Saturday Feb 07, 2026

Saturday Feb 07, 2026

Tuesday, 1 November 2016 00:46 - - {{hitsCtrl.values.hits}}

Global rating agency Moody’s yesterday described the introduction of new VAT regime from 1 November as credit positive and would keep the crucial IMF program on track.

On 26 October, the Sri Lanka (B1 negative) Parliament voted in favour of amendments to the Value Added Tax (VAT) bill, which will increase the VAT tax rate to 15% from 11%, paving the way for higher government revenues and adherence to International Monetary Fund (IMF) program commitments.

“This is credit positive because a higher VAT rate will facilitate fiscal consolidation by strengthening Sri Lanka’s low revenue-to-GDP ratio, which is a key credit constraint,” said Moody’s William Foster, Vice President – Senior Credit Officer, Sovereign Risk Group, Moody’s Investors Service Amelia Tan, Associate Analyst, Sovereign Risk Group, Moody’s Investors Service Singapore Ltd., in comments to Moody’s Credit Outlook.

They said the Government originally implemented the VAT hike in May, but retracted it in July after a legal challenge by the main political opposition party in Parliament.

“Backsliding on VAT reform demonstrates the implementation risks surrounding fiscal reforms. Had the implementation delay been prolonged, Sri Lanka would have been at risk of derailing its IMF program and loan disbursements, which would have strained the balance of payments and harmed investor confidence,” they added.

The VAT Parliamentary vote took place immediately following a Supreme Court ruling that deemed the tax hike permissible under Sri Lankan law. In addition, Parliament approved amendments that increase the nation building tax rate on importers, manufactures and service providers to 4% from 2%.

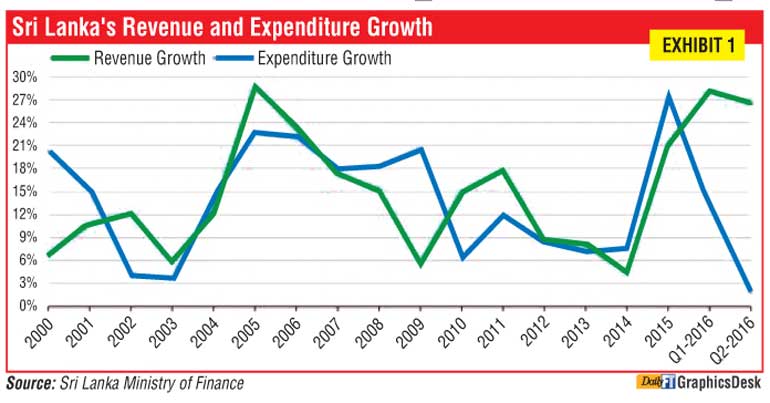

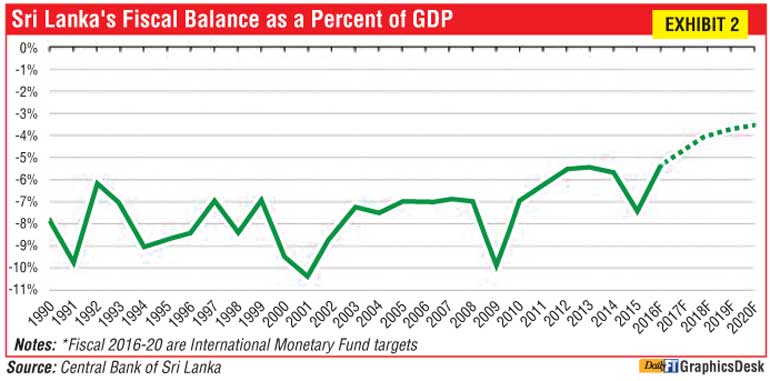

Moody’s said fiscal consolidation is a major focus of the IMF program with a reduction in the deficit to 5.4% of GDP this year and 3.5% by 2020, from 6.9% in 2015, or 7.4% including one-off expenses. In first-half 2016, government revenues including grants rose a robust 27.3% year on year while expenditures increased 7.1%.

Revenue growth was broad-based, with increases in VAT, the national building tax and custom duties. As a result, the primary balance, which excludes interest payments, was in deficit of Rs. 38.6 billion by June 2016, ahead of the IMF program target of Rs. 46 billion.

Moody’s said despite a favourable first half of the year, the primary deficit widened markedly in July. The VAT hiatus makes meeting primary deficit targets challenging, at Rs. 85 billion for September and Rs. 97 billion for December.

In particular, salary and pension payments accounting for about 36% of primary expenditure and interest payments amounting to around a quarter of total expenditures constrain room to cut expenditures.

Longer term, the objective of reducing the deficit to 3.5% of GDP by 2020 is ambitious and would be the smallest deficit in the past 25 years, and indeed in most years since 1950.

The IMF forecasts an increase in Sri Lanka’s revenue-to-GDP ratio to 15.8% by 2020 from 13.0% this year. Reinstating the VAT rate hike is an important step toward achieving the Government’s revenue objectives, but meeting the IMF or Government objectives will involve additional revenue measures. The government aims to broaden the tax base via a new Inland Revenue Act and strengthen revenue collection and administration, Moody’s said.

“We expect fiscal consolidation to continue, although at a gradual pace, given implementation risks and the country’s long track record of poor revenue collection and tax exemptions, which will take several years to change significantly. We forecast a budget deficit of 6.0% of GDP this year and 5.5% in 2017,” it added.