Sunday Feb 15, 2026

Sunday Feb 15, 2026

Monday, 22 June 2015 00:00 - - {{hitsCtrl.values.hits}}

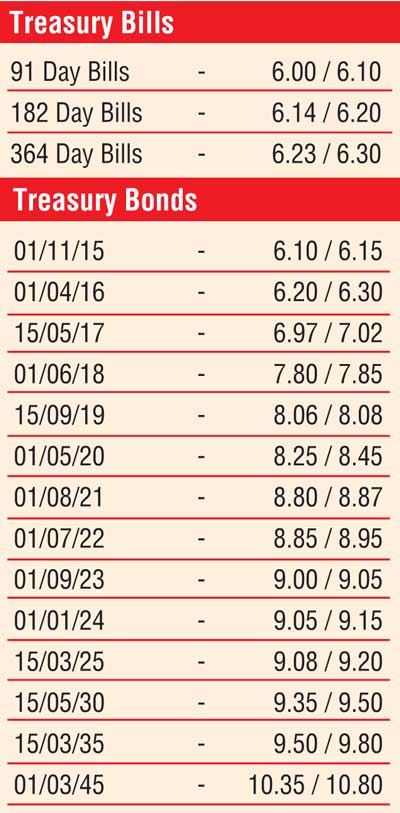

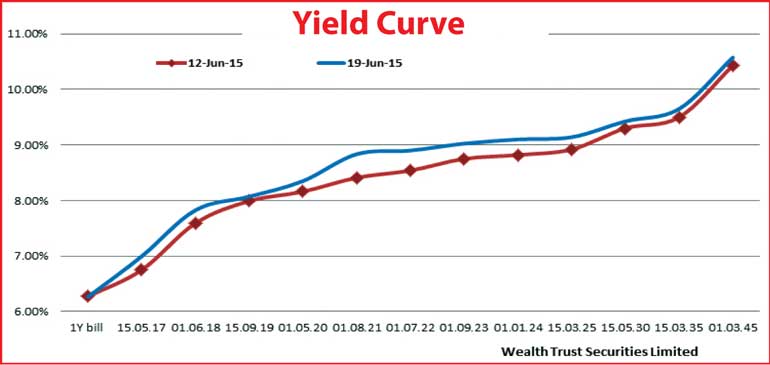

The secondary bond market, driven by continued foreign selling in rupee bonds, saw yields increase across the board during the week ending 19 June, reflecting a considerable parallel shift upwards of the yield curve for a second consecutive week.

Selling interest on the 1 August 2021, 1 July 2022 and 1 September 2023 maturities saw its yields increase by a significant 43 basis points (bp), 47 bp and 25 bp respectively week on week to a two month high of 8.83%, 8.90% and 9.00% on the back of sizeable volumes changing hands. The pass through effect saw yields increase across the rest of the yield curve as well, mainly on the short end to the belly end.

The 15 May 2017 maturity increased to a weekly high of 7.00%, the 1 June 2018 to 7.80% and the 15 September 2019 to 8.15%. This was despite the positive outcome of the weekly Treasury bill auction, at where the weighted average on the 364 day bill reduced by one bp to 6.28% for the first time in four weeks.

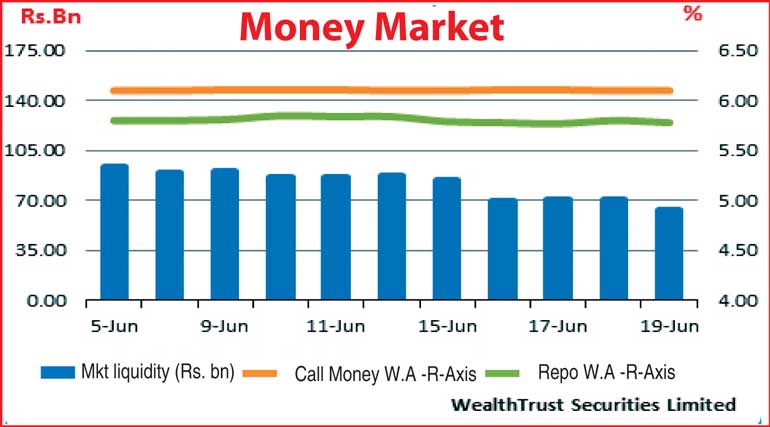

Meanwhile, the overnight repo rate decreased marginally during the week ending 19 June to average 5.78% against its previous week’s average of 5.83% despite surplus liquidity dipping to average Rs.71.76 billion for the week against its previous week’s average of Rs. 88.29 billion. Call money remained steady to average 6.10% for the week.

Rupee dips close to all time low levels

The continued importer demand coupled with foreign selling in rupee bonds saw the rupee on spot contracts depreciate during the week to Rs. 134.20 close to its all-time low level of Rs. 134.30 and recovered marginally once again to close the week at Rs. 134.10. The daily average USD/LKR traded volume for the first four days of the week was at $ 62.77 million.