Saturday Feb 21, 2026

Saturday Feb 21, 2026

Friday, 6 November 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The positive momentum of the secondary bond market continued, with buying interest mainly of the longer end of the yield curve, with moderate activity.

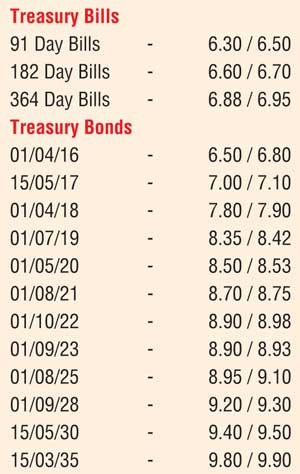

Bond maturities of 1 September 2028, 15 May 2030 and 15 March 2035 were seen changing hands within a thin range of 9.28% to 9.30%, 9.50% to 9.55% and 9.80% to 9.90% respectively, in comparison to its previous day’s closing levels of 9.25/40, 9.40/65 and 9.90/00.

Furthermore, the favorite maturity of 1 May 2020 traded within a range of 8.50% to 8.53% while the 1 September 2023 maturity moved within a range of 8.91% to 8.93%. Meanwhile, in the secondary bill market, the 182 day bill continued to be quoted at levels of 6.60% to 6.70%.

In the money market, surplus liquidity stood at Rs. 115.34 billion as overnight call money and repo rates remained mostly unchanged to average 6.31% and 6.11% respectively.

Rupee closes steady

Meanwhile in Forex markets, the rupee was seen closing the day mostly unchanged at levels of Rs. 141.45/60 subsequent to hitting a fresh low of Rs.141.75. The total USD/LKR traded volume for the 4 November was $ 61.79 million.

Some of the forward USD/LKR rates that prevailed in the market were: one month – 141.95/10; three months – 142.80/00; and six months – 144.10/30.

Reuters: The rupee ended higher on Thursday after falling for five straight sessions as exporter dollar sales helped boost the currency, dealers said.

The rupee ended at 141.40/60 per dollar, a tad firmer from Wednesday’s record closing low of 141.50/60.

“There were some exporter sales and the rupee ended firmer,” a currency dealer said, asking not to be named.

Investors are waiting to see some clarity on economic policies from the 2016 Budget announcement on 20 November.

Some currency dealers said the statement by Prime Minister Ranil Wickremesinghe on Thursday was confusing because he promised to suspend some taxes.

“He has pledged a lot. We may need further clarity on the statement. We have seen Finance Minister Ravi Karunanayake saying something and the Prime Minister saying something else,” said a currency dealer, asking not to be named.

Commercial banks parked Rs. 115.34 billion ($815.70 million) of surplus liquidity on Thursday, using the Central Bank’s deposit facility at 6%, official data showed.