Sunday Feb 22, 2026

Sunday Feb 22, 2026

Monday, 13 July 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

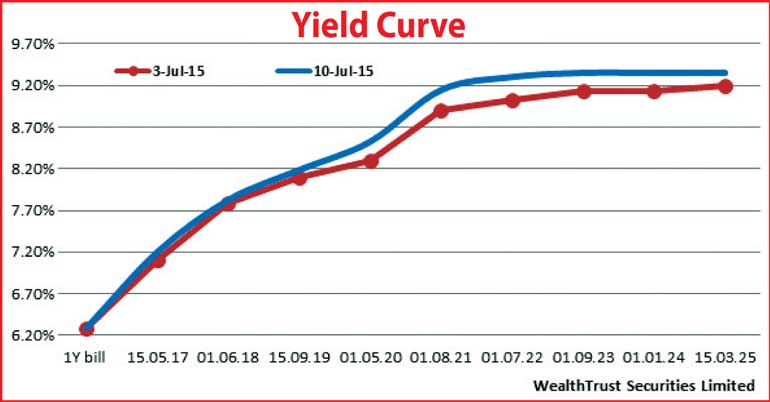

The outcome of the primary auctions conducted during the week ending 10 July, led to secondary market bond yields increase, reflecting a parallel shift upwards of the yield curve.

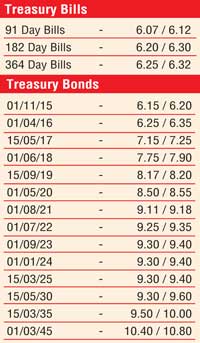

Initially, the outcome of the weekly auction where the weighted averages on the 91-day and 182-day bills were seen increasing for a second consecutive week was followed by the weighted averages on the Treasury bond auctions increasing as well which saw yields on the liquid maturities of 01.05.2020, 01.08.2021, 01.07.2022 and 01.09.2023 increasing the most week-on-week by 22 basis points (bp), 25 bp each and 23 bp respectively to a 12-day trading high of 8.55%, 9.20%, 9.25% and 9.35%.

This was closely followed by the 01.01.2024 and 15.03.2025 maturities increasing week on week by 20 bp and 17 bp respectively to highs of 9.35% and 9.40%. Meanwhile, on the shorter end of the curve, the 15.05.2017, 01.06.2018 and 15.09.2019 maturities were seen increasing by 10 bp, 7 bp and 9bp respectively as well to weekly highs of 7.20%, 7.85% and 8.19%.

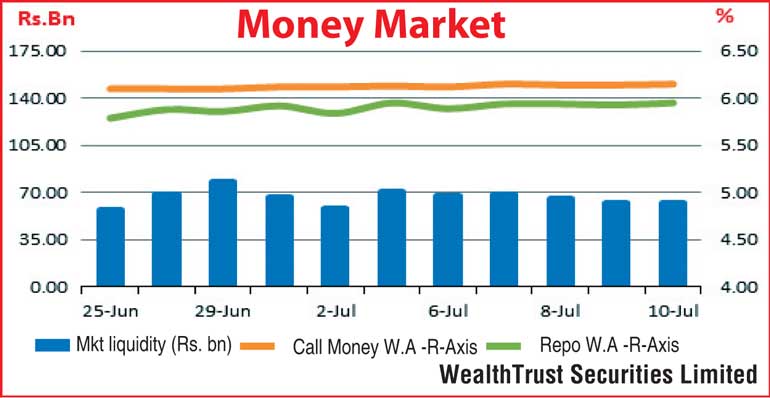

Meanwhile, in money markets, the overnight call money and repo rate increased further during the week to average 6.14% and 5.93% respectively against its previous week’s average of 6.12% and 5.89% as surplus liquidity decreased during the week to average Rs. 65.42 billion against its previous week’s average of Rs. 68.57 billion.

Rupee stagnant during the week

The USD/LKR rate on spot contracts remained unchanged during the week to close at Rs. 133.60. The daily average USD/LKR traded volume for the first three days of the week was at $ 44.06 million. Some of the forward dollar rates that prevailed in the market were 1 month - 134.18/20, 3 months - 135.33/35 and 6 months -136.85/95.