Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 21 July 2015 00:37 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

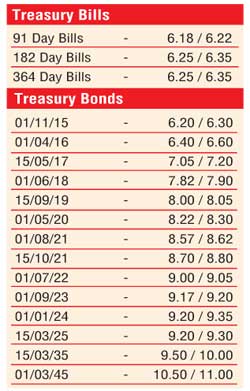

Activity in secondary bond markets was witnessed mostly during the morning hours of trading, as yields of the liquid maturities consisting of 01.08.2021, 01.10.22 and 01.09.23 declined to intraday lows of 8.50%, 9.05% and 9.13% respectively when compared  against the previous day’s closing levels of 8.67/72, 9.15/22 and 9.25/28.

against the previous day’s closing levels of 8.67/72, 9.15/22 and 9.25/28.

However, with selling interest at these levels, yields increased once again towards the latter part of the day to settle at levels of 8.57/62, 9.10/20 and 9.17/20. Furthermore, the three-year maturity of 01.06.2018 too dropped to levels of 7.78% before closing the day at 7.82/90 with the four-year maturities changing hands within a range of 8.00% to 8.05%.

Meanwhile, in money markets, overnight call money and repo rates remained mostly unchanged to average 6.11% and 5.80% respectively as surplus liquidity remained high at Rs. 95.17 Bn.

Rupee remains steady

The dollar/rupee rate on spot contracts remained steady to close the day at Rs. 133.80 for a sixth consecutive day. The total USD/LKR traded volume for the previous day (17-07-15) stood at $ 51.50 million.

Some of the forward dollar rates that prevailed in the market were one month - 134.40/50; three months - 135.35/50 and six months -137.00/15.