Sunday Feb 15, 2026

Sunday Feb 15, 2026

Friday, 29 July 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The Central Bank of Sri Lanka was seen increasing its policy rates by 50 basis points at its monthly monitory policy meeting held yesterday,  signalling its second policy tightening cycle for 2016 following an SRR (Statutory Reserve Requirement) hike of 150 basis points in December 2015.

signalling its second policy tightening cycle for 2016 following an SRR (Statutory Reserve Requirement) hike of 150 basis points in December 2015.

The new Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) will be at 7.00% and 8.50% respectively effective from the close of business on 28 July.

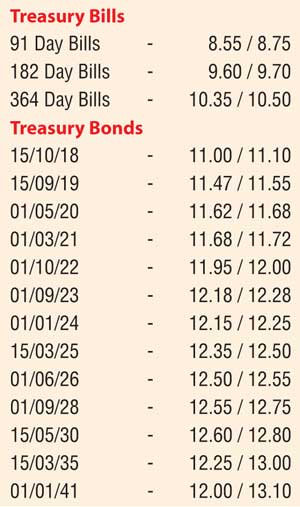

In the secondary bond market, yields were seen seesawing during the day as buying interest during morning hours of trading saw yields dip. The liquid maturities on the belly end of the curve, consisting of the 01.09.23, 01.01.24, 15.03.25 and 01.06.26 were seen dipping to intraday lows of 12.15%, 12.20%, 12.30% and 12.40% respectively against its days opening highs of 12.20%, 12.25%, 12.40% and 12.50%.

However, selling interest towards the latter part of the day saw yields increase once again to its opening highs when markets closed at 5 p.m. before the policy announcement at 6 p.m. On the short end of the curve, the 01.03.21 maturity saw its yield dip to an intraday low of 11.68% against its opening high of 11.75%.

This was ahead of today’s Treasury bond auctions of Rs. 60 billion in lieu of a Rs. 98.6 million bond and coupon maturity due on 1 August. Rs. 20 billion each will be on offer at today’s auction, consisting of a 4.07 year maturity of 01.03.2021, an eight-year maturity of01.08.2024 and a 10-year maturity of 01.08.2026.

Meanwhile in money markets, the net liquidity shortfall was seen dipping for a third consecutive day to Rs. 30.57 billion yesterday as an amount of Rs. 30 billion was injected on an overnight basis at a weighted average of 7.98% by the OMO department of Central Bank.

Rupee appreciates marginally

The one week forward contract in the Forex market was seen appreciating marginally yesterday to close the day at Rs 146.15/20 against its previous day’s closing of Rs. 146.25/30 on the back of foreign buying in rupee bonds and export conversions outweighing importer demand.

Given are some forward USD/LKR rates that prevailed in the market: one month – 146.80/90; three months – 148.50/65; six months – 150.80/95.