as average liquidity in the market stood at a deficit of Rs. 14.09 billion against its previous weeks average surplus of Rs. 17.11 billion. The upward pressure in money market rates were controlled during the week as the Open Market Operations (OMO) department of Central Bank started to infuse liquidity by way of overnight reverse repo auctions.

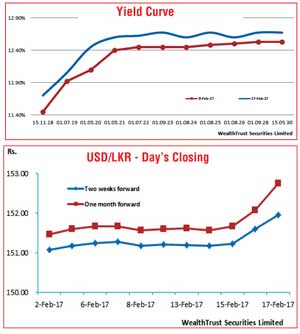

Rupee dips during the week

The USD/LKR rate on active two weeks and one month forward contracts depreciated during the week to close the week at Rs. 151.80/10 and Rs. 152.60/90 respectively against its previous weeks closing of Rs. 151.17/25 and Rs. 151.55/65 on the back of importer demand and foreign selling in rupee bonds.

The daily USD/LKR average traded volume for the first three days of the week stood at $ 116.46 million.

Some of forward dollar rates that prevailed in the market were three months – 154.50/80 and six months – 156.35/50.