Tuesday Mar 03, 2026

Tuesday Mar 03, 2026

Monday, 9 January 2017 01:09 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

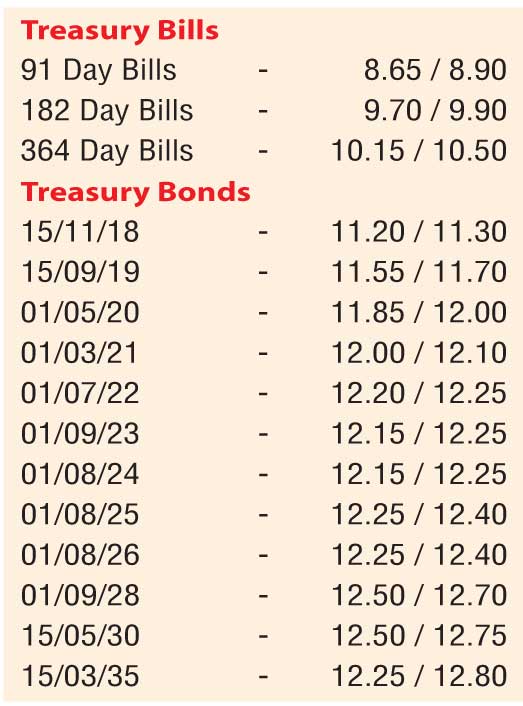

The secondary bond market started the year on a positive note as yields decreased during the early part of the week ending 6 January 2017 on fresh buying interest fuelled by the increase in liquidity to a one year high. The yields on the liquid maturities of 15.09.19, 01.03.21, 01.09.23 and 01.08.24 decreased to lows of 11.50%, 11.97%, 12.10% and 12.15% respectively against its previous weeks closing levels of 11.65/80, 12.12/18, 12.25/40 and 12.30/35.

However considerable foreign selling interest retuning back to the market on the maturities of 01.11.19, 01.08.21 and 01.07.22 at highs of 11.80%, 12.20% and 12.30% respectively coupled with the continuous increase of weighted averages at the weekly bill auction saw sentiment turn bearish towards the latter part of the week.

This was ahead of today’s (9) bond auctions, at where Rs. 55 billion in total will be on offer 1consisting of Rs. 16 billion each on a 4.11 year maturity of 15.12.2021 and a 7.07 year maturity of 01.08.2024 and a further Rs. 6 billion on a two year maturity of 15.01.2019 and Rs. 17 billion on a 9.07 year maturity of 01.08.26.

