Saturday Feb 21, 2026

Saturday Feb 21, 2026

Monday, 1 February 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

By Wealth Trust Securities

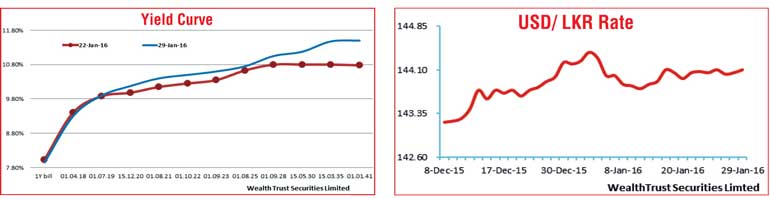

The secondary market bond yield curve reflected a parallel shift upwards during the week ending 29 January mainly on the belly end to the long end of the curve on the back of foreign selling in rupee bonds and weighted averages increasing at the primary bond auctions.

Yields on the 2019, 2020 and 2021 maturities were seen hovering around its two year highs subsequent to hitting weekly highs of 10.05%, 10.26% and 10.50% respectively against its weekly lows of 9.85%, 10.07% and 10.30% on the back of foreign selling. The foreign holding in rupee bonds was seen dipping a further Rs. 8.4 billion for the week ending 27 January recording its third consecutive week of outflows totalling Rs. 14.7 billion. On the long end of the curve, following the bond auctions, yields on the 01.08.2025, 01.06.2026 and 15.05.2030 maturities were seen dipping to weekly lows of 10.70%, 10.98% and 11.05% respectively against its highs of 10.75%, 11.07% and 11.50%.

In addition, on the short end of the curve, 2017 and 2018 maturities were seen changing hands within the range of 8.35% to 8.45% and 9.20% to 9.55% as well during the week.

The above developments led to a steepening of the yield curve once again reversing the flattening trend witnessed over the previous week ending 22 February.

In money markets, the rejection of the weekly bill auction coupled with the term repo maturities saw average surplus liquidity in the system increasing during the week ending 29th January to Rs. 63.59 billion against its previous week’s average of Rs. 42.29 billion. This intern led to overnight Call money and Repo rates decreasing during the week to average at 6.78% and 6.49% respectively despite the Open Market Operations (OMO) department of Central Bank commencing to drain out liquidity during the week. A total amount of Rs. 43.4 billion was drained out from the system at weighted averages ranging from 6.29% to 6.55% for durations of 6 days to 15 days.

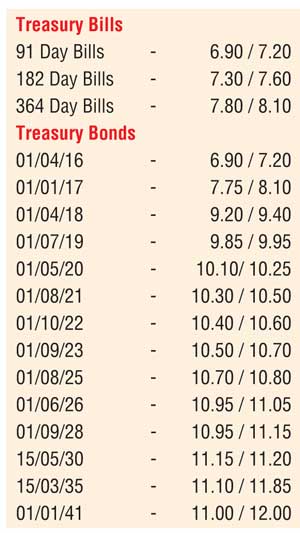

Rupee remains steady during week

The USD/LKR rate on spot contracts was seen remaining steady throughout the week to close the week at Rs. 144.00/30 as activity dried up considerably. The daily USD/LKR average traded volume during the first four days of the week stood at $ 53.90 million.

Some of the forward dollar rates that prevailed in the market were one month – 144.80/00; three months – 145.85/10 and six months – 147.60/00.