Friday Feb 20, 2026

Friday Feb 20, 2026

Friday, 3 July 2015 00:24 - - {{hitsCtrl.values.hits}}

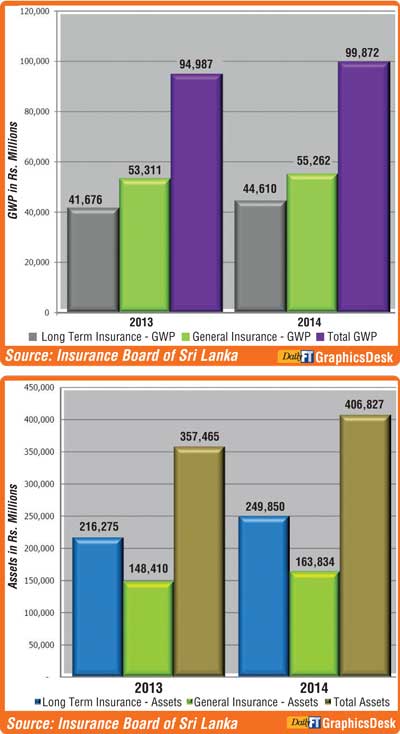

Gross Written Premium

Year 2014 was another positive year for the Sri Lankan insurance industry, which recorded growth in Gross Written Premium (GWP) of both Long-Term and General Insurance business sectors along with the assets of insurance companies. The total Gross Written Premium (GWP) generated by insurance companies grew by 5.14% and total assets increased by 13.81% year on year.

The total GWP Income for Long Term Insurance and General Insurance  businesses in 2014 was Rs. 99,872 million compared to 2013 amounting to Rs. 94,987 million which reflected a growth of 5.14%. The Long Term Insurance Business recorded premium income of Rs. 44,610 million (2013: Rs. 41,676 million) while the General Insurance Business recorded a premium income of Rs. 55,262 million during 2014 (2013: Rs. 53,311 million). Thus, Long Term Insurance Business and General Insurance Business witnessed a growth of 7.04% and 3.66% respectively in GWP Income during 2014 when compared to 2013.

businesses in 2014 was Rs. 99,872 million compared to 2013 amounting to Rs. 94,987 million which reflected a growth of 5.14%. The Long Term Insurance Business recorded premium income of Rs. 44,610 million (2013: Rs. 41,676 million) while the General Insurance Business recorded a premium income of Rs. 55,262 million during 2014 (2013: Rs. 53,311 million). Thus, Long Term Insurance Business and General Insurance Business witnessed a growth of 7.04% and 3.66% respectively in GWP Income during 2014 when compared to 2013.

Total assets

The total assets held by insurance companies amounted to Rs. 406,827 million as at 31 December 2014 when compared to Rs. 357,465 million recorded as at the end of 2013, reflecting a growth of 13.81%. The assets of Long Term Insurance Business amounted to Rs. 249,850 million (2013: Rs. 216,275 million), while the assets of General Insurance Business amounted to Rs. 163,834 million (2013: Rs. 148,410 million) indicating a growth rate of 15.52% and 10.39% respectively year on year.

Investment in Government securities

At the end of 2014, the investment of total assets of Long Term Insurance Business in Government Debt Securities amounted to Rs. 111,600 million representing 44.67% (2013: Rs. 93,539 million; 43.25%), while such investment of the total assets of General Insurance Business amounted to Rs. 25,496 million representing 15.56% (2013: Rs. 28,163 million; 18.98%). Accordingly, the total investment of both Long Term Insurance Business and General Insurance Business in Government Debt Securities amounted to Rs. 137,096 million (2013: Rs. 121,702 million) as at 31st December 2014.

Dispute resolution and investigations

IBSL, under its overall objective of safeguarding the interests of policyholders, inquires into policyholders’ grievances in connection with insurance claims pertaining to life and general insurance policies and matters relating to qualifications of agents. In terms of Section 98 of the Regulation of Insurance Industry Act, No. 43 of 2000, IBSL is empowered to investigate into and resolve disputes between insurers and claimants relating to the settlement of claims which are referred to IBSL by claimants.

During the year 2014, 284 new matters were referred to IBSL. IBSL settled/closed a total of 230 complaints received in 2013 and 2014. Out of the matters settled, 38 claims were honoured by insurers upon the intervention of IBSL.

Insurers

Out of 21 Insurance Companies (Insurers) operating as at 31 December 2014, 12 are composite companies (dealing in both General and Long Term Insurance Businesses), six companies carry on General Insurance Business and three companies carry on only Long Term Insurance Business.

Insurance brokers

During the year 2014, fifty-nine insurance brokering companies operated in the market. Insurance brokering companies are registered with IBSL in terms of Section 82 of the Act in order to engage in insurance brokering business. As similar to previous years, insurance brokers’ contribution towards Long Term Insurance Business was insignificant in 2014. However, the premium income generated through General Insurance Business indicates the importance of brokers as an intermediary in the General Insurance market. The premium income generated through Insurance Brokering Companies with respect to General Insurance Business amounted to Rs. 14,559 million (2013: Rs. 14,189 million) while the premium income generated with respect to Long Term Insurance Business amounted to Rs. 158 million (2013: Rs. 191 million).

The total premium income from both General Insurance Business and Long Term Insurance Business generated through insurance brokering companies amounted to Rs. 14,716 million during 2014, compared to Rs. 14,380 million during the previous year. Thus, the total premium income generated through insurance brokering business witnessed a growth of 2.34% during the year 2014 when compared to 2013.

Note:

1) 2014 Figures – Provisional.

2) 2013 Figures – Reinstated Audited.

3) The above analysis does not include National Insurance Trust Fund information, since required information was not submitted to IBSL.

4) Strike, Riot, Civil Commotion and Terrorism (SRCC&T) premium inco-me of National Insurance Trust Fund (NITF) was not considered for insurance companies’ general insurance business GWP.

5) Inter segment balances (i.e. transactions between Long Term Insurance and General Insurance segments) eliminated for 2014 amounting to Rs. 6,857 million and 2013 amounting to Rs. 7,220 million.