Monday Feb 23, 2026

Monday Feb 23, 2026

Thursday, 16 June 2016 00:00 - - {{hitsCtrl.values.hits}}

An investor looks at an electronic screen showing stock information at a brokerage house in Nanjing, Jiangsu Province, China, May 9 – REUTERS

Hong Kong (Reuters): China has failed again to convince U.S. index provider MSCI Inc to add local Chinese shares to its key emerging market index, and the company could not say when it was likely to give the green light, as global investors raised fresh objections.

The index company said on Tuesday that China still had to do more to make its markets accessible to foreign investors.

That is a blow for Chinese policymakers who have rushed to address MSCI’s concerns over the past six months in the hope that inclusion in the Emerging Markets Index, tracked by $1.5 trillion in global assets, could draw up to $400 billion into China’s stocks over the next decade. Chinese shares seemed to shrug off the news, however, rising more than 1% in morning trade. Market-watchers and analysts said the surprise decision, the third year running it has said no, highlighted reservations among global institutional investors about yuan-denominated assets and Beijing’s commitment and ability to implement capital markets reform.

China’s markets have had a turbulent 12 months, with a 40% crash in stocks, followed by heavy state intervention and an unprecedented exodus of capital that has put pressure on the Chinese currency.

“The decision highlights a much bigger issue, which is the resistance among global investors to allocate into yuan assets, despite the fact China is home to the world’s second-largest equity market and third-largest bond market,” said Peter Alexander, CEO of investment consultancy Z-Ben Advisors in Shanghai.

He added that the decision put global investors “on the wrong side of history”.

China’s securities regulator said on Wednesday any global benchmark index that doesn’t include China A shares is incomplete, but the decision wouldn’t affect reforms to open its markets.

Remy Briand, MSCI global head of research, told reporters on Wednesday that China’s reform program was moving in the right direction but investors had concerns over the process for allocating investment quotas and monthly limits on repatriating capital.

He said investors also needed more time to assess if new share suspension rules would be effective in preventing a repeat of last summer, when more than half of China’s listed companies halted trading in their stocks to sit out the crash.

“There have been a lot of significant improvements made recently by the Chinese authorities to improve accessibility for global investors; however, some of them are relatively recent, so we need a little bit of time to assess the effectiveness of these measures,” Briand said.

New objections

MSCI this year raised new objections to a rule that requires foreign investors to seek approval from the country’s stock exchanges before launching products based on A shares, which MSCI says could reduce investors’ ability to hedge exposure.

“This is a very big problem for investors, and the removal of these requirements is necessary for inclusion,” Briand said.

He added that the company could not commit to a timeline for inclusion and could not rule out the possibility that new issues may arise as discussions continued.

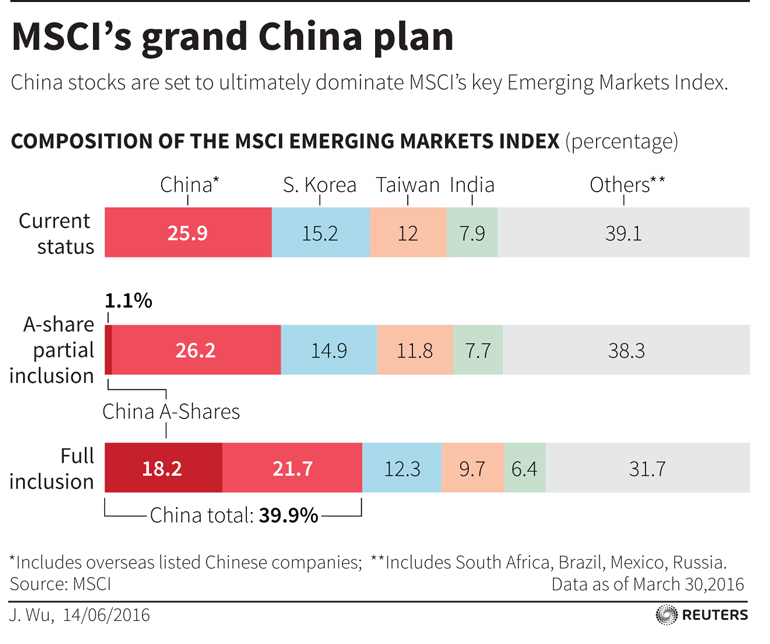

Under an industry consultation re-launched in April, MSCI had proposed adding 5% of the free float value of 421 A shares, which would have accounted for 1.1% of its benchmark index. If the decision had gone China’s way, the change would have taken effect in June 2017.

Expectations that MSCI would say yes this time climbed after Chinese authorities rushed through a series of fixes over the past five months, including relaxing the country’s quota-based foreign investment scheme, clarifying foreign ownership rights, and tightening up share suspension rules.

“Recent developments over the past weeks definitely skewed the decision closer to the favorable side in our view, so we are slightly surprised by this negative outcome,” said Caroline Yu Maurer, head of Greater China equities at BNP Paribas Investment Partners in Hong Kong.

Many analysts had put the chances of inclusion at 50% or higher, with Goldman Sachs raising the odds to 70% last month. In a note published on Wednesday, HSBC said it had “under-estimated the resistance from the global investment community”.

Tuesday’s outcome highlighted growing divisions among global investors, with local China managers saying the decision process appeared to be driven by the concerns of MSCI’s U.S. client base, though the index is tracked globally.

Francois Perrin, portfolio manager, greater China markets, at East Capital, said MSCI put too much emphasis on the remaining problems with the QFII scheme and the product pre-approval issue.

“It seems that many of these objections are coming from passive managers, based out of the United States.”

MSCI said investors beyond Asia do tend to have more reservations, but it takes into account a range of investor feedback.

BlackRock, the world’s largest passive manager, said: “As a long-term investor, we would welcome further progress in facilitating broader participation in the nation’s domestic stock markets for international investors.”