Friday Mar 06, 2026

Friday Mar 06, 2026

Wednesday, 18 January 2017 00:00 - - {{hitsCtrl.values.hits}}

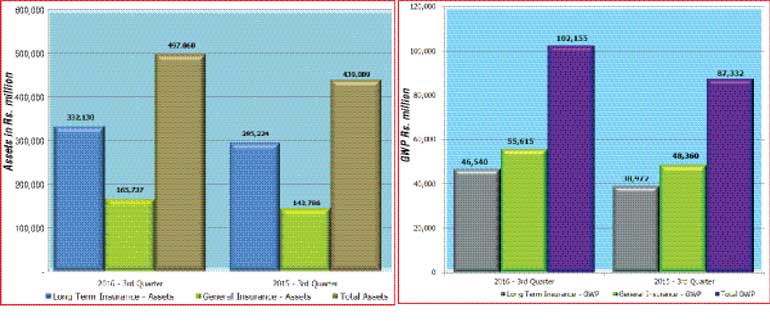

The insurance industry was able to achieve a growth of 16.97% in terms of overall Gross Written Premium (GWP), at the end of third quarter of 2016, recording an increase of Rs. 14,823 million when compared to the same period of 2015.

The GWP for the long-term insurance and general insurance businesses for the third quarter ending 30 September 2016 was Rs. 102,155 million compared to the third quarter of 2015 amounting to Rs. 87,332 million.

The GWP of the long-term insurance business amounted to Rs. 46,540 million (Q3, 2015: Rs. 38,972 million) while the GWP of the general insurance business amounted to Rs. 55,615 million (Q3, 2015: Rs. 48,360 million). Thus, the long-term insurance business and general insurance business witnessed a GWP growth of 19.42% and 15.0% respectively, when compared to the corresponding period of 2015.

The value of total assets of insurance companies has increased to Rs. 497,868 million as at 30 September 2016, when compared to the Rs. 439,009 million recorded as at 30 September 2015, reflecting a growth of 13.41%. The assets of the long-term insurance business amounted to Rs. 332,130 million (Q3, 2015: Rs. 295,224 million) indicating a growth rate of 12.50% year-on-year. The assets of the general insurance business amounted to Rs. 165,737 million (Q3, 2015: Rs. 143,786 million) depicting a growth rate of 15.27%.

At the end of third quarter of 2016, investment in Government Securities amounted to Rs. 162,052 million, representing 48.79% (Q3, 2015: Rs. 128,232; 43.44%) of the total assets of the long-term insurance business, while such investment of the total assets of the general insurance business amounted to Rs. 33,535 million, representing 20.23% (Q3, 2015: Rs. 29,024; 20.19%).

Accordingly, the total investment of both the long-term insurance business and general insurance business in Government Securities amounted to Rs. 195,587 million (Q3, 2015: Rs. 157,256 million) as at 30 September 2016. Thus, the investment in Government Securities for both the long-term insurance business and general insurance business has increased by 26.37% and 15.54% respectively.

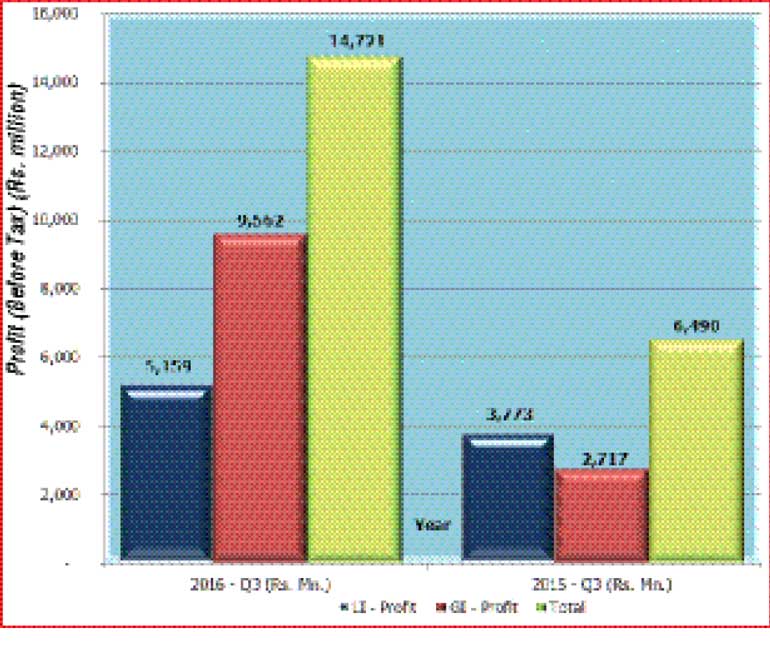

The profit (before tax) of insurance companies in both the long-term insurance business and general insurance business has increased to Rs. 14,721 million (Q3, 2015: Rs. 6,490 million), showing a 126.83% growth in profits.

The profit (before tax) of the long-term insurance business amounted to Rs. 5,159 million (Q3, 2015: Rs. 3,773 million) while the profit (before tax) of the general insurance business amounted to Rs. 9,562 million (Q3, 2015: Rs. 2,717 million) at the end of the third quarter of 2016. Thus, the profit (before tax) of the long-term insurance business and general insurance business witnessed a growth of 36.76% and 251.87% respectively, when compared to the corresponding period of 2015. Such growth in profit (before tax) is due to the increase in the Other Income segment of an insurance company.

Out of 28 insurance companies (insurers) in operation as at 30 September 2016, 12 are engaged in the long-term (life) insurance business, 13 companies are carrying out only the general insurance business and three are composite companies (dealing in both the long-term and general insurance businesses).

Fifty-six insurance brokering companies registered with the board as at 30 September 2016 mainly concentrate on the general insurance business. Total assets of insurance brokering companies have increased to Rs. 3,961 million as at the end of the third quarter of 2016 when compared to the Rs. 3,695 million recorded as at 30 September 2015, reflecting a growth of 7.22% year-on-year.