Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 1 September 2015 00:57 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

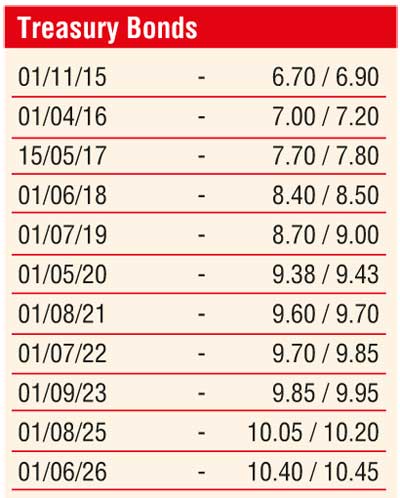

The upward momentum in primary markets continued at yesterday’s bond auctions as the weighted averages (W.Avgs) sustained its upward trend.

The W.Avg on the shorter maturity of 1 May 2020 (4.08 years) reflected an significant increase of 97 basis points to 9.35% against its previous W.Avg while the 1 August 2021 maturity (6.11 years) increased by 64 basis points to 9.71%.

Furthermore, the 10.09 year maturity of 1 June 2026 recorded a W.Avg of 10.34% in comparison to a 9.11 year maturity of 1 August 2025 which fetched a W.Avg of 9.97% on 25 August.

An additional amount of Rs.1.3 billion was accepted against the total offered amount of Rs.30 billion as a substantial amount of Rs.24 billion was accepted on the 10.09 year maturity against its initial offered amount of Rs.12.5 billion.

Activity in secondary bond markets continued to be rather moderate with a limited amount seen on the three auction maturities post auction within the range of 9.40% to 9.45%, 9.65% to 9.70% and 10.45% to 10.50% respectively. This was mainly due to most market participants adopting a ‘wait and see’ policy ahead of the monetary policy announcement due at 7:30 p.m. yesterday.

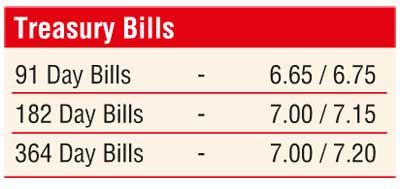

In secondary bill markets, the 91 day bill was seen changing hands within the range of 6.70% to 6.75%.

Meanwhile in money markets, overnight call money and repo rates increased further to average 6.29% and 6.32% respectively as the surplus liquidity in the market dipped to Rs.25.27 b yesterday.

Rupee dips considerably for a second consecutive day

The USD/LKR rate on spot contracts was seen dipping considerably yesterday to close the day at Rs. 134.50, signifying its second consecutive day of declines. The total USD/LKR traded volume for 28 August was $ 57.20 million.

Given are some forward USD/LKR rates that prevailed in the market: one month – 135.15/20; three months – 136.32/42; six months – 138.14/24.