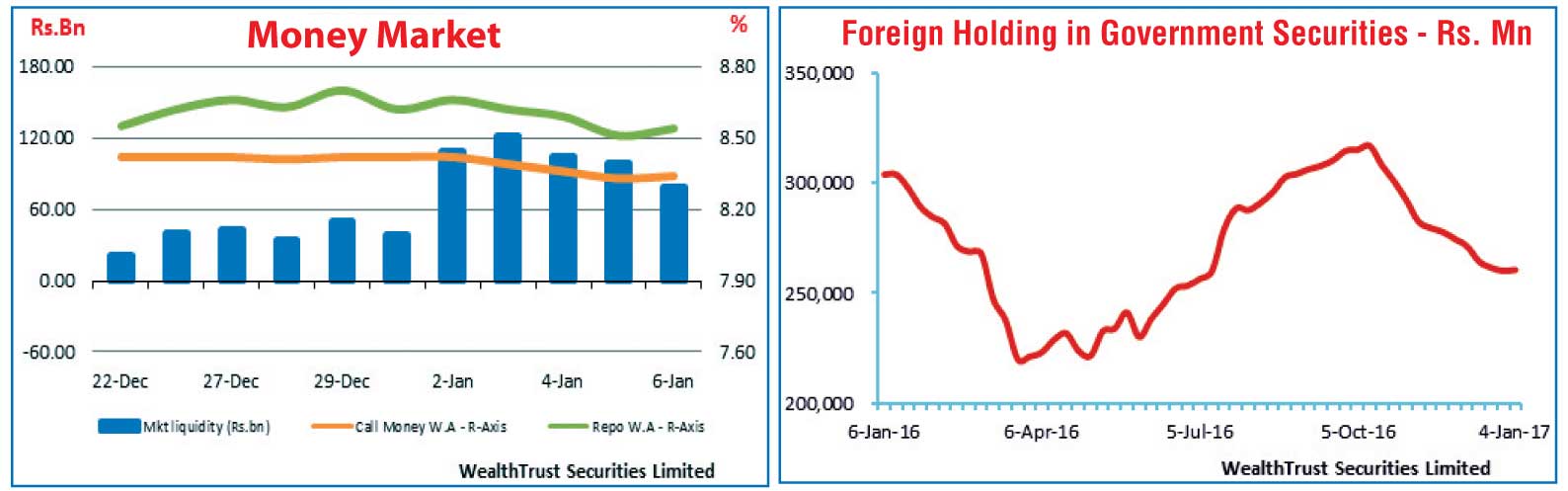

Furthermore the holiday week ending 4 January saw a reversal in the foreign holding as it recorded a marginal increase for the first time since 12 October 2016 to the of Rs. 260.58 million.

In money markets, the overnight call money and repo rates decreased further during the week to average 8.37% and 8.58% respectively against its previous week’s average of 8.42% and 8.65% as net surplus liquidity in the system increased considerably to Rs. 102.13 billion, against its previous week’s average of Rs. 41.75 billion.

The OMO (Open Market Operations) department of Central Bank was seen mopping up excess liquidity by way of two auctions for outright sales of Treasury bills and three term repo auctions for the first time in 12 months. The bill auctions drained out an amount of Rs. 3.5 billion in total at weighted averages of 8.39% for a period 35 days and 8.46% for a period 39 days while it drained out total an amount of Rs. 37.00 billion at weighted averages ranging from 7.43% to 7.44% for period ranging from seven days to eight days. Furthermore it continuously drained out liquidity by way of overnight repo auctions at weighted averages ranging from 7.40% and 7.42%.

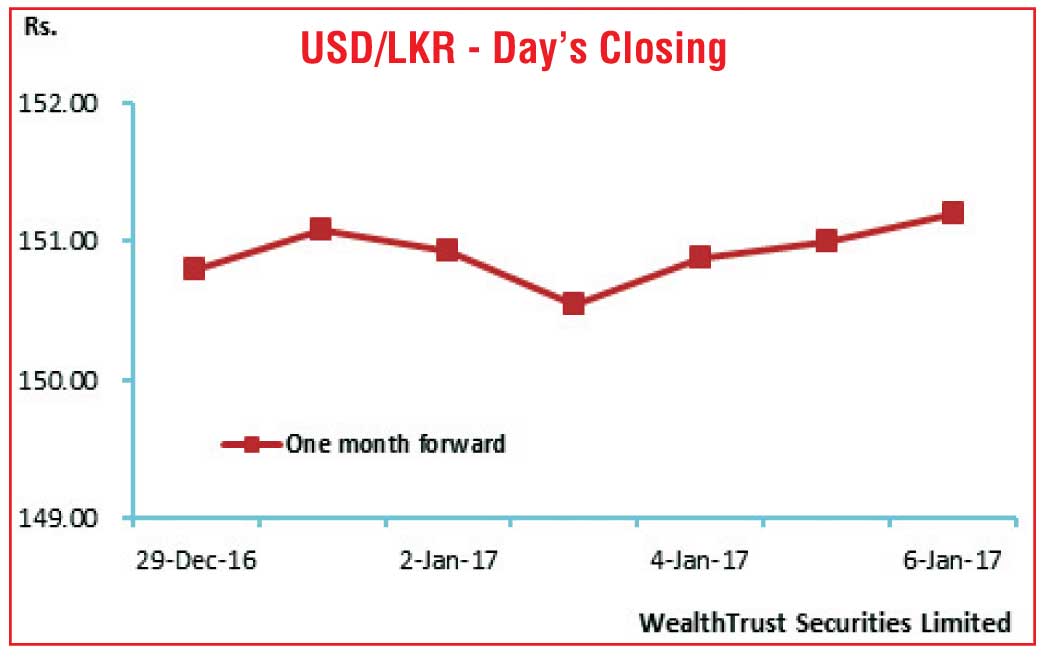

Rupee dips further during the week

The active one month forward dollar/rupee contracts depreciated further during the week ending 6 January to close the week at Rs. 151.15/25 against its previous weeks of Rs. 150.75/85 while two weeks forward contracts were quoted at Rs. 150.60/70 on the back of foreign selling in rupee bonds and importer demand.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 54.20 million.

Some of the forward dollar rates that prevailed in the market were three months – 152.65/75 and six months – 154.85/95.