Sunday Feb 15, 2026

Sunday Feb 15, 2026

Wednesday, 8 February 2017 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

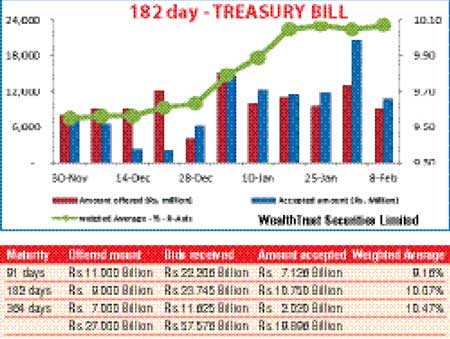

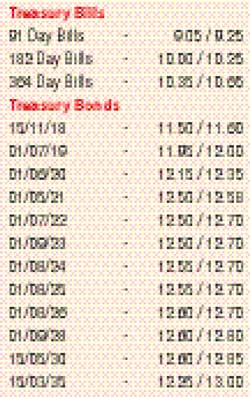

At the weekly Treasury bill auction held yesterday, the weighted averages of all three maturities continued to increase, with the 91 day bill reflecting the highest jump of eight basis points to 9.16% closely followed by the 364 day bill increasing by five basis points to 10.47% and the 182 day bill by two basis points to 10.07%.

The total accepted amount dipped below the total offered amount once again with only an amount of Rs. 19.89 billion being accepted against a total offered amount of Rs. 27 billion.

However, yields in the secondary bond market dipped marginally, following the monetary policy announcement, where the Central Bank of Sri Lanka continued to hold rates steady. The 01.07.19 and 01.05.21 maturities saw volumes change hands within the range of 11.96% to 12.00% and 12.52% to 12.70% respectively while the 01.02.18, 01.04.18 and 15.11.18 maturities were seen trading within the range of 10.55% to 10.70%, 10.90% to 11.00% and 11.50% to 11.55% respectively.

Meanwhile in money markets, the overnight call money and repo rates increased marginally to average 8.43% and 8.45% respectively as the net surplus liquidity decreased to Rs. 16.99 billion. The Open Market Operations (OMO) Department of the Central Bank of Sri Lanka drained out an amount of Rs. 27.00 billion on an overnight basis at a weighted average of 7.50%.

The USD/LKR rate on the active two week and one month forward contracts remained mostly unchanged to close the day at Rs. 151.25/30 and Rs. 151.65/70 respectively.

The total USD/LKR traded volume for 6 February 2017 was $ 28.67 million. Some of the forward USD/LKR rates that prevailed in the market were three months - 153.50/60 and six months - 156.05/15.

Reuters: The rupee ended slightly weaker on Tuesday due to dollar demand from banks as foreign investors continued to sell government securities, while the central bank revised the spot reference rate to a record low of 150.75, dealers said.

The market shrugged off the central bank’s policy rate decision in which the monetary authority kept rates steady for a sixth straight month.

However, the Central Bank flagged possible “corrective measures” in the months ahead in a sign that further tightening might be on the cards to temper inflation pressures and safeguard a fragile rupee. The Central Bank has revised the spot rupee reference rate to a record low of 150.75 from 150.50, dealers said.

Rupee forwards were active, with two-week forwards ending at 151.22/32 per dollar, compared with Monday’s close of 151.18/25. Dealers said the central bank wanted to discourage foreign investors exiting from government securities by making these expensive for them.

Officials at the Central Bank were not available for comment. The rupee has fallen 0.5% so far this year and has been under pressure due to rising imports and net selling of government securities by foreign investors, while the central bank has said defending the currency with foreign exchange reserves “does not seem sensible”.

Foreign investors net sold Rs. 26.6 billion ($ 177.10 million) worth of government securities in the four weeks to 1 February, according to latest Central Bank data.