Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Thursday, 18 June 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

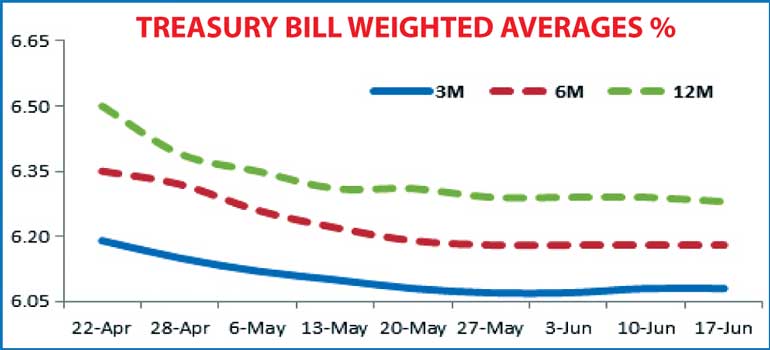

The weighted average (W.Avg) on the 364 day bill resumed its downward trend for the first time in four weeks at its weekly Treasury bill auction conducted yesterday to reflect a dip of one basis point to 6.28%.

The W.Avgs of the 91 day and 182 day bills remained unchanged at 6.08% and 6.18% respectively. A total amount of Rs. 24.86 billion was accepted from the auction against its total offered amount of Rs. 22 billion with the 91 day representing 59.94% of this volume.

However, contrary to the outcome in primary markets, the upward trend in secondary bond markets continued yesterday as well on the back of considerable volumes changing hands. Selling interest on the liquid maturities of 1 August 2021, 1 July 2022 and 1 September 2023 saw its yields increase to a one and a half month high of 8.65%, 8.75% and 9.00% respectively.

Nevertheless, buying interest from this point onwards saw yields dip once again to its opening levels of 8.55%, 8.65% and 8.90%. In addition, a limited amount on the 15 September 2019 and the 15 March 2025 maturities changed hands within the range of 8.00% to 8.05% and 9.00% to 9.05% respectively as well.

Meanwhile in money markets, overnight call money and repo rates remained steady to average 6.11% and 5.77% respectively as surplus liquidity remained steady at Rs. 70.80 b yesterday.

Rupee remains steady

In Forex markets, the USD/LKR rate on spot as well as three month forward contracts remained steady to close the day at levels of Rs. 134 and Rs. 135.85/05 respectively. The total USD/LKR traded volume on 16 June stood at $ 63.94 million.