Monday Feb 16, 2026

Monday Feb 16, 2026

Friday, 22 May 2015 00:15 - - {{hitsCtrl.values.hits}}

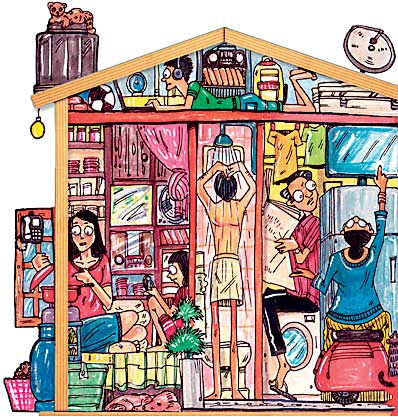

The satisfaction of a place you can call your own is priceless. There are many financial and personal reasons why you would want your own home rather than live on rent. The most obvious reasons would include the pride of ownership and the sense of stability that come with building your own equity. One of the often overlooked reasons for owning a home however, is the freedom you enjoy once you have achieved this major goal in life. The security and peace of mind that come with home ownership is a great accomplishment and becomes a strong anchor for a fulfilling life.

Conceived with the belief that true freedom in life comes with a home of your own, NDB has thoughtfully devised a number of home financing options at rates as low as 10% p.a. (fixed for five years) to suit the varying needs of its diverse clientele; helping them to acquire their dream homes with ease. NDB offers Home Loans to finance the purchase of land, outright purchase of houses, construction of houses or even renovation and refinancing of expenses already incurred on home building or home purchase.

The loan values range from Rs. 100,000 up to a maximum based on the client’s requirement and the capacity to repay, while the flexible repayment schedules are extended even up to 20 years depending on the client’s age and date of retirement. The applicants also enjoy the ease of repaying the loan at a competitive interest rate in equal instalments enabling the salaried individuals to easily plan their monthly commitments. NDB Home Loans would cover up to 100% of the cost in the case of construction and up to 80% of the value of a house for outright purchase. For home improvement and extensions clients could obtain loans up to 100% of the improvement cost and for the purchase of land, the bank will fund up to 70% of the value.

The bank has designed a loan scheme with a special repayment plan for non resident Sri Lankans with permanent employment contracts abroad, enabling them to obtain a house in their homeland with ease.

A joint initiative of NDB and the Employee Trust Fund (ETF), Viyana Home Loan is another option offered by NDB to employees of member companies of the ETF board. This financing is made more affordable with a fixed interest rate starting at 10.5% per annum for employed individuals who are members of the ‘Employee Trust Fund’. This is an ideal option for those seeking for home financing at a concessionary interest rate.

Further, NDB has geared itself to cater to the corporates who wish to provide for the welfare of their work force offering staff loan schemes, where the employer subsidies a part of the interest cost. These loans too are granted at exclusive reduced interest rates. Several blue chip companies have already tied up with the bank, to provide their employees with such facilities as part of the remuneration package.

As part of its on-going efforts for empowering entrepreneurs, NDB also offers a customised housing loan scheme that will cater to the self-employed, looking for a loan for the purpose of ready purchase, construction, extension, improvement of a house. With an attractive interest rate and a starting loan amount of Rs. 500,000 this scheme offers the borrower the ability to match his income with the repayment by giving him greater flexibility with a 10 year repayment period.

With a wide range of options to choose from, NDB is poised to cater to the diverse housing financing requirements of its varying clientele. The dynamic, experienced team at NDB is committed to delivering a superior service to enable customers to obtain the facility within the shortest possible time. NDB strives to continuously improve the experience of its customers and NDB Home Loans are made available through the bank’s island-wide network of 88 braches making it convenient and accessible to all. Further information about the facility can be obtained by calling the bank’s 24 hour hotline 2448888 or visiting the website via www.ndbbank.com.