Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 27 March 2017 00:35 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

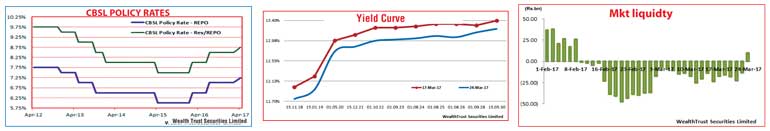

The Central Bank of Sri Lanka was seen increasing its policy rates by 25 basis points at its second monetory policy announcement on 24 March, signalling its first policy tightening for 2017 following its hike of 50 basis points in July 2016. The new Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) will be at 7.25% and 8.25% respectively effective from 24 March 2017.

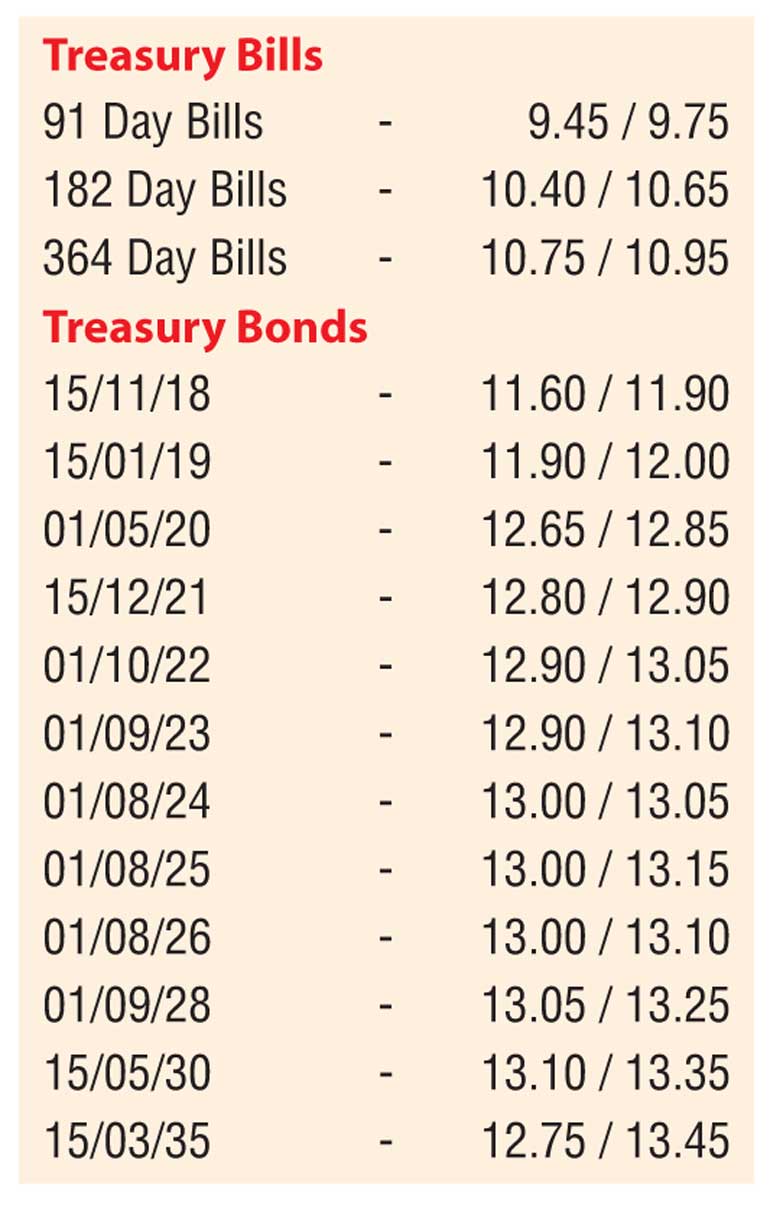

In secondary bond markets, yields were seen seesawing during the week as continued selling interest during early part of the week saw yields increasing on the liquid maturities of 01.07.19, 15.12.21, the two 2024’s (i.e. 01.01.24 and 01.08.24), the two 2025’s (i.e. 15.03.25 and 01.08.25) and the two 2026’s (i.e. 01.06.26 and 01.08.26) to intraweek highs of 12.40%, 13.05%, 13.30% each, 13.35% each and 13.30% each respectively.

This sentiment was further supported by the weekly Treasury bill auction result where weighted averages increased across all three maturities and the accepted amount dipped to a 17-week low. Nevertheless, buying interest leading to the monetory policy announcement and subsequent to it saw yields decreasing once again with the liquid maturities of 01.07.19, 15.12.21, 01.08.24 and 01.08.26 hitting intraweek lows of 12.07%, 12.80%, 13.00% and 13.02% respectively on the back of foreign and local buying interest reflecting a parallel shift downwards of the overall yield curve for the first time in three weeks.

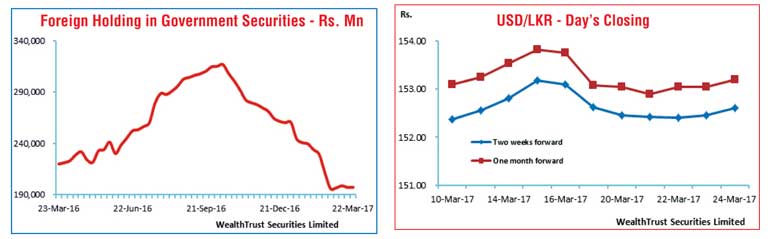

Meanwhile, the foreign holding in Sri Lankan rupee bonds recorded an inflow once again to the value of Rs. 70 million during the week ending 22 March. The daily secondary market Treasury bond transacted volume for the first four days of the week averaged Rs. 1.26 billion.

In money markets, liquidity was seen turning positive on 24 March 2017 for the first time since 8 February 2017 as the system recorded a net surplus of Rs. 10.05 billion, reversing a net average shortfall of Rs. 17.45 billion over the previous four days. The OMO department of the Central Bank was seen conducting an overnight repo auction in order to drain out liquidity with Rs. 13.00 been mopped up at a weighted average rate of 7.75% against reverse repo auctions conducted during the rest of the week at 8.50%. Overnight call money and repo rates averaged 8.55% and 8.59% respectively during the week ending 24 March 2017.

Rupee closes week

mostly unchanged

The dollar rupee rate on active two weeks forward contracts closed the week mostly unchanged at Rs. 152.55/65 as activity moderated during the week and markets were at equilibrium.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 82.18 million. Some of the forward dollar rates that prevailed in the market were one month - 153.00/40, three months - 154.80/00 and six months - 157.70/00.