Monday Feb 16, 2026

Monday Feb 16, 2026

Friday, 1 April 2016 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The weighted averages at yesterday’s Treasury bond auctions were seen declining in comparison to its secondary market yields and the weighted averages fetched at the previous bond auctions conducted on 29 March 2016. The 12.05 year maturity of 01.09.2028 recorded a weighted average of 13.72%, below the 13.80% and 13.93% weighted averages recorded for the 8.11 year maturity of 15.03.2025 and the 10.02 year maturity of 01.06.2026 on the 29th of March. The weighted averages on the 1.10 year maturity of 01.02.2018, the 3.03 year maturity of 01.07.2019 and the 5.04 year maturity of 01.08.2021 were recorded at 11.75% each and 13.00% respectively with the total accepted volume hitting Rs.50 billion against its total offered volume of Rs.20 billion.

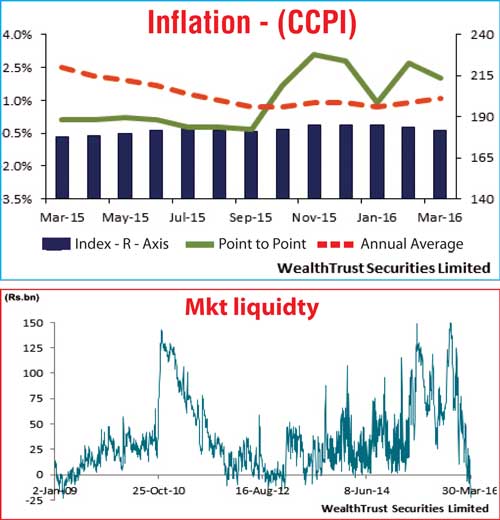

Activity in secondary bond markets was seen increasing drastically yesterday as yields were seen plunging following the auction outcome, on the back of considerable buying interest. Activity centered on the liquid maturities of 01.08.2021, 15.03.2025, 01.06.2026 and 15.05.2030 as its yields dipped to intraday lows of 12.65%, 12.70%, 12.80% and 13.00% respectively against its days opening highs of 12.90%, 13.30% each and 13.50%. The drop in Inflation to 2.0% from 2.70% on its point to point for the month of March contributed to the drop in yields as well.

In money markets, the overnight call money and repo rates remained broadly steady to average 8.09% and 8.03% respectively as the Open Market Operations (OMO) department of Central Bank was seen infusing liquidity for the first time since 19th February 2016 by way of a reverse repo auction. An amount of Rs.20 billion was infused at a weighted average of 7.90%. The deficit in money markets was seen increasing to over a seven year high of Rs.22.17 billion yesterday.

Volatility increase

in Forex markets

The USD/LKR rate on the active spot next contract was seen appreciating to an intraday high of Rs. 144.50 in morning hours of trading yesterday against its opening low of Rs. 149.30 on the back of selling interest. However it lost ground once again to close the day at Rs. 145.80/30, still above its previous day’s closing of Rs. 149.25/35. The total USD/LKR traded volume for 30 March 2016 was US $ 45.19 million.

Some of the forward USD/LKR rates that prevailed in the market were 1 Month - 146.60/90; 3 Months - 148.40/80 and 6 Months - 149.80/20.

Reuters: Sri Lankan five-day rupee forwards ended firmer on Thursday as dollar selling by a state bank outweighed heavy demand for the greenback by importers, dealers said.

The forwards, which act as a proxy for the spot currency and are called spot next, hit 145.00 per dollar before closing at 146.20/70 per dollar, firmer than Wednesday’s close of 149.25/35.

The spot rupee, which has not been active since 27 January, did not trade. The Central Bank has fixed the spot trading price at 143.90 through moral suasion, dealers said.

Central Bank officials were not available for comment.

“The state bank intervened and sold dollars and the spot next gained from 149.20 to around 145.00 levels,” a currency dealer said asking not to be named.

“This is a window-dressing exercise because of March 31,” the dealer said, referring to the end of the quarter when banks have to file their accounts.

Dealers said the move could help the Government to show the currency had really not depreciated in the given quarter.

The one-week forwards, which have been active since 27 January and were hovering near record lows, did not actively trade on Thursday, dealers said.

The rupee has been under pressure due to foreign investors exiting government securities and amid the country’s economic woes.

Sri Lanka’s 2015 borrowing jumped more than 25% compared with the previous year due to high cost of refinancing loans, raised by the previous government without parliamentary approval, the finance minister said last week.

The Central Bank on Tuesday kept key policy rates steady, and said it was gauging the impact of recent tightening measures amid government efforts to secure a $1.5 billion IMF loan, which is needed to avert a balance of payments crisis.

Reuters: Sri Lankan shares firmed up on Thursday led by large caps on fiscal year-end buying, but closed nearly 12% lower in the March quarter as rising interest rates dented investor appetite for risk assets, brokers said.

The benchmark share index ended 0.51% higher, or up 30.89 points at 6,071.88. It fell 11.9% in the quarter ended Thursday.

“The market is up on year-end buying,” said Reshan Kurukulasuriya, Chief Operating Officer at Richard Pieris Securities Pvt Ltd, referring to the end of the financial year for many listed firms including banks.

“It was due to window-dressing for the end of the financial year, and we don’t expect much activity in April due to the festival holidays.”

Yields on treasury bills increased between 47 and 74 basis points at the weekly auction on Wednesday despite the Central Bank keeping key rates steady at its policy review on Tuesday.

Investors are likely to shift investments to fixed assets if market interest rates continue to rise, brokers said.

Shares in Carson Cumberbatch PLC climbed 7.06%, while Commercial Bank of Ceylon PLC gained 1.62% and Ceylon Tobacco Company PLC rose 0.71%.

Turnover was 690.9 million rupees ($4.76 million), less than this year’s daily average of 773.4 million rupees.

Foreign investors sold a net 38.99 million rupees ($268,434) worth of shares on Thursday, extending the year to date net foreign outflow to 1.99 billion rupees worth shares.

The Central Bank yesterday announced that with effect from 01 April, 2016, the Hongkong and Shanghai Banking Corporation Ltd (HSBC) at 24, Sir Baron Jayathilaka Mawatha, Colombo 01, ceases to operate as a Primary Dealer.

“HSBC will, however, continue to function as a Dealer Direct Participant in scripless securities and transact in scripless securities on behalf of customers and maintain customer accounts in LankaSecure,” the Central Bank added.