Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 2 January 2017 00:59 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

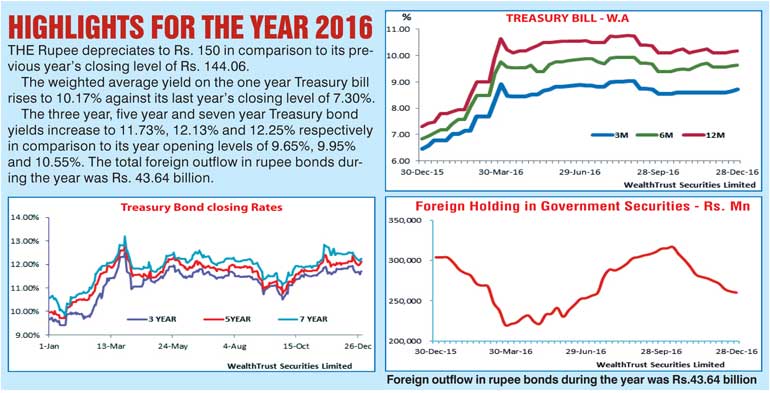

The Central Bank of Sri Lanka was seen holding its policy rates steady for a fifth consecutive month at 7% and 8.50% at its meeting held on Friday 30 December 2016.

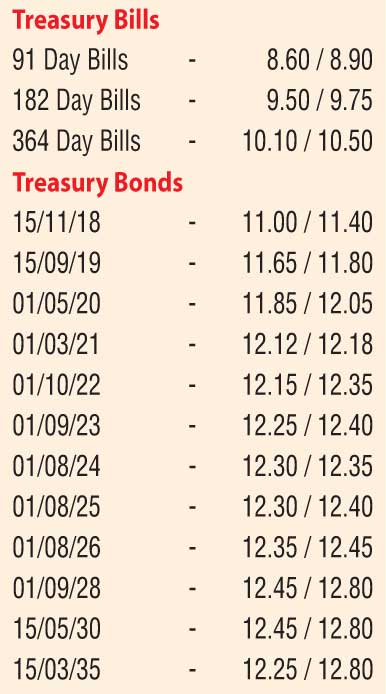

The short trading week ending 30 December 2016 commenced with an unanticipated Treasury bond auction result, where the weighted averages of the 4.02 year maturity of 01.03.21, the 7.07 year maturity of 01.08.24 and the 9.07 year maturity of 01.08.26 recorded 11.94%, 11.98% and 12.11% respectively, below its secondary market levels. However the weighted averages of the weekly Treasury bill auction continued to increase for a fourth consecutive week.

Activity in the secondary bond market see sawed during the week as it initially moderated subsequent to the bond auction outcome with the auctioned maturities been quoted at levels of 11.90/00, 12.10/20 and 12.20/40 respectively. Thereafter, the yields of the said maturities were seen increasing once again to highs of 12.13%, 12.35% and 12.39% on the back of selling interest and profit taking as activity increased mid-week and dipped once again at the end of the week and the year.

The market also witnessed continued foreign selling interest of rupee bonds, with an outflow of Rs. 1.3 billion for the week ending 28 December, recording a total outflow of Rs. 56.58 billion over the past 11 weeks. Furthermore, the Point to Point inflation for the month of December increased to 4.1% from 3.4% recorded in November with the annual average increasing to 3.7%.

