Monday Feb 16, 2026

Monday Feb 16, 2026

Friday, 29 May 2015 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The weighted averages (W. Avgs) of the 4.11 year maturity of 01.05.2020 and the 8.03 year maturity of 01.09.2023 was seen declining by 11 basis points (bp) and 95 bp respectively to 8.35% and 8.78% against its previously recorded W.Avgs at yesterdays concluded Treasury bond auctions. In addition, the newly-issued 14.11 year maturity of 15.05.2030 was seen recording a W. Avg of 9.67%. The auctions attracted total bids of Rs. 72.42 billion with Rs. 20.19 billion been accepted in total.

In secondary bond markets, buying interest was witnessed throughout the day following the news of a 10 year sovereign dollar bond issue by Sri Lanka for a minimum of $ 500 million.

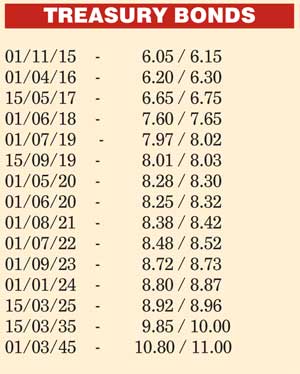

Activity centered the 01.06.2018, 01.07.2019, 15.09.2019, 01.05.2020, 01.08.2021, 01.07.2022 and 01.09.2023 maturities as its yields were seen hitting intraday lows of 7.62%, 8.00%, 8.01%, 8.30%, 8.40%, 8.50% and 8.72% respectively as volumes changing hands remained high.

Meanwhile, in money markets yesterday, overnight call money and repo rates remained steady to averaged 6.10% and 5.80% respectively as surplus liquidity increased to Rs. 119.12 billion.

Rupee appreciates

In Forex markets yesterday, the rupee on active three-month forward contracts appreciated considerably to close the day at Rs. 137.65/80 against its previous day’s closing of Rs. 138.20/50 on the back of the sovereign dollar bond news. The total USD/LKR traded volume for the previous day (27-05-15) stood at $ 64.93 million.

The six-month forward dollar rate that prevailed in the market is 139.10/30.