Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 11 July 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

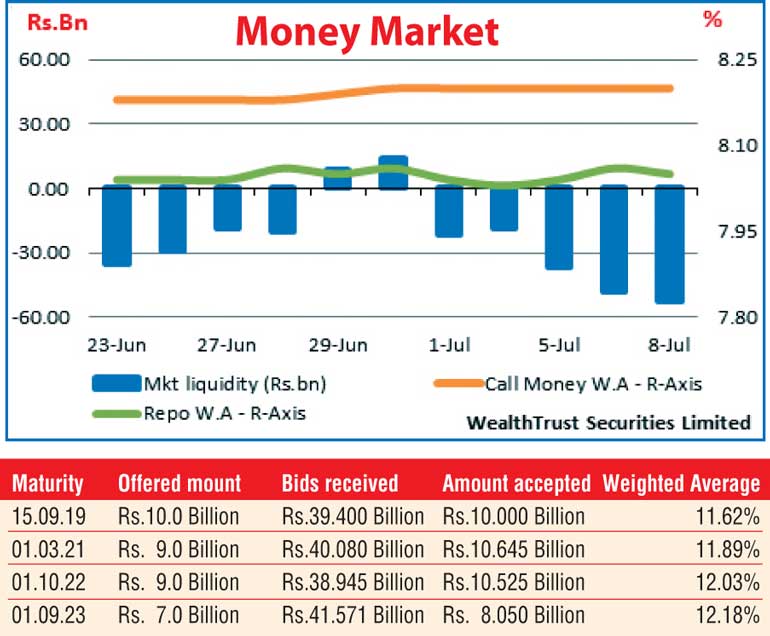

The positive sentiment in the bond market was seen continuing for a second consecutive week for the week ending 8 July as yields continued to tumble on the back of foreign and local buying interest and impressive outcomes at the Primary auctions. The four Treasury bond auctions conducted on Friday drew over Rs. 39 billion in successful bids at impressive weighted averages against its total offered amount of Rs. 35 billion. The 4.08 year maturity of 01.03.2021 and the 06.03 year maturity of 01.10.2022 saw its weighted averages remain steady at 11.89% and 12.03% respectively against its previous averages while the weighted averages on the 03.02 year maturity of 15.09.2019 and the 7.02 year maturity of 01.09.2023 recorded 11.62% and 12.18% respectively.

In the secondary bond market for the week ending 8 July, yields on the liquid maturities of 01.05.19, 15.12.20, 01.01.24, 01.08.25 and 01.06.26 were seen dipping to weekly lows 11.50%, 11.55%, 12.15%, 12.20% and 12.30% respectively against its previous weeks closings of 11.55/65, 11.70/75, 12.45/50 and 12.50/60. In addition, 2018 maturities were seen changing hands within the range of 11.05% to 11.30% while on the long end, the 01.09.28 and 15.05.30 maturities changed hands within the range of 12.60% to 12.80% and 12.20% to 12.80% respectively as well during the week.

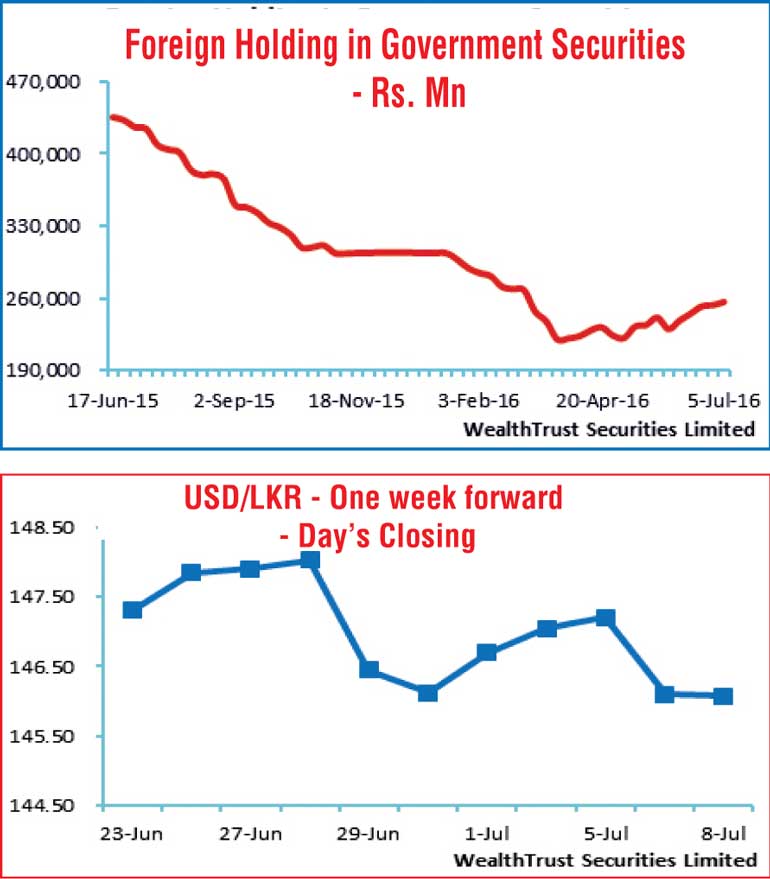

The positive momentum was further supported by the increase in the foreign holdings in rupee bonds for a fifth consecutive week, recording an inflow of Rs.3.0 billion during the week ending 5 July.

In the money market, the average net liquidity shortfall in the system increased to Rs. 39.07 billion for the week against its previous week’s average short of Rs. 7.55 billion. Nevertheless the overnight call money and repo rates remained steady to average at 8.20% and 8.05% respectively due to the OMO (Open Market Operations) department of Central Bank bridging the deficit through overnight reverse repo auctions at weighted average of 7.98% and 7.99%.

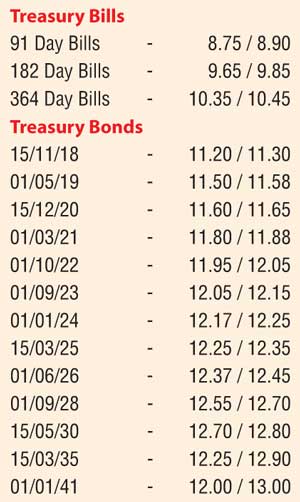

Rupee appreciates for a second consecutive week

The USD/LKR rate on the one week forward contract appreciated further during the week to close the week at Rs. 145.95/20 against the previous weeks closing level of Rs. 146.55/85 on the back of continued foreign buying in Rupee bonds and export conversions. The daily USD/LKR average traded volume for the first three days of the week stood at $ 48.90 million.

Some of the forward dollar rates that prevailed in the market were 1 Month - 147.50/70; 3 Months - 148.15/30 and 6 Months - 150.20/40.