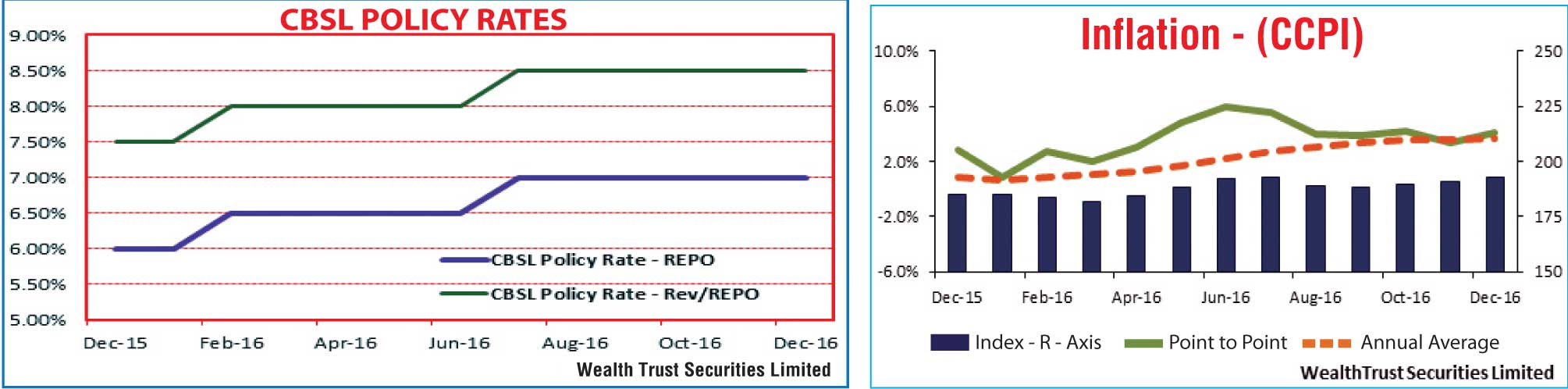

In money markets, the net surplus liquidity increased to a ten month high of Rs. 49.64 billion on Thursday while the average net surplus liquidity for the week stood at Rs. 41.25 billion against its previous week’s average of Rs. 13.12 billion. This in turn, resulted in The OMO (Open Market Operation) Department of the Central Bank of Sri Lanka draining out liquidity throughout the week, on an overnight basis at weighted averages ranging from 7.42% to 7.43%. The overnight call money and repo rates averaged at 8.42% and 8.65% respectively during the week.

Meanwhile, the CBSL Treasury bill holding was seen increasing by Rs. 97.72 billion to a 11 year high of Rs. 330.07 billion on 30 December against its previous day holding of Rs. 232.35 billion.

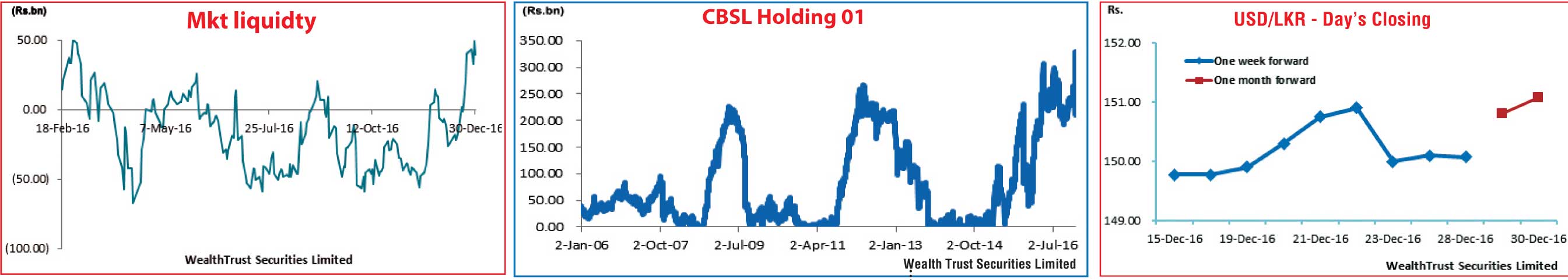

Rupee dips during the week.

The dollar rupee rate on one week forward contracts lost ground during the early part of the week to a low of Rs. 150.05/25 on the back of continued importer demand, while activity was seen shifting to one month forward contracts during the latter part of the week to close at Rs. 150.75/85.

The daily USD/LKR average traded volume for the first three days of the week stood at $ 70.39 million.

Some of the forward dollar rates that prevailed in the market were three months – 152.55/65 and six months – 154.85/